Microsoft has once again tried to convince the US Federal Trade Commission (FTC) that the Activision Blizzard acquisition wouldn’t hurt competition. The deal will also help the company significantly increase its mobile revenues.

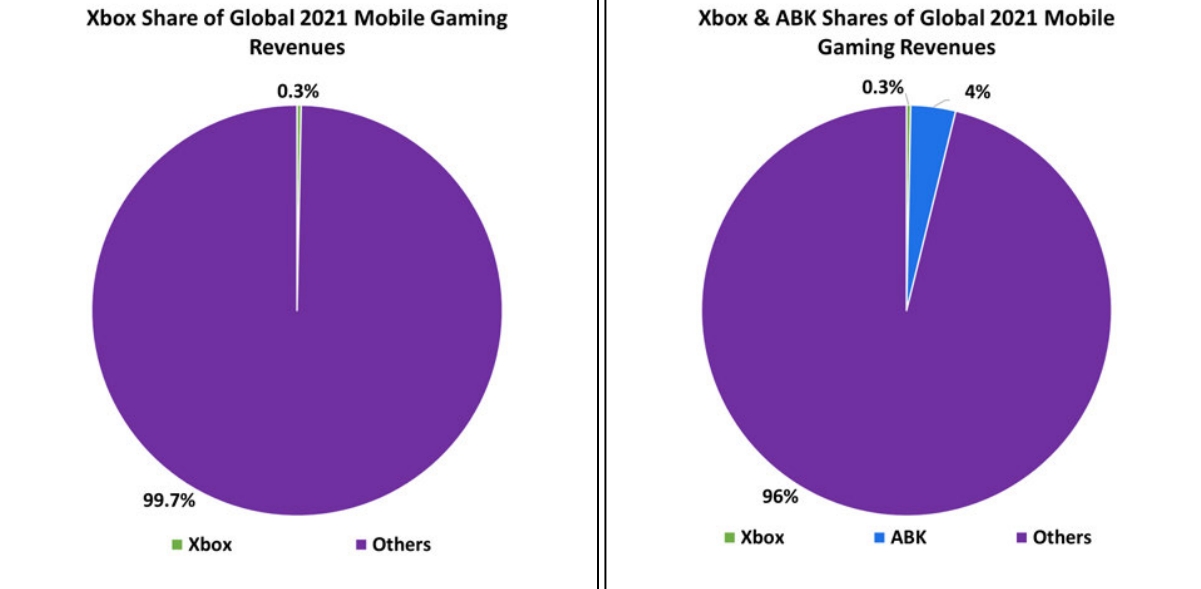

According to a diagram from Microsoft’s submissions to the FTC (spotted by industry analyst @DomsPlaying), its share of global mobile gaming revenues in 2021 was just 0.3%.

However, with Activision Blizzard King titles on board, the company would increase it to over 4%. This would give Microsoft a larger presence in the mobile market.

Activision Blizzard’s mobile portfolio consists of games like Call of Duty: Mobile (on track to reach $2 billion in lifetime revenue) and Diablo Immortal. But it is worth noting that these titles were developed in partnership with Chinese tech giants, Tencent and NetEase.

So the real value for Microsoft in this deal is King. The Malta-based developer was the largest contributor to Activision Blizzard’s mobile growth in Q3 2022 — all thanks to the long-lasting success of the Candy Crush IP:

- King generated $692 million in revenue for the three months ended September 30, outperforming Activision ($480 million) and Blizzard ($543 million);

- It also accounted for 74% of ABK’s total third-quarter mobile revenue of $932 million;

- King had 240 million monthly active users (MAU) in Q3, compared to the company’s total MAU of 368 million.

“Xbox wants to grow its presence in mobile gaming, and three quarters of Activision’s gamers and more than a third of its revenues come from mobile offerings,” Microsoft said in its latest FTC filing, adding that it still wants to keep CoD available on all platforms. “Xbox also believes it is good business to make Activision’s limited portfolio of popular games more accessible to consumers, by putting them on more platforms and making them more affordable.”

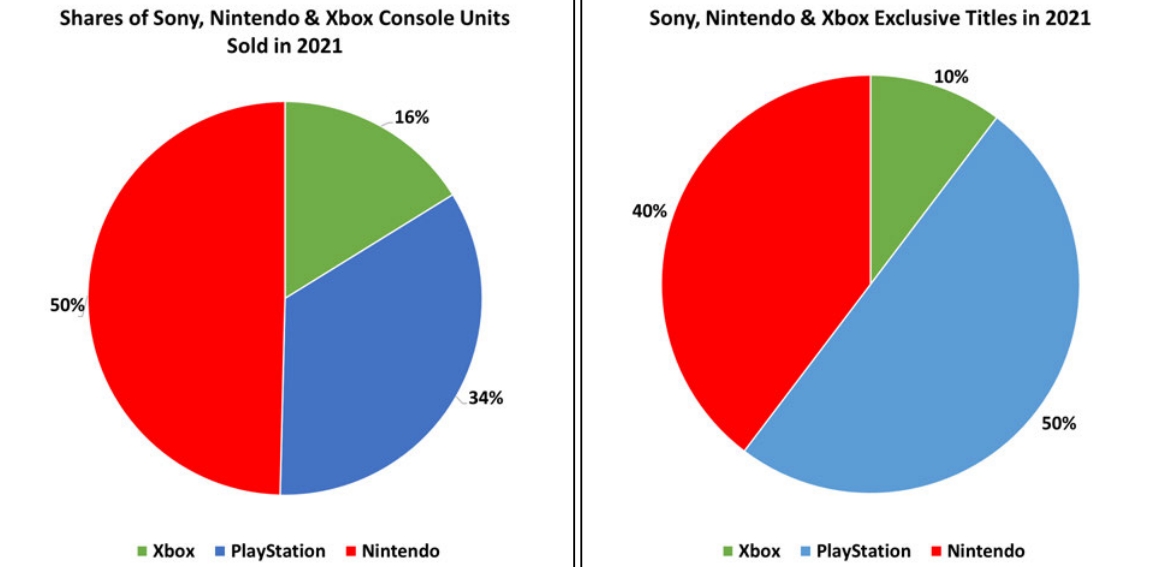

Microsoft, while referring to itself as the “third-place console manufacturer”, also argued that the acquisition of a single game “cannot upend a highly competitive industry.” It also published a diagram showing that Nintendo and Sony outperform Xbox by both console unit sales and the number of exclusive titles.

The FTC filed a lawsuit to block the $68.7 billion deal earlier this month, expressing concerns that Microsoft would suppress its rivals and make ABK games exclusive to the Xbox ecosystem. The case is set to go to trial in the agency’s administrative court on August 2, 2023. However, Microsoft expects the deal to close by June 30, so the legal fight could result in a multi-billion dollar fee being paid to Activision Blizzard if the deadline expires.