Games and Names is a new podcast launched by AppMagic in partnership with WN Media Group. The first episode, featuring Niko Partners’ Daniel Ahmad, is focused on mobile genres that managed to beat the overall market decline in 2022.

The Games and Names podcast is hosted by Stan Minasov, VP of Product at AppMagic. He is joined by two experts, Niko Partners Director of Research & Insights Daniel Ahmad and AppMagic Business Development Manager Kirill Vaganov.

Together, they have analyzed the state of the mobile games market to help developers and publishers better understand what trends they should look up to in 2023 and what genres have the most success potential right now.

Below are the key takeaways from the conversation, but to get the big picture and breakdown of each genre, listen to the full episode on:

How did the Merge-2 genre double in revenue despite the market downturn?

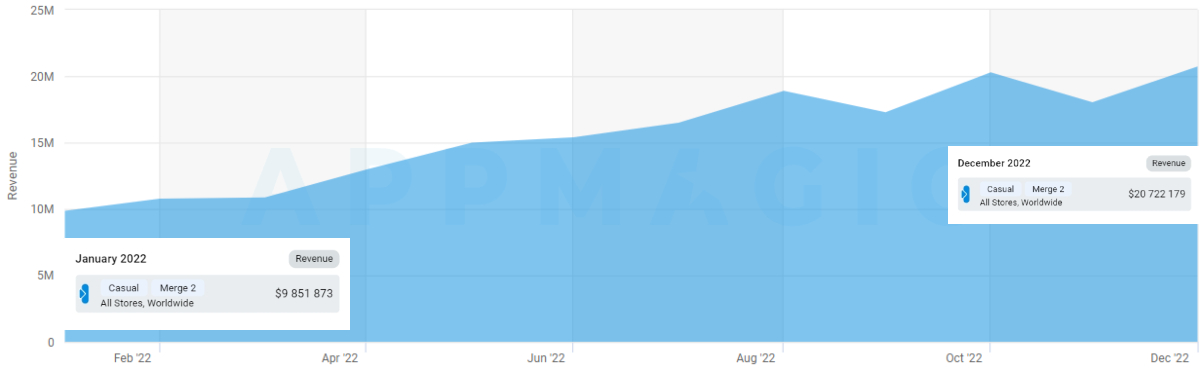

- The Merge-2 games saw strong growth in 2022, with revenue up 102% year-over-year amid an overall market decline and a 10% drop in some genres. In Tier 1 West countries, the category went from around $7 million per month in January 2022 to nearly $15 million per month by the end of the last year.

- The growth was largely driven by breakout titles such as Higgs Studio’s Chef Merge or Micro Fun’s Gossip Harbor and Seaside Escape.

- As pointed out by Daniel Ahmad, the genre has also doubled year-over-year in Asia, thanks to games like Merge Mansion and Merge County, which fueled growth in Japan and South Korea.

- There is also a global trend where Merge mechanics are applied to other genres such as expedition games or idle tycoons, creating new hybrid titles.

- Not to mention the implementation of Merge-2 into Match-3 titles in terms of live ops and events. The main reason is that this is a pretty simple yet very comfortable mechanic to fit into different casual genres.

- Another trend is the emergence of much simpler Merge games in terms of gameplay mechanics and production costs aimed at another audience (somewhere between hyper-casual and hybrid-casual). The main examples are Merge Studio and Makeover Merge, which use ads as the main source of revenue (as opposed to traditional Merge titles, which rely more on IAPs).

Increase in Merge-2 monthly revenue globally from January 2022 to December 2022

Is the Match-3 Tile genre a new big thing?

- The subgenre came into existence in 2021 with the release of games like Match Triple 3D. In contrast to classic Match-3 titles, they were way more casual and way more simple to make. The core gameplay was Mahjong-like where players simply had to select matching tiles on the board.

- But it was Zen Match that launched in late 2021 and quickly became the new leader by combining relaxing gameplay with the decoration meta, which was really popular in the mobile market at the time.

