Embracer Group held its annual general meeting on September 21. The Swedish holding company shared some insights into its financial performance, specific game sales and revenues, as well as its restructuring program and strategy going forward.

PC & Console segment performed weaker than expected last year

Overviewing Embracer’s financial highlights for the fiscal year ended March 31, 2023, CEO Lars Wingefors noted that the company expected much better results despite a 121% revenue growth and a 43% increase in adjusted EBIT.

One of the biggest setbacks for Embracer was a failure of a previously planned deal — reportedly with Savvy Games Group — that was expected to generate over $2 billion in contracted development revenue over the next six years.

However, Wingefors also attributed lower-than-expected results to the PC & Console opearting segment, which grew organically but showed “notably lower margins year-over-year.” Here are the main reasons:

- Pipeline shifts (i.e. game delays);

- Lackluster reception for certain releases;

- Weaker consumer purchasing power;

- Lower ROI on released titles like the Saints Row reboot (as mentioned by CFO Johan Ekström).

It is worth noting that by the end of FY22/23 (March 31, 2023), Embracer invested a total of SEK 11.4 billion ($1.023 billion) in its video game portfolio, of which SEK 2.1 billion ($188.5 million) relates to released titles and SEK 9.3 billion ($834.5 million) to ongoing development.

Last year alone, the company invested SEK 5.6 billion ($502.6 million) in game expenditures. As pointed out by Ekström, “When our pipeline matures and games are released, we expect this to be a driver of future cash flows and profits.”

