2024 has once again been a record year for Steam across a variety of metrics. So we’ve done some data crunching to look back at the top games over the past 12 months, highlight the biggest winners, sum up key trends, and dive into other data about the state of the platform as a whole.

The state of Steam 2024 in numbers

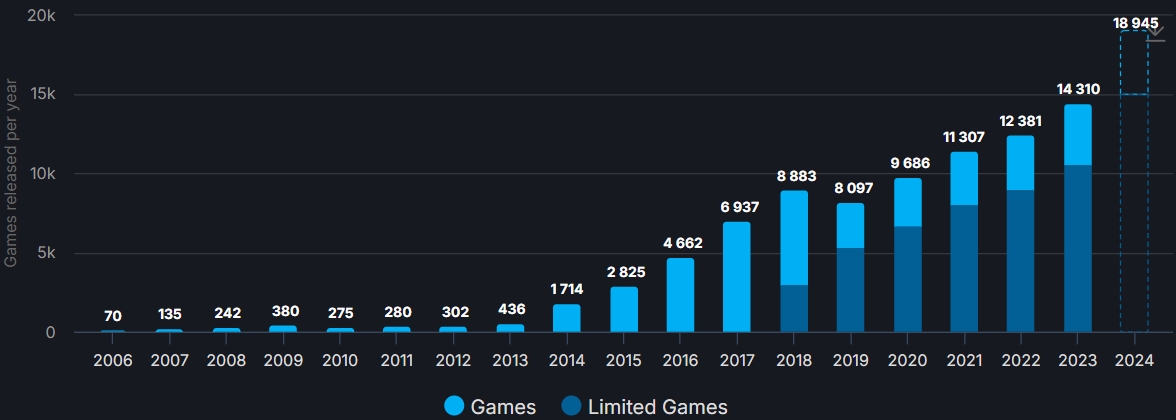

- According to SteamDB, 18,945 games were released on Steam in 2024, up 32.3% year-over-year. The number may change as there are still a couple of days left in the year, and there also may be some adjustments to the data later.

- It is worth noting that SteamDB now divides all products into two groups: Games and Limited Games. The latter includes products with the “Profile Features Limited” tag, which Valve grants to all games before they reach certain player and revenue thresholds.

- “Limited Games” are usually free titles and various hobbyist projects. This is basically a protection measure against products that abuse profile customization features like trading cards and achievements. This doesn’t mean all games in this category are shovelware — most of them just haven’t generated enough sales on the store or achieved broad player engagement.

- So of the 18.9k releases in 2024, 10.4k are labeled as “Limited Games,” up 17.3% year-over-year. When excluding this category, you can see that the number of games with enabled profile features isn’t growing as rapidly — 3,874, up 11% from 3,491 in 2023.

- As with last year, October was the peak month for new releases with 1,901 launches. Other busy periods include November (1,834), August (1,748), and July (1,663).

Number of games released on Steam by year (via SteamDB)

- Steam continues to expand rapidly. The number of new products released on the platform has grown steadily at a CAGR of 14.36% since 2020.

- 2024 was a landmark year, with Steam smashing its own records almost every month. Valve doesn’t disclose DAU and MAU numbers, so concurrent users (CCU) is the only available metric to indicate steady growth.

- In March, the platform surpassed 35 million concurrent users (including those who just stay online without necessarily playing games) for the first time ever. On December 15, Steam peaked at 39,319,632 CCU, and there is no doubt that it will cross the 40 million mark in the near future. For comparison, last year’s record was 33.59 million concurrent users.

- Another metric showing in-game users is no less impressive. While Steam crossed 10 million active players four times in 2023, there wasn’t a single month in 2024 where that number dropped below 11 million. In August, Steam hit a new all-time high, with 12.53 million people playing various games simultaneously (it nearly broke that record on December 23, peaking at 12.51 million in-game users).

Concurrent Steam users and active in-game players during 2024 (via SteamDB)

- According to VG Insights, 704 million game copies were sold on Steam in 2024, up 21% compared to last year. Their total gross revenue (before Steam’s cut and taxes) grew 24% year-over-year to $10.9 billion.

- Singleplayer remained the most popular tag, used in 77% of games released in 2024. It is followed by Casual (47%) and Indie (46.5%).