- The growth of the Match 3 Tile subgenre continued in 2022, with AppMagic data showing that it surged by 85% in revenue year-over-year.

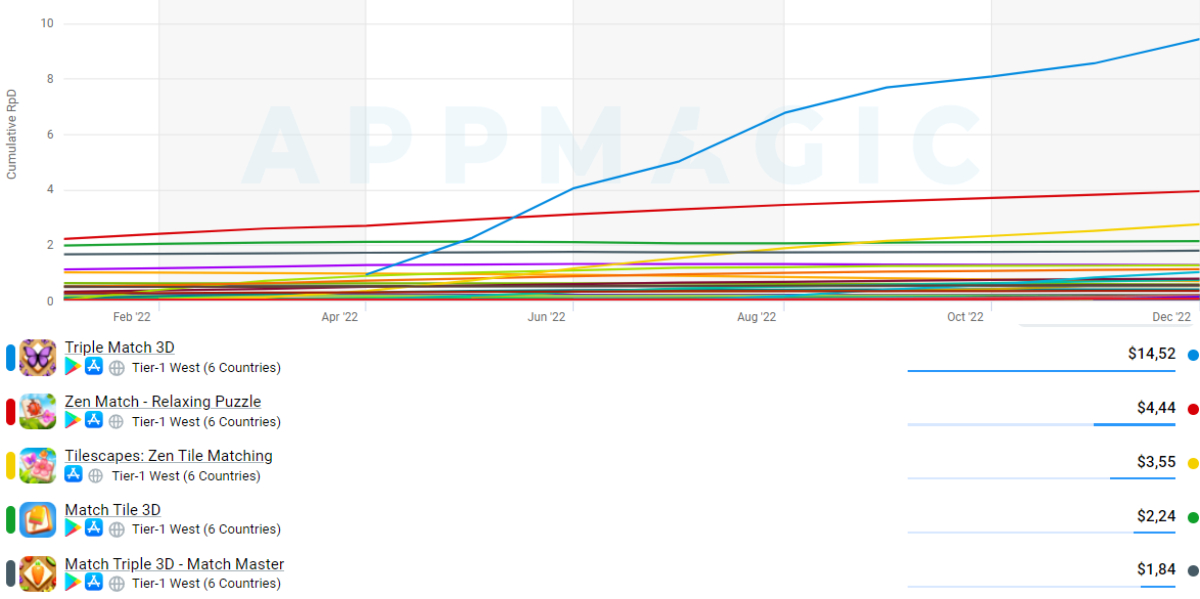

- The main driver here is Triple Match 3D, which accelerated player spending by adding the order system and making users purchase various power-ups and additional lives. As a result, the game reached $10 million in monthly revenue and a whopping $14 RpD in Tier-1 West countries.

- According to Niko Partners, the Match-3 Tile subgenre was also hugely successful in Asia, more than tripling its revenue in 2022.

Top Tile-3 games by RpD in Tier 1 West countries

The success of Survivor.io

- Launched last Summer, Survivor.io, which copies a lot of elements from Vampire Survivors, has become another big hit in the portfolio of Archero publisher Habby. It is also very successful in Asia, with China being the largest market for the game in the region.

- According to Ahmad, one of the reasons behind its success is the combination of casual gameplay of Archero and more complex roguelike elements, which serves well for onboarding both casual and midcore audiences.

- So the recipe here is adding advanced mechanics to a simple yet already proven concept. This makes the game deep, not difficult, and keeps players engaged as they discover new layers of gameplay.