All data on this slide is current as of March 31, 2023

More about restructuring and its active phase

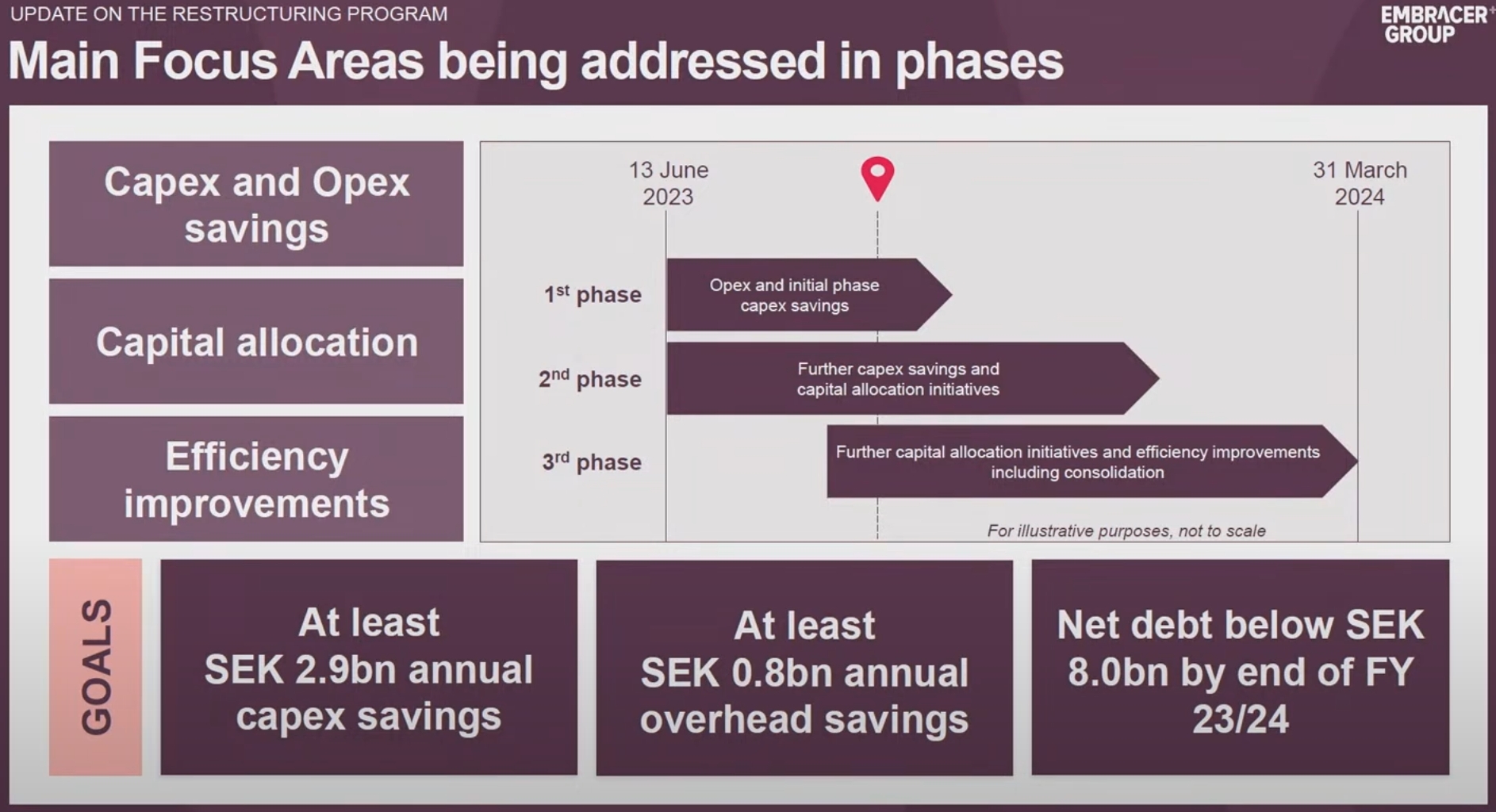

Wingefors went on to discuss a restructuring program that Embracer announced in June after the aforementioned $2 billion deal collapsed.

The company currently aims to save at least SEK 2.9 billion ($260.3 million) in capital expenses and at least SEK 800 million ($71.8 million) in overheads on a full-year basis by FY24/25 (beginning April 1, 2024). As a result, Embracer’s net debt is expected to be lowered from SEK 16.75 billion ($1.53 billion) to at least SEK 8 billion ($732 million) by March 31, 2024.

Answering questions from investors later in the meeting, Wingefors described the restructuring as a difficult period for Embracer. He also noted that due to the “volatility of game releases,” it is bad for any game company in the industry to carry too much debt, so that was also one of the reasons for starting the program.

Although some shareholders told Wingefors that Embracer doesn’t need to lower its net debt so much, he believes that sometimes it is crucial to set strict goals and deadlines to push forward.

Embracer has already conducted layoffs at studios like Beamdog, Gearbox Publishing, and Crystal Dynamics, as well as entirely closed Campfire Cabal and Volition. But the restructuring is still going, and there might be more divestments until March 31, 2024.

“We ultimately are making decisions to either restructure or downsize some teams, and there will be a few cases of closures,” Wingefors said. “It’s difficult and it takes time, but we announced this in June and now we’re at the end of September and we’re confident to deliver on the targets we set out for the end of the fiscal year.”