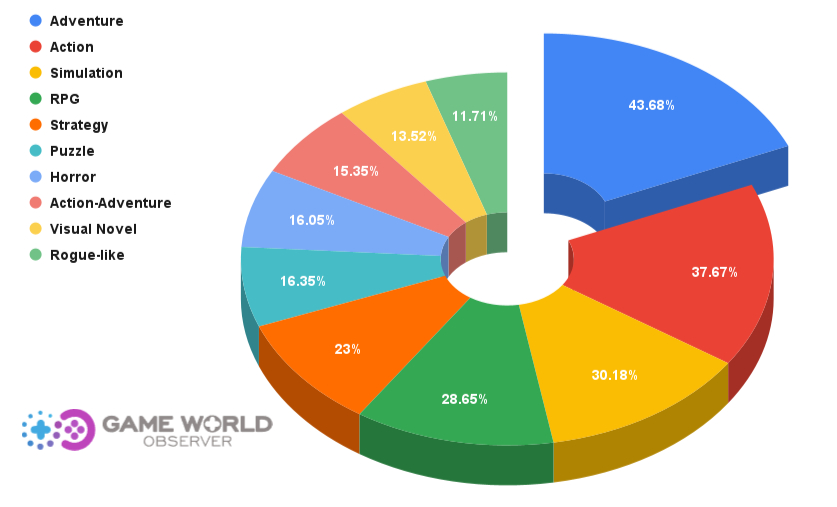

- The top 5 genre-specific tags were Adventure, Action, Simulation, Puzzle, and Strategy. They are followed by RPG, Action-Adventure, Arcade, Horror, and Shooter (note that each game can have several tags related to various categories).

- When only looking at games with at least 10 user reviews (just over 3,700 titles), the situation changes a bit (see the chart below), with Visual Novel and Rogue-like breaking into the top 10.

Top 10 Steam tags of 2024 for games with at least 10 reviews (and the percentage of games they are used in)

- If we filter out games with less than 1,000 reviews, the most popular genre tags of 2024 would be Action, Adventure, RPG, Simulation, and Strategy. Overall, there were 752 games in 2024 with at least 1,000 reviews, of which 521 were single-player, 256 were labeled as Indie, and 246 had multiplayer features.

- In other observations, over 2,700 Steam releases in 2024 used the Early Access tag. There were also over 2,100 multiplayer and 2,000 free-to-play games. Almost 1,100 titles used the Co-op tag.

- Last but not least: nearly 94% of all games released in 2024 had English language support. The top 10 also include Simplified Chinese (35.4%), Japanese (31.4%), French (26.6%), German (26.4%), Spanish (25.3%), Russian (24.6%), Korean (21%), Traditional Chinese (18.5%), Italian (18%).

- Keep in mind that this only applies to localization. Earlier this year, Valve named the top 5 languages on Steam globally: English (35.08% of all users), Simplified Chinese (28.08%), Russian (7.91%), Castilian Spanish (5.25%), and German (3.41%).

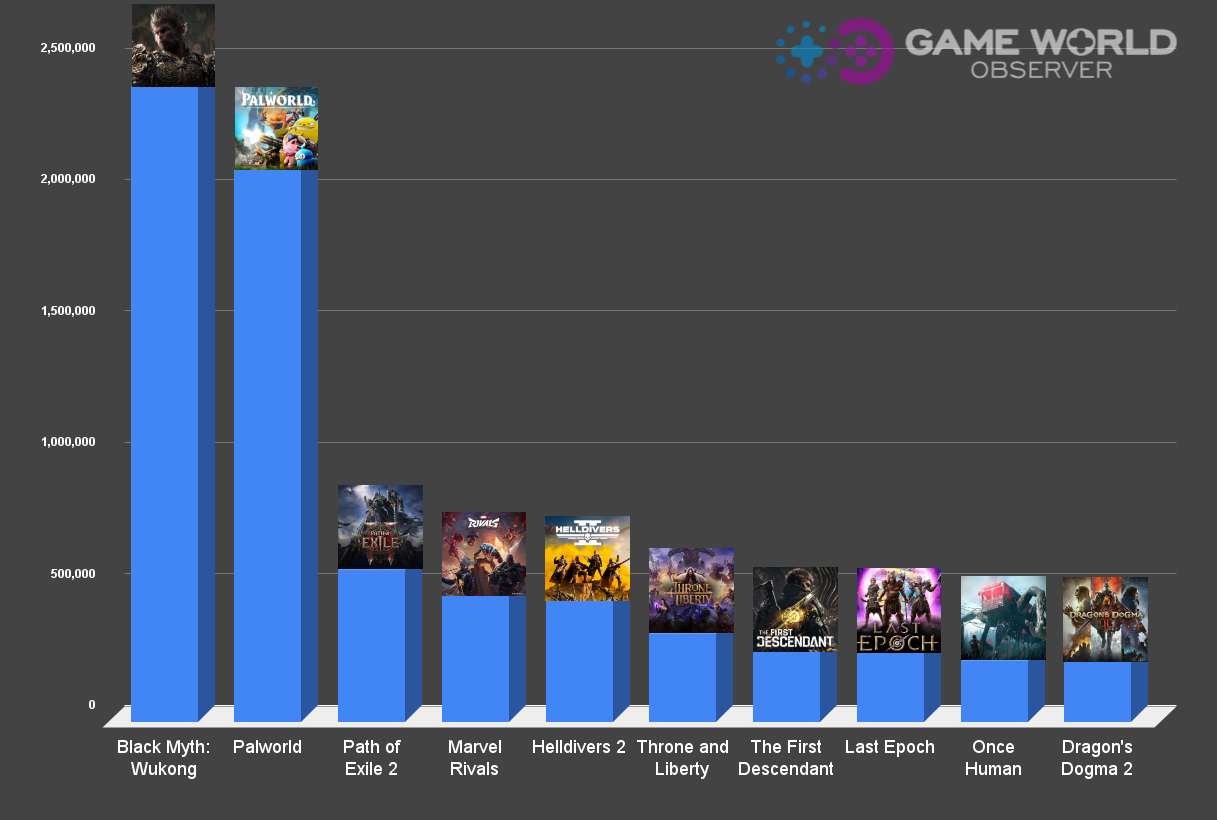

Most played new games of 2024 (by peak CCU)

When looking at the top Steam releases of 2024 by peak concurrent players, Black Myth: Wukong (2.4 million CCU) and Palworld (2.1 million CCU) were the biggest outliers. The closest is Path of Exile 2 (578.5k CCU), and no game this year, except Wukong and Palworld, has managed to cross the 1 million mark.

