With Ubisoft shares still in turmoil, one of its investors has proposed some radical changes to its management and operations. One of them is to take the French company private.

Assassin’s Creed Shadows

On September 9, Slovakian hedge fund AJ Investments, which controls less than 1% of Ubisoft shares (via WSJ), published an open letter to Ubisoft’s board of directors. The investor believes that the company is greatly undervalued, also expressing concerns about its management and business direction.

“Ubisoft at current state is mismanaged and shareholders are hostages of Guillemot family members and Tencent who take advantage of them,” the letter reads, adding that the company’s management is focused on pleasing investors with beating quarterly results rather than of making high-quality games for players.

AJ Investments urged Ubisoft and its board of directors to:

- Take the company private, with Tencent remaining as a “significant partner” and shareholder;

- Allow the sale process to a strategic investor or let the Guillemot family buy out minorities for a fair price;

- Reduce costs by laying off employees and considering selling some studios focused on non-core games to lower the company’s debt and become more efficient and competitive in the long term;

- Focus on core IPs such as Rainbow Six, Assassin’s Creed, Far Cry, Watch Dogs, and Splinter Cell;

- Reevaluate the current management team and consider hiring a new CEO instead of Yves Guillemot.

One of AJ Investments’ main concerns is that the Guillemot family and Tencent are “discounting potential value of Ubisoft in order to buy more shares at lower valuation and eventually take full control of the company.”

The Chinese tech giant first invested in Ubisoft in March 2018 by acquiring a 5% stake. In 2022, it bought a 49.9% stake in Guillemot Brothers Ltd., a company owned by Ubisoft founders. The deal was worth €300 million and provided Tencent with 5% of the voting rights in the holding company.

It is worth noting that €300 million was invested in Guillemot Brothers Ltd. at a valuation of €80 per share for Ubisoft. However, the next year Guillemot Brothers Ltd bought more than 4 million Ubisoft shares (3.5% of the total capital) at around €19 per share. From this, AJ Investments concludes that they are using the current situation with the company to acquire more shares at an even lower price.

Tencent and the Guillemot family currently control over 25% of Ubisoft’s share capital, while minority shareholders own roughly 70%. AJ Investments noted that “based on our talks with other shareholders we believe that we have enough voting power to challenge Guillemot’s.”

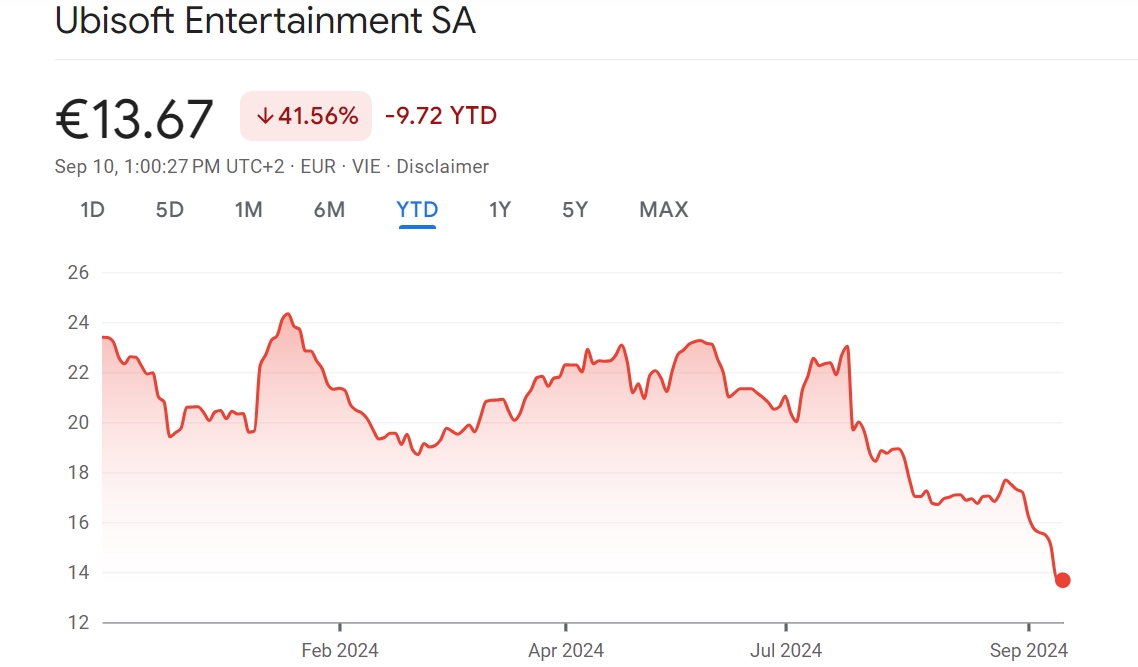

The firm also thinks Ubisoft should be worth between €40-45 per share. However, the French company has been in turmoil for a while now, with its stock currently trading at €13.74 per share (after the letter was published). This brings its market cap to just €1.74 billion.

Last week, Ubisoft share fell to the lowest level since 2015. Analysts lowered sales forecasts for Star Wars: Outlaws, also expressing concerns about the future of the recently launched free-to-play shooter XDefiant.

Overall, the French company’s stock has plunged over 40% since the start of 2024, with the decline over a 12-month period exceeding 50%.