Some interesting and weird stats on Embracer shares

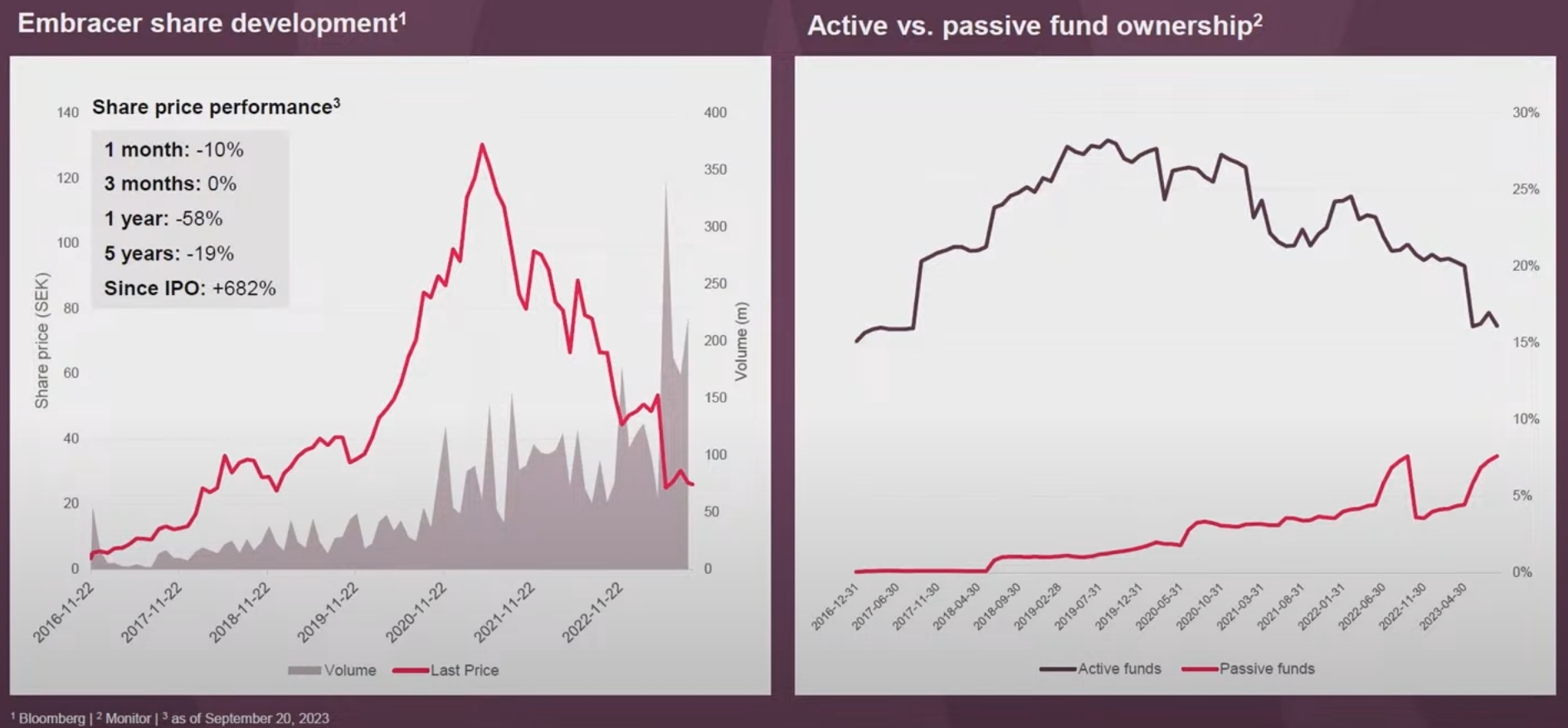

The company’s head of investor relations Oscar Erixon noted that Embracer’s share price has dropped by 58% in the last year. He attributed it to the factors mentioned above, including the collapsed deal, mixed reception of some games, and delays.

Over the course of five years, its stock has plunged 19%. However, since the company’s IPO in 2016, its shares have risen 682%. As can be seen from the graph below, the biggest spike occurred in 2020, during the pandemic and around the time Embracer began its aggressive shopping spree.

Erixon also shared some fun stats regarding Embracer Group shareholders (this makes us wonder what the split is like at other public game companies):

- Most shareholders are in the age groups 21-30 (28k), 31-40 (32.3k), 41-50 (23.5k), and 51-60 (20.5k);

- 8 shareholders are over 101 years old;

- 117 are between 91 and 100 years old;

- 673 are between 1 and 10 years old.

What about Embracer Group’s game sales?

Not all operating groups prepared presentations for the general meeting, but there still was some previously undisclosed data.

For example, Gunfire Games CEO David Adams announced that Remnant 1 and 2 have reached combined sales of roughly 7 million units, with over $200 million in revenue.