The top 20 most played titles of 2024* can be seen below:

*Concurrent users ≠ sales or total number of players

We don’t want to state the obvious, but given the distorted perception of this metric by many people online lately, we’ll leave a note here anyway, just in case:

- Don’t take concurrent player count as the ultimate measure of success — it simply shows the number of users playing a given game simultaneously;

- Trying to extrapolate CCU to sales or other data is speculative at best — if one title peaked at, say, 100k CCU, and another has an all-time high of 75k CCU, it doesn’t necessarily mean the first one sold better;

- This metric can be used to see the overall interest in the game at launch, which is also influenced by a variety of factors, from wishlists to pre-orders and general hype around a particular IP;

- CCU charts vary depending on game type, genre, etc. — if a single-player game’s player count has dropped several times over a period of time, it doesn’t mean it flopped commercially, but if a multiplayer live service project can’t retain an active player base after launch, it could be a worrying sign;

- Indie games don’t need enormous CCUs to succeed — a peak of 20.2k CCU (launch numbers were below 9k) didn’t prevent Buckshot Roulette from selling over 4 million units globally;

- The top games by peak CCU tend to be the most hyped and, sometimes, most popular titles of the year, but always look at concurrent player count in context — for example, Balatro is not even in the top 40 releases of 2024 by peak CCU, but it’s still one of the biggest hits of the year with over 3.5 million units sold across all platforms;

- It’s great that Valve shares these numbers publicly, but they shouldn’t be used as a tool to judge all games by one single pattern.

- Black Myth: Wukong — 2.4 million CCU;

- Palworld — 2.1 million CCU;

- Path of Exile 2 — 578.5k CCU;

- Marvel Rivals — 480.9k CCU;

- Helldivers 2 — 458.7k CCU;

- Throne and Liberty — 336.3k CCU;

- The First Descendant — 264.8k CCU;

- Last Epoch — 264.7k CCU;

- Once Human — 231.6k CCU;

- Dragon’s Dogma 2 — 228.5 CCU;

- Warhammer 40k: Space Marine 2 — 225.6k CCU;

- Content Warning — 204.4k CCU (reached its peak while being free-to-keep in the first 24 hours of launch);

- Satisfactory — 186.1k CCU;

- Manor Lords — 173.1k CCU;

- Enshrouded — 160.4k CCU;

- Farming Simulator 25 — 135.9k CCU;

- 7 Days to Die — 125.4k CCU;

- Dragon Ball: Sparking! ZERO — 122.5k CCU;

- S.T.A.L.K.E.R. 2: Heart of Chornobyl — 121.5k CCU;

- Delta Force — 114k CCU.

Top 10 Steam games of 2024 by peak concurrent players

Before we move on to our observations and conclusions, here are a few things to keep in mind. The list above doesn’t include several games from the SteamDB charts:

- Banana, which peaked at over 917k concurrent users, because it is more of an app for speculations rather than a full-fledged game (people keep it launched for hours to get tradable cards);

- Titles that reached their peak prior to 2024 (mostly Early Access graduates like Sons of the Forest and V Rising).

We also excluded all DLCs and major expansions, as it is impossible to see data for them separately. For example, Elden Ring peaked at over 781k concurrent players shortly after the launch of Shadow of the Erdtree (the base game’s all-time high is 953k CCU). It is clear that the DLC has caused a surge in player interest and should be somewhere in the top 10 releases of 2024 by peak CCU, but there is still no way to verify how many of those users played the expansion specifically.

A similar issue applies to one of this year’s biggest AAA releases, Call of Duty: Black Ops 6. Sold as a standalone game, it is linked to the main Call of Duty HQ app (also includes MWII-III and Warzone). This makes the game almost untrackable using publicly available metrics. Call of Duty HQ peaked at 315.3k concurrent players shortly after BO6 launched on October 25, its highest since the release of Warzone 2.0 in November 2022.

Let’s wrap this section up with a few observations:

- Two games surpassed 2 million concurrent players this year (Black Myth: Wukong, Palworld) — the only title with a higher all-time peak on Steam is PUBG, which reached 3.25 million CCU in January 2018.

- Four new releases managed to break into the top 20 most played Steam games of all time: Black Myth: Wukong (#2), Palworld (#3), Path of Exile 2 (#15), Marvel Rivals (#20).

