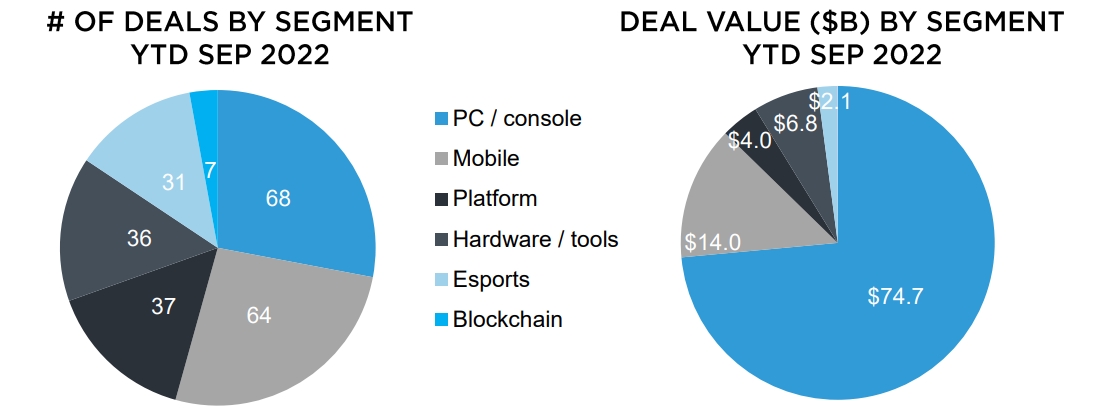

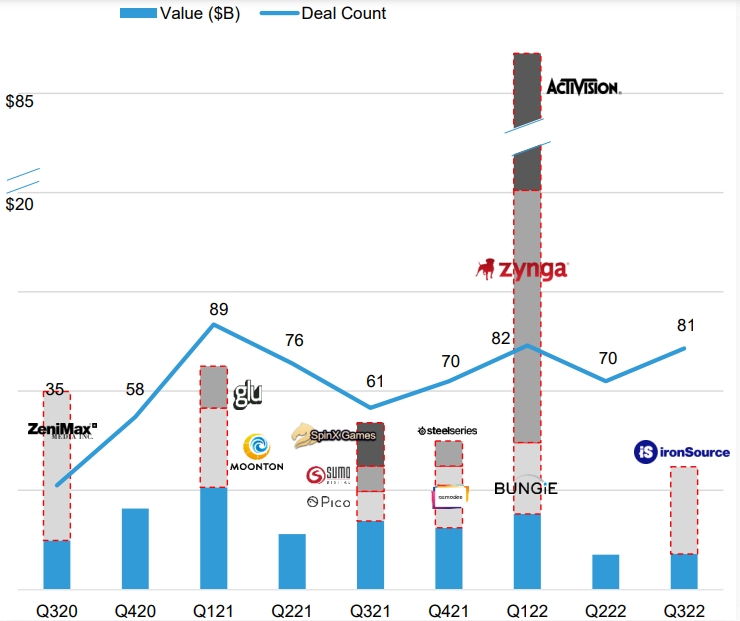

In the first nine months of 2022, 976 deals were announced or closed across the games industry globally. Here are some key takeaways from Drake Star’s latest report, including the top 15 largest M&A deals this year.

Key takeaways

- According to Drake Star, the total disclosed value of all deals announced or closed in 2022 was $123 billion.

- M&A activity across mobile, PC / console, and esports amounted to $101.6 billion. The sum is largely due to Microsoft’s proposed acquisition of Activision Blizzard, which is the largest deal in video game history.

- Private companies raised $9.6 billion through 685 financing rounds. 15 of these investments were valued at over $100 million.

- The remaining $11.5 billion was raised through IPOs, SPACs, and other public financing deals.

- Blockchain and NFT game companies raised $3.4 billion in the first nine months of 2022.

- Drake Star called 2022 a “record year of consolidation, diversification, and investments in the industry.”

- More mega deals are expected in the fourth quarter of 2022.

“Considering the lower valuation levels of the public companies across global markets, many of the public gaming strategics are now more focused on higher quality targets that exhibit strong profitability,” Drake Star noted. “Listed companies are now under even more pressure to show growth and profitability, and we expect a strong volume of smaller and mid-sized M&A deals and a few mega deals going forward.”

Top 15 largest M&A deals of 2022 (so far)

- Microsoft x Activision Blizzard — $68.9 billion

- Take-Two x Zynga — $12.6 billion

- Unity x ironSource — $4.4 billion

- Sony x Bungie — $3.6 billion

- Savvy Gaming Group x ESL — $1.05 billion

- Embracer Group — five big acquisitions totaling $765 million

- Leta Capital x MY.GAMES — $642 million

- Infinite Reality x ReKTGlobal — $470 million

- Tencent x Black Shark — $470 million

- Savvy Gaming Group x FaceIt — $450 million

- Stillfront Group x 6waves — $300.6 million

- SciPlay x Alictus — $300 million

- Embracer Group x Eidos Montreal and Crystal Dynamics — $300 million

- Landvault x Admix — $300 million

- Media and Games Invest x AxesInMotion — $173.6 million

Drake Star also mentioned NetEase’s acquisition of Quantic Dream, Sony’s purchase of Savage Game Studios, and Scopely’s acquisition of Kitka Games’ battle royale Stumble Guys among the key M&A deals this year.