Last week, Sensor Tower announced its acquisition of Video Game Insights to expand into console and PC games data. The question is, what could be the consequences of consolidation in the gaming analytics sector? Here’s our deep dive into Sensor Tower’s M&A strategy and the potential risks it poses to the market.

Contents:

- Sensor Tower aims for consolidation;

- VG Insights’ market position: what its acquisition means for Sensor Tower;

- Monopolizing data analytics: the downside of Sensor Tower’s expansion.

Sensor Tower aims for consolidation

Consolidation in video game analytics is not a common trend. Most companies prefer to grow independently. One of the few exceptions was Nielsen’s acquisition of SuperData Research in 2018. That deal was intended to strengthen Nielsen’s position in esports data tracking. However, the company shut down SuperData as a separate entity less than three years after the acquisition, with some experts saying the data market was already overcrowded at the time.

Against this backdrop, Sensor Tower is taking a much more aggressive approach. The VG Insights acquisition marks the company’s third M&A deal. Previous buys include:

- 2021 | Pathmatics — a marketing platform that enriched Sensor Tower with mobile advertising analytics and data for platforms like TikTok and YouTube;

- 2024 | data.ai (formerly App Annie) — a direct competitor in mobile analytics, whose acquisition provided Sensor Tower with new data collection tools and significantly expanded its corporate client base.