- Interesting case: the Monster Hunter Wilds open beta peaked at 463.7k concurrent players, which is an extremely high number for a playtest. This indicates a strong interest in the IP, and it’ll be interesting to see how the game performs upon its February 2025 launch.

- 24 games peaked at over 100k CCU in 2024 (excluding apps like Banana or Cats). In addition to titles mentioned above, these are Granblue Fantasy: Relink (114k CCU), Liar’s Bar (113.7k CCU), EA Sports FC 25 (110k CCU), and Hades II (103.5k CCU).

- 33 titles crossed the 50k mark this year, including the likes of Chained Together (94.4k CCU), Dragon Age: The Veilguard (89.4k CCU), Metaphor: ReFantazio (85.9k CCU), Deep Rock Galactic: Survivor (56.9k CCU), and Supermarket Simulator (51.3k CCU).

- 73 games peaked at 20k+ CCU and over 110 crossed the 10k mark: Backpack Battles (36.5k CCU), No Rest for the Wicked (36.2k CCU), God of War Ragnarök (35.6k CCU), Age of Mythology: Retold (25.8k CCU), and more.

- For comparison, 2023 saw 12 titles with 100k+ CCU, 25 with 50k+, and just over 100 with 10k+.

- Of the top 20 titles, nine were developed by independent studios*: Black Myth: Wukong, Palworld, Helldivers 2, Last Epoch, Content Warning, Manor Lords, Enshrouded, Farming Simulator 25, and 7 Days to Die.

*We can’t call all of them indie games. For example, Arrowhead is technically an independent studio, but Helldivers 2 is published and owned by Sony. Game Science (Black Myth: Wukong) and Eleventh Hour Games (Last Epoch) self-published their games, but they received investments from major companies like Tencent. And you can’t label games like FS25 (developed and published by Giants Software) or Wukong as indie when you have titles like Manor Lords.

- Nine games in the top 20 were developed by Asian companies: Wukong (Game Science, China), Palworld (Pocketpair, Japan), Marvel Rivals (NetEase, China), Throne and Liberty (NCSoft, South Korea), The First Descendant (Nexon, South Korea), Once Human (NetEase’s Starry Studio, China), Dragon’s Dogma 2 (Capcom, Japan), Dragon Ball: Sparking! ZERO (Spike Chunsoft, Japan), Delta Force (Tencent’s TiMi Studio Group, China).

- Five games in the top 20 are free-to-play: Marvel Rivals, Throne and Liberty, The First Descendant, Once Human, and Delta Force. Four titles are Early Access releases (Palworld, Path of Exile 2, Manor Lords, Enshrouded), and three projects had their 1.0 launch in 2024 (Last Epoch, Satisfactory, 7 Days to Die).

- 11 titles are original IPs: Black Myth: Wukong, Palworld, The First Descendant, Last Epoch, Once Human, Manor Lords, Content Warning, Satisfactory, Manor Lords, Enshrouded, 7 Days to Die. While Throne and Liberty is also technically not part of any series, it was originally developed as a Lineage successor.

Top-grossing Steam games of 2024 and other chart leaders

Unlike concurrent players, sales and revenue data can only be seen by developers and publishers. Earlier this month, Valve named the best-selling Steam games of 2024. The top 5 new games by gross revenue were (in no particular order):

- Helldivers 2

- Palworld

- Call of Duty: Black Ops 6

- Black Myth: Wukong

- Warhammer 40k: Space Marine 2

Other top-grossing releases of 2024 include S.T.A.L.K.E.R. 2: Heart of Chornobyl, Path of Exile 2, Manor Lords, Dragon Ball: Sparking! ZERO, Dragon’s Dogma 2, EA Sports FC 25, and NBA 2K25.