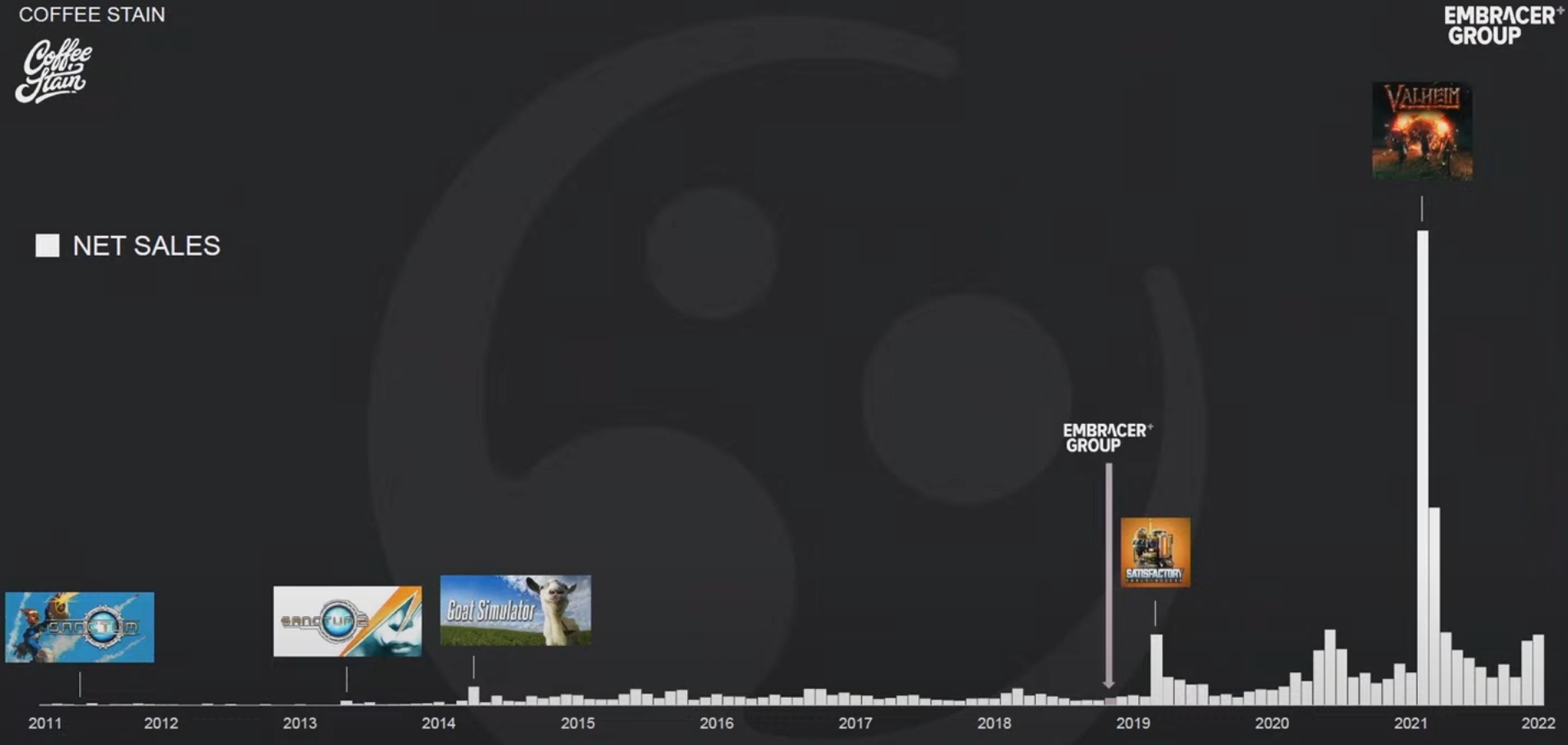

Coffee Stain CEO Anton Westbergh pointed out the biggest milestones in the history of Coffee Stain. While 2014’s Goat Simulator did take the publisher to the next level, its success seems almost invisible compared to the commercial performance of the company’s biggest hits.

In 2019, shortly after joining Embracer Group, Coffee Stain launched Satisfactory. And then, two years later, Valheim came out, showing crazy numbers. Not to mention Deep Rock Galactic, which launched in 2018 and has been steadily growing since then.

Westbergh then disclosed sales and revenues of the biggest titles in Coffee Stain’s portfolio:

- Satisfactory — 5 million copies sold, SEK 700 million ($62.8 million) in revenue;

- Deep Rock Galactic — 7 million copies sold, SEK 800 million ($71.8 million) in revenue;

- Valheim — 12 million copies sold, SEK 1.7 billion ($152.6 million) in revenue.

He also mentioned Welcome to Bloxburg, a Roblox game that Coffee Stain acquired last year. Westbergh noted that it is now one of the publisher’s biggest titles “both by player numbers and revenue” (exact figures remain undisclosed).

Embracer spends more money on store fees than game development

During a Q&A session, Wingefors was asked what he thinks about Epic’s recently announced First Run program, under which devs will be able to receive 100% of revenue during the first six months of exclusivity on the platform.

The Embracer Group CEO noted that “it’s good having competition to Steam, because it puts them on their toes to deliver the best experience.”

“We’re paying more fees to platforms than we spend on game development every year,” he continued. “If you just think about that number, it’s crazy. So there are margins within the platforms that I would preferably have within building more games and more margins.”

It is hard to say what amounts Wingefors meant specifically. But given that Embracer’s development expenditures surpassed $500 million last year, the numbers must be really “crazy.”