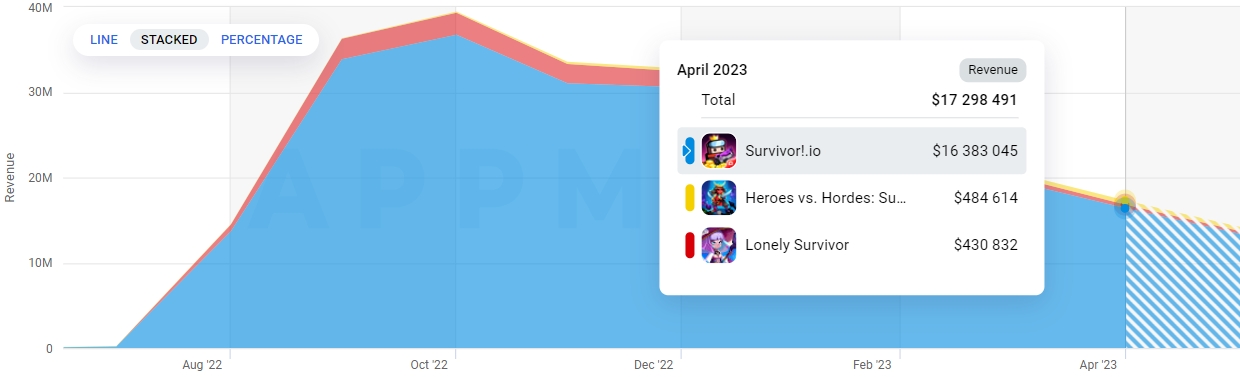

- Of course there are a lot of clones that try to follow in Habby’s footsteps and emulate its success. However, its closest competitors haven’t even reached 10% of Survivor.io’s monthly revenue.

- In April, Survivor.io generated $16.3 million, while titles like Heroes vs. Hordes and Lonely Survivor only reached $484k and $430k in revenue respectively.

Survivor.io monthly revenue compared to similar titles

Why a strong IP is essential for entering the Core games market

- Despite some big launches like Diablo Immortal ($165 million in IAP revenue last year) and Marvel Snap ($27 million), the core games market faced some hurdles in 2022.

- One of the reasons for the decline in both revenue and downloads is Apple’s App Tracking Transparency framework, which made it almost impossible to buy traffic and target the specific audience. This affected complex genres like RPG and Strategy.

- One thing that can help overcome these challenges in the core niche is building a game around a strong IP. Having a franchise that is already popular outside of mobile can also help in targeting the right audience.

- The same applies to not only Western markets, but Asian ones as well. “If we look at new games launched in China in 2022 and how successful they were, pretty much all of the top games were based on IP of some kind,” Ahmad noted, citing Diablo Immortal Return to Empire, and League of Legends Esports Manager as prime examples.

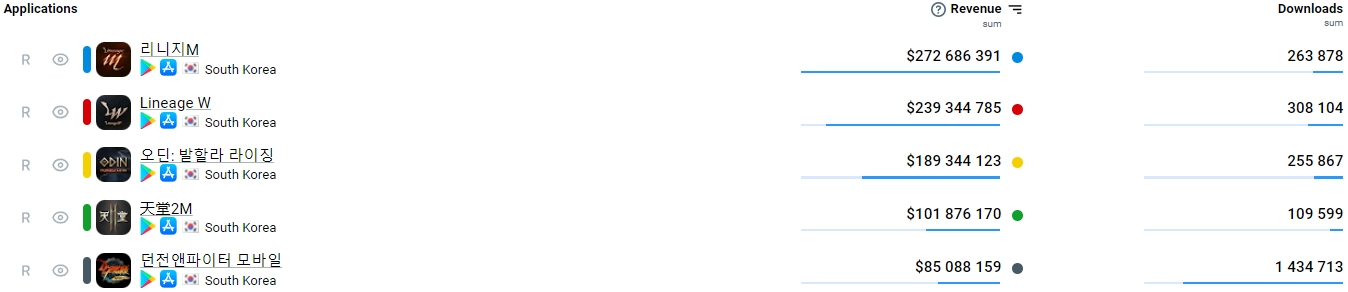

- South Korea is the region dominated by local developers and publishers backed by strong franchises. For example, there were three Lineage games in the top 5 highest-grossing mobile RPGs of 2022, as well as Nexon’s new title Dungeon & Fighter M.

Top mobile RPGs by revenue in South Korea (in 2022)

More insights on other genres, such as Idle Tycoon and hyper-casual games, and great game recommendations from Daniel and Kirill can be found in the full episode of the Games and Names podcast.