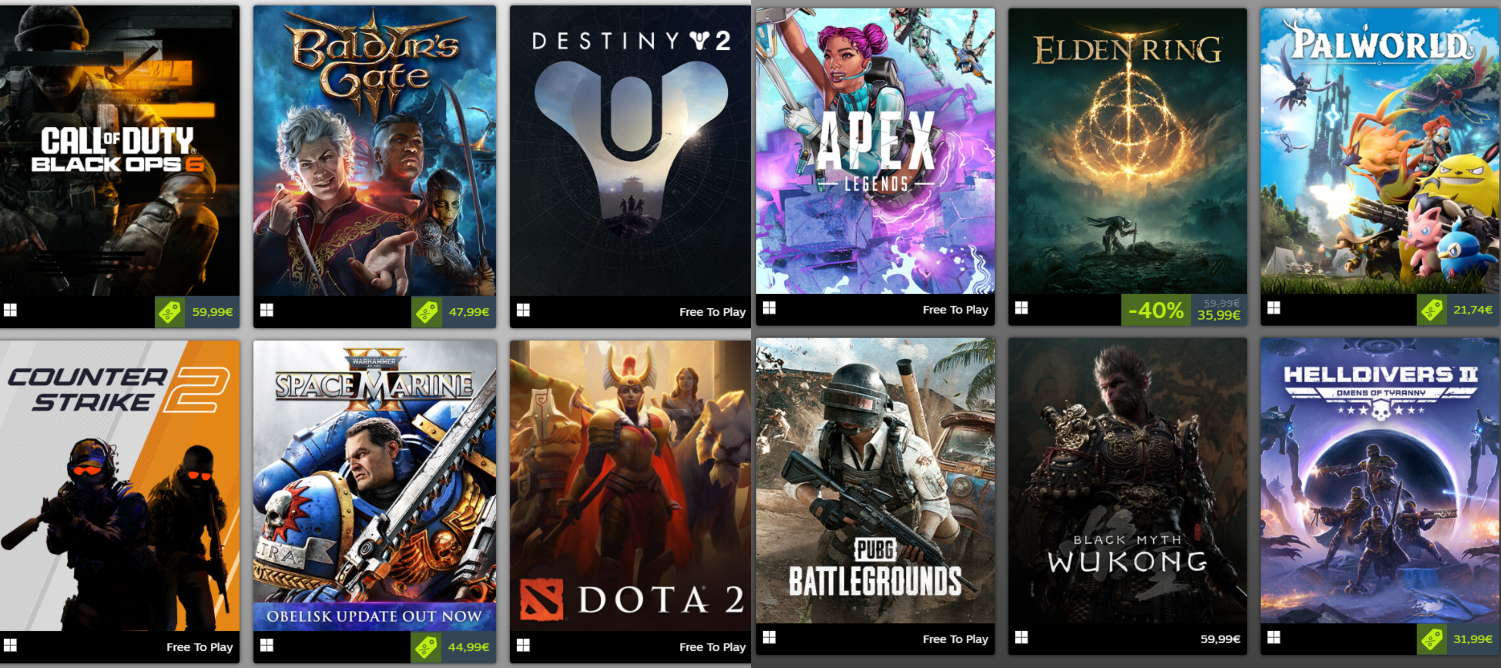

Top 12 games of 2024 by gross revenue on Steam overall (in no particular order)

According to GameDiscoverCo, 14 new games sold over 2 million units this year, and four crossed the 5 million mark (Black Myth: Wukong, Palworld, Helldivers 2, Chained Together).

Below are the officially disclosed sales figures for some of the top 2024 releases:

- Black Myth: Wukong — 20 million copies sold in its first month (across PC and PS5, the exact share of Steam is unknown, but it accounts for the lion’s share of the total);

- Palworld — 15 million copies sold on Steam in its first month;

- Helldivers 2 — 12 million copies sold in three months (across PC and PS5, Circana previously estimated that Steam accounted for 60% of the game’s sales in the US);

- Enshrouded — over 3 million unique players on Steam;

- Manor Lords — over 2.5 million copies sold on Steam;

- Buckshot Roulette — over 4 million copies sold;

- Warhammer 40k: Space Marine 2 — 5 million unique players (across all platforms)

- Balatro — 3.5 million copies sold (across all platforms);

- Dragon’s Dogma 2 — 3.3 million copies sold (across all platforms);

- Deep Rock Galactic: Survivor — 1 million copies sold on Steam in its first month;

- S.T.A.L.K.E.R. 2: Heart of Chornobyl — 1 million copies sold in two days (across Steam and Xbox Series X|S).

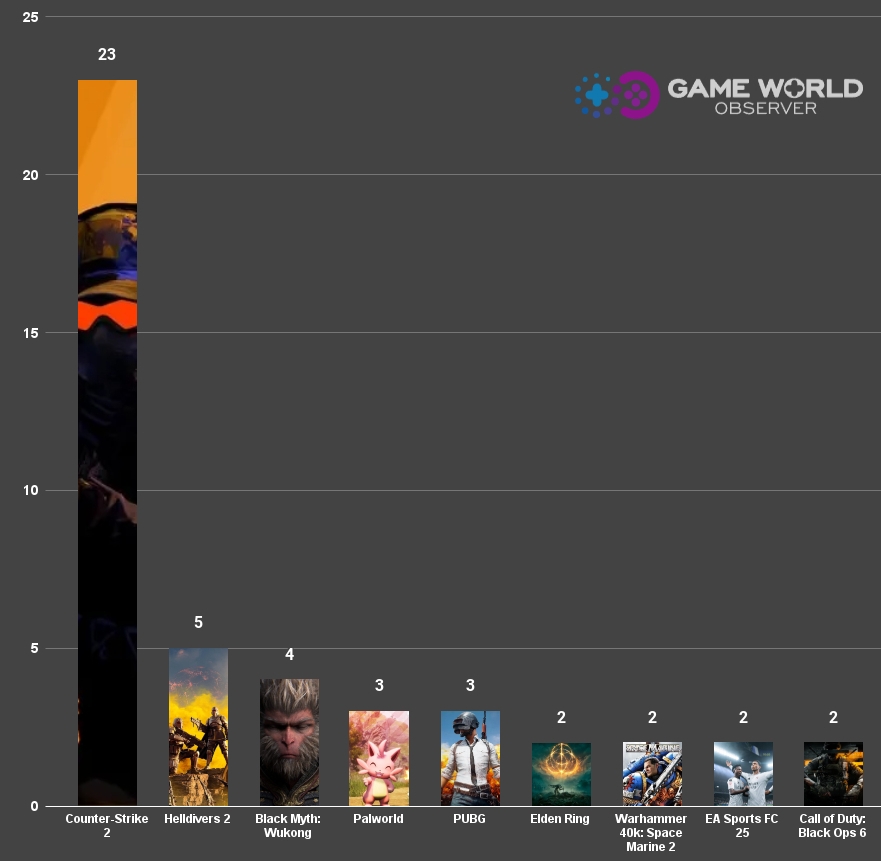

We also decided to take a look at Steam’s Weekly Top Sellers chart (global) to see which games have spent the most weeks at #1 this year:

- Unsurprisingly, Counter-Strike 2 leads with 23 weeks at #1, outshining all other titles by a wide margin. Valve’s free-to-play shooter was the global top seller for nearly half of the 52 total weeks in 2024;

- The closest is Helldivers 2 with five weeks, followed by Black Myth: Wukong (4), Palworld (3), and PUBG (3). Four games spent two weeks at #1 each: Elden Ring, Space Marine 2, EA Sports FC 25, and Call of Duty: Black Ops 6;

- Other chart toppers of 2024 (all with one week at #1) include Baldur’s Gate 3, Apex Legends, Gray Zone Warfare, The First Descendant, Stalker 2, and Path of Exile 2;

- There was also a period when CS2 remained the highest-grossing product on Steam for seven weeks in a row (from March 12 to April 30)! And two times it topped the charts for four consecutive weeks;

- In terms of continuous chart leadership, Helldivers 2 ranks second, having spent five straight weeks at #1 (from February 6 to March 11);

Games with the most weeks at #1 on Steam’s Global Top Sellers chart in 2024 (excluding Steam Deck)

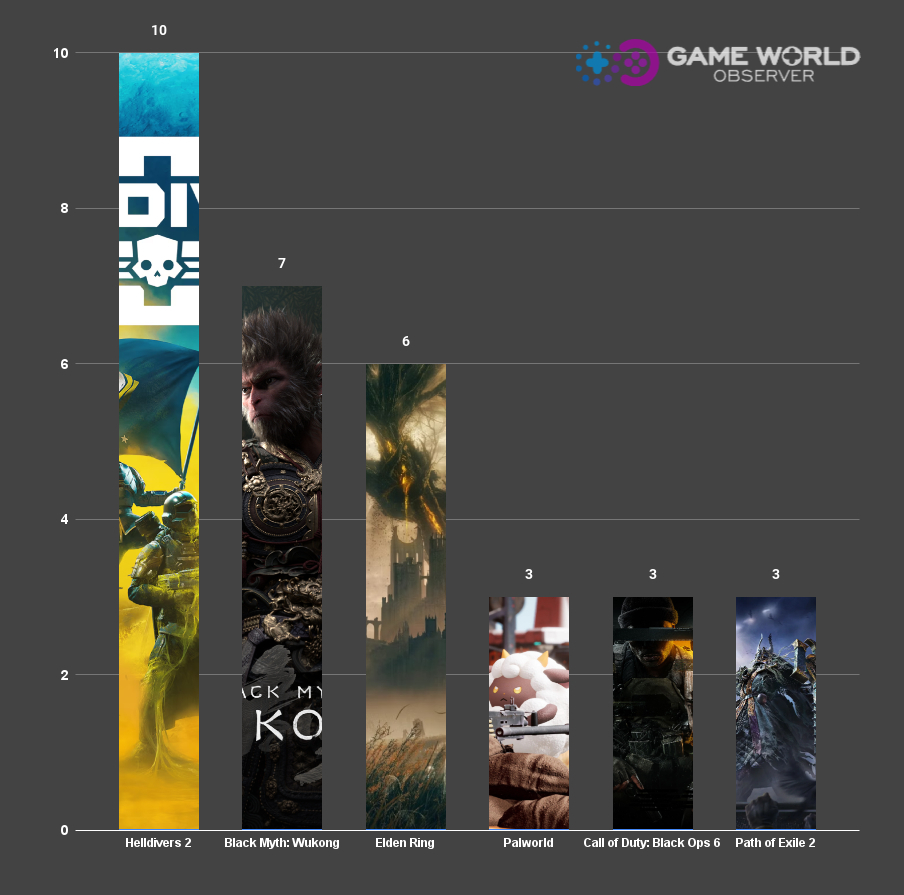

- When only looking at premium games (excluding free-to-play titles), the leader is Helldivers 2 with 10 weeks at #1 this year. It is followed by Black Myth: Wukong (7) and Elden Ring (6);

- Three paid titles topped the charts three times each: Palworld, Black Ops 6, and Path of Exile 2. The latter has been dominating the charts for the last three weeks since its Early Access launch.

- Four games spent two weeks at #1 each: Space Marine 2, Ghost of Tsushima, Baldur’s Gate 3, and EA Sports FC 25;

- Other premium titles that topped the Steam charts at least once include Dragon’s Dogma 2, Manor Lords, Hades II, Farming Simulator 25, and Cyberpunk 2077.