Embracer Group’s transmedia ambitions

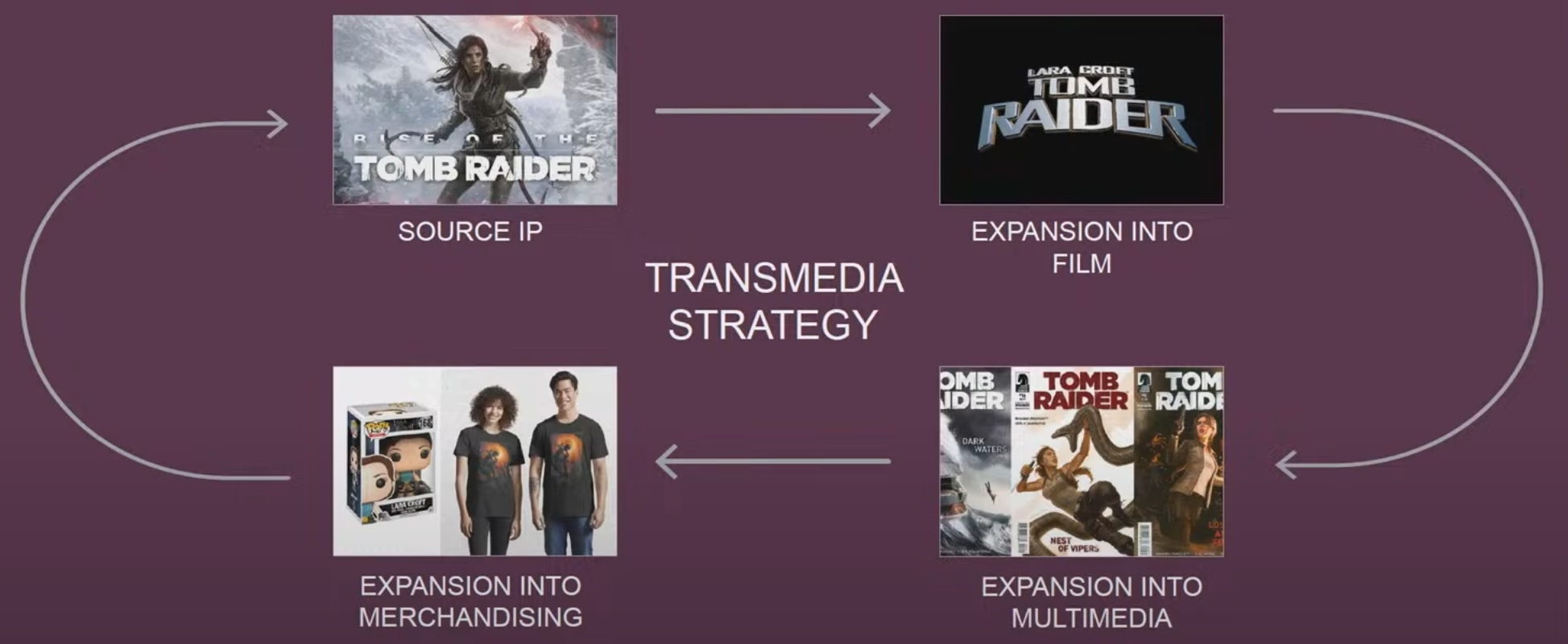

At the beginning of the general meeting, chair of the board Kicki Wallje-Lund announced that the company’s transmedia strategy finally “started to take road and began to bear fruit.”

The idea is to take its most valuable IPs and then use its divisions specializing in various areas to create products across several mediums. For example, there could be not only Tomb Raider games, but also films, comics, tabletop games, and merch. All of this should contribute to Embracer’s financial health and long-term growth.

Keep in mind that last year, the Swedish holding company paid $395 million to acquire The Lord of the Rings rights spanning video games, films, merchandise, and even theme parks. Not to mention other franchises it currently owns.

“Through our transmedia strategy, we strive to build an even stronger ecosystem based on diversified IP portfolio, with an opportunity to cross-fertilize IPs and strenghten licensing parnterships across gaming categories, different content formats, and platforms,” Wingefors said, adding that Embracer Group is now a “full-scale gaming and entertainment company.”

The full recording of Embracer Group’s general meeting can be viewed below.