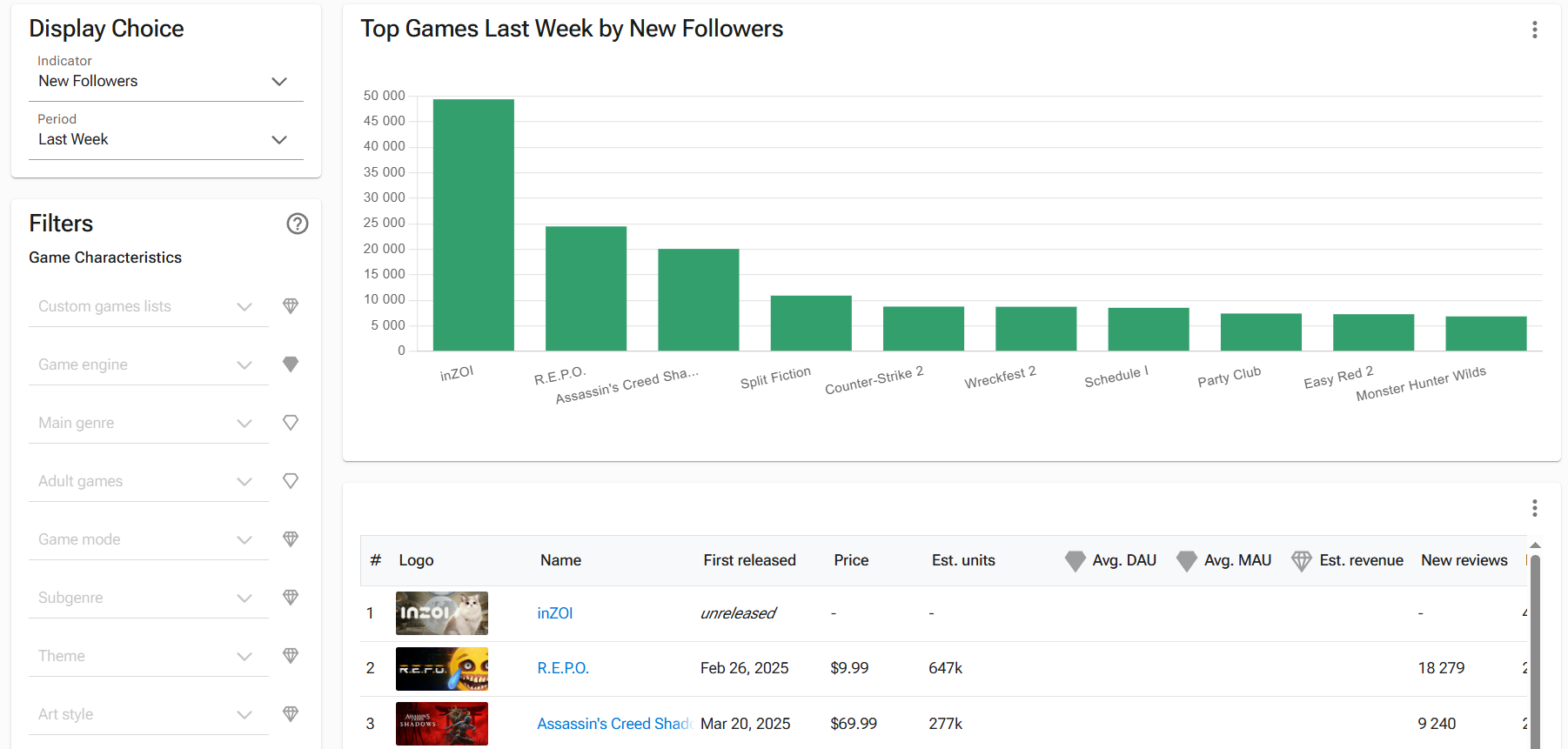

Sensor Tower’s introduction of Steam, Xbox, and PlayStation market intelligence through VG Insights

Sensor Tower hasn’t publicly disclosed the financial terms of these acquisitions. The Pathmatics and data.ai deals were partially funded by Sensor Tower’s majority shareholder Riverwood Capital, which first invested $45 million in the company back in 2020. Joost van Dreunen, co-founder of SuperData and now CEO of research firm Aldora, estimated the data.ai acquisition at around $300 million, based on its annual revenue of roughly $100 million.

At the time of the deal, data.ai was larger than Sensor Tower, as evidenced by its workforce, estimated revenue, and capital raised. According to Crunchbase, data.ai closed several funding rounds totaling $157 million. That’s why many industry folks were surprised not only by the deal itself, but also by the fact that Sensor Tower was the buyer.

In addition to Riverwood Capital’s investment, Sensor Tower received credit-based financing from Bain Capital Credit, a subsidiary of Bain Capital specializing in mezzanine loans among other areas. The firm led the financing for the data.ai deal, but its exact terms remain undisclosed.

VG Insights is still a relatively small company, positioning itself as a startup. So its acquisition likely required far fewer resources.

One of the dashboards on the VG Insights platform

However, dependance on private investors could eventually put Sensor Tower in a vulnerable position. While it remains a private company for now, increasing investor influence comes with growing expectations for business expansion.

One possible approach is acquiring competitors instead of developing products in-house. It is quite a radical strategy for the data business, but Sensor Tower COO Tom Cui explicitly outlined this goal after the data.ai acquisition. The company aims to show growth by any means necessary, both organically and inorganically.

The data.ai and VG Insights acquisitions, announced just a year apart, were both revealed during the Game Developers Conference (GDC). It remains to be seen whether Sensor Tower will continue its M&A expansion at the same pace. One thing is clear: the company is committed to expanding its analytics services with the long-term goal of becoming a “one-stop shop” for tracking all segments of the global games market.

This includes data tools for mobile, web, PC, and console products. Sensor Tower wants every market player to see it as the end-to-end solution. “It’s going to take us years to get there. But with the combined resources [of acquired companies] and further brain power, we’re able to get there,” Cui stated.

VG Insights’ market position: what its acquisition means for Sensor Tower

From a business development perspective, the VG Insights acquisition seems logical. Following the deal, Sensor Tower has positioned itself as the “preeminent source for gaming insights,” expanding its coverage into PC and console markets.

VG Insights was founded in 2020 by Karl Kontus, who developed the platform while working at 2K Games’s London office (he only left the company in April 2024). He noted that the idea for VG Insights arose due to the lack of comprehensive analytics tools for indie teams making games for PC.

If you’re a mobile game developer, you’re in luck when it comes to data. If you have enough money to get a Sensor Tower or App Annie subscription, there’s close to unlimited amount of data available for you. It’s incredibly good. And if you’re on the PC side, it’s much more of a struggle.

CEO of VG Insights