Premium games with the most weeks at #1 on Steam’s Global Top Sellers chart in 2024 (excluding F2P titles and Steam Deck)

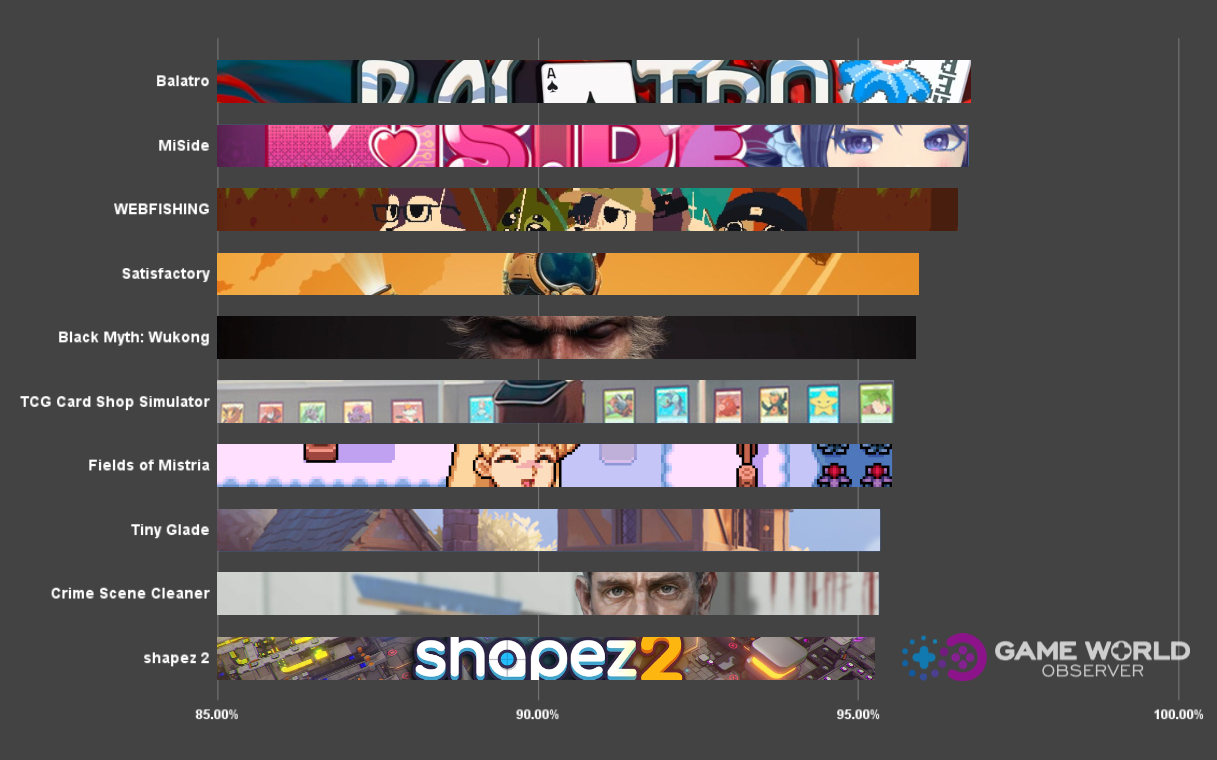

Top-rated Steam games of 2024 (by user score)

At the time of writing, Balatro is the highest-rated new release of 2024. The poker roguelike developed by LocalThunk is rightfully considered one of the biggest indie hits of 2024.

Interestingly, indie horror game MiSide, created by two-person Russian studio Aihasto, ranked 2nd, despite only launching on December 11. It gained a huge popularity on Steam thanks to word of mouth and viral videos from various streamers across the world. It already has an “Overwhelmingly Positive” rating based on more than 41k user reviews.

As we reported earlier this month, the list includes free-to-play titles such as The WereCleaner (96.23%), Sleepy: A Short Adventure (96.12%), Paper Lily – Chapter 1 (95.48%), and 20 Small Mazes (95.47%). However, we decided to focus only on paid games.

Below are the top 15 premium titles of 2023 by user score*:

*Note: SteamDB uses its own formula biased towards the average rating of 50% to estimate the score, so it may slightly differ from the one displayed on the store: “For every 10x the reviews we have, we should be 2x more certain that the rating is correct.” This means if a game has 1 review, SteamDB is 100% uncertain about what its rating should be, 10 reviews — 50% uncertain, 100 reviews — 25% uncertain, etc. That’s why Balatro’s 98% user score translates into 96.75%, and the more reviews it receives, the closer it gets to the actual rating on Steam.

- Balatro — 96.75%;

- MiSide — 96.75%;

- WEBFISHING — 96.52%;

- Satisfactory — 95.95%;

- Black Myth: Wukong — 95.9%;

- TCG Card Shop Simulator — 95.55%;

- Fields of Mistria — 95.53%;

- Tiny Glade — 95.34%;

- Crime Scene Cleaner — 95.33%;

- shapez 2 — 95.26%;

- Tactical Breach Wizards — 95.13%;

- ATLYSS — 95.05%;

- Blade and Sorcery — 95.03%;

- Murders on the Yangtze River — 94.97%;

- I Wani Hug that Gator! — 94.97%.

Top 10 highest-rated premium games of 2024 on Steam

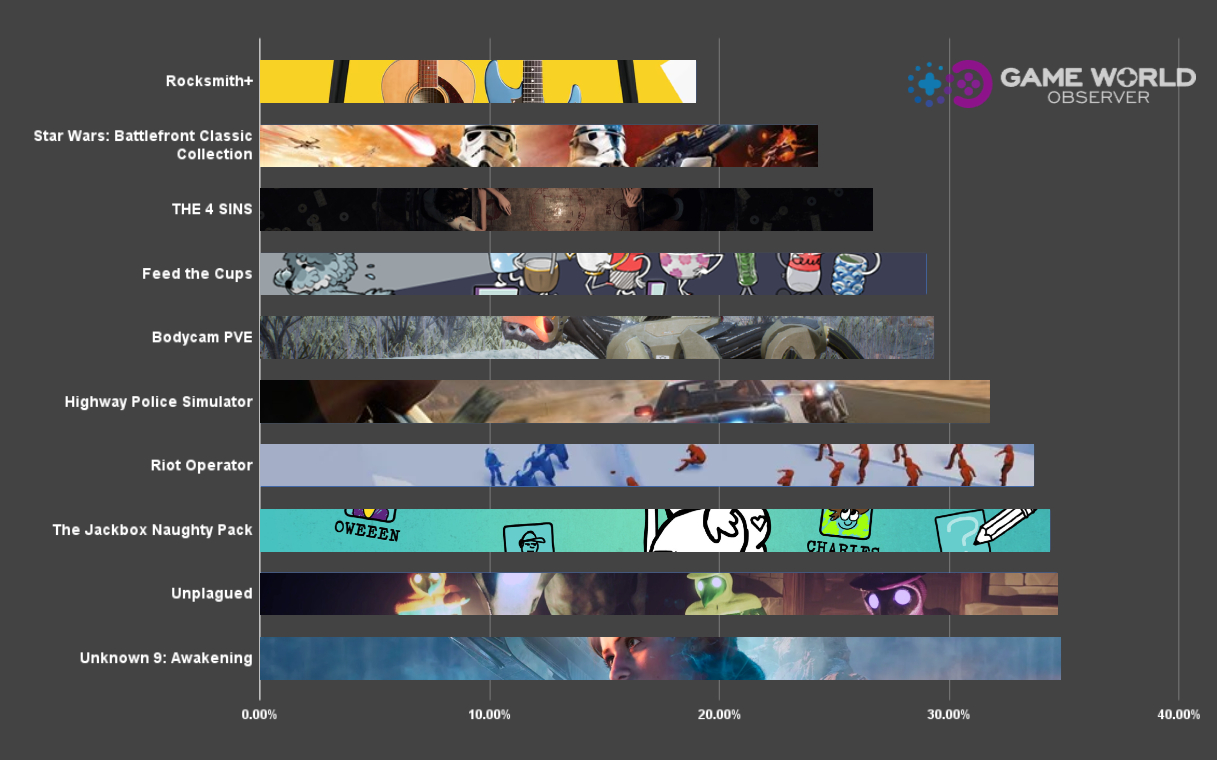

Interestingly, the lowest-rated products of 2024 were various DLCs, such as Cities: Skylines II – Beach Properties (9.65%), Persona 3 Reload – Digital Soundtrack (9.9%), Call of Duty: Black Ops 6 – BlackCell Season 01 (16.85%), and Overwatch 2 – Ultimate Battle Pass Bundle: Season 9 (18.22%).

Two games have already been removed from sale on Steam due to various reasons: 失乐星图Nornium (18.09%) and Kingdom: The Blood (26.56%). We also excluded co-op horror game Egg Raiders, as most of its reviews were written by users who got the game for free during the first week of launch.

Rocksmit+ is the lowest-rated video game of 2024 (19.03%). Although it is listed as a free-to-play title, it requires a subscription to access its key features. Other titles on the list include Star Wars: Battlefront Classic Collection (24.27%), The 4 Sins (26.7%), Highway Police Simulator (31.94%), and more.

When looking at products from AAA publishers, there is also Anya Chalotra-starred action game Unknown 9: Awakening (34.86%), developed by Reflector Entertainment and published by Bandai Namco.

10 lowest-rated premium games of 2024 on Steam (100+ reviews)

***

In 2024, Steam cemented its position as the largest PC game platform globally. Despite market oversaturation, it remains the number one storefront for developers and publishers around the world, providing studios of all sizes with opportunities and tools to succeed.

Every year we will see more and more hit games, including those from independent developers, and the advantages of Steam will continue to offset the growing competition. At the same time, it is important to keep in mind the tens of thousands of titles that will be buried in this ever-expanding bottomless ocean. Learning to survive in this ecosystem is better from the mistakes and failures rather than the biggest success stories.