Market intelligence platform InvestGame has issued a new report on deal activity in the games industry for the first quarter of 2023. Here are the key findings from analysts.

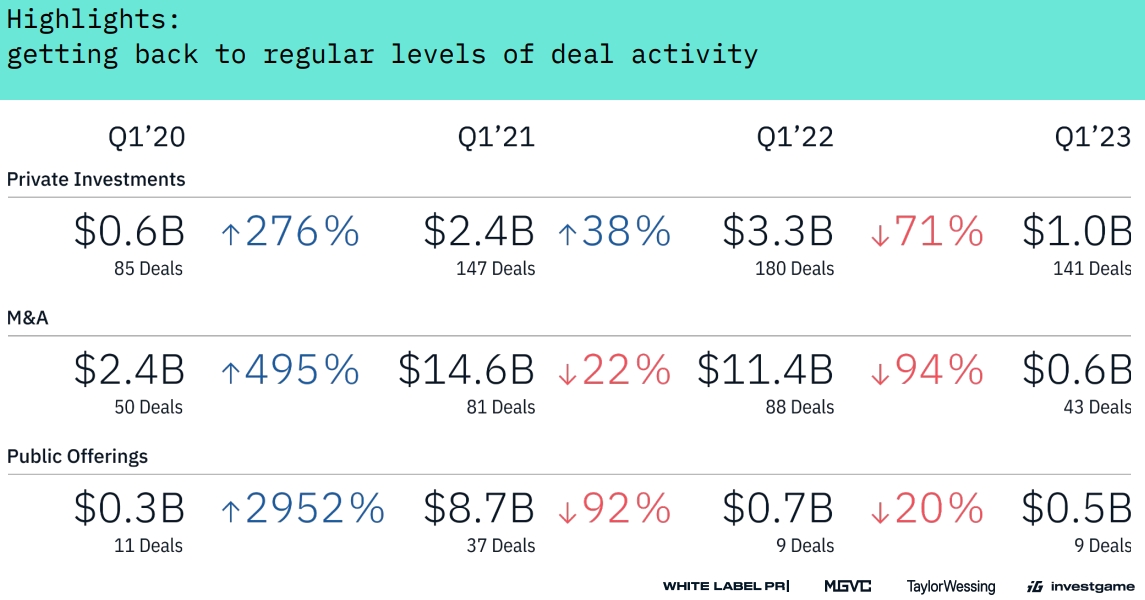

- According to the latest InvestGame report, there were 193 closed deals in the games industry in the first quarter, compared to 277 in the same period last year.

- Their total value was $2.1 billion, down 86% from $15.4 billion in the first quarter of 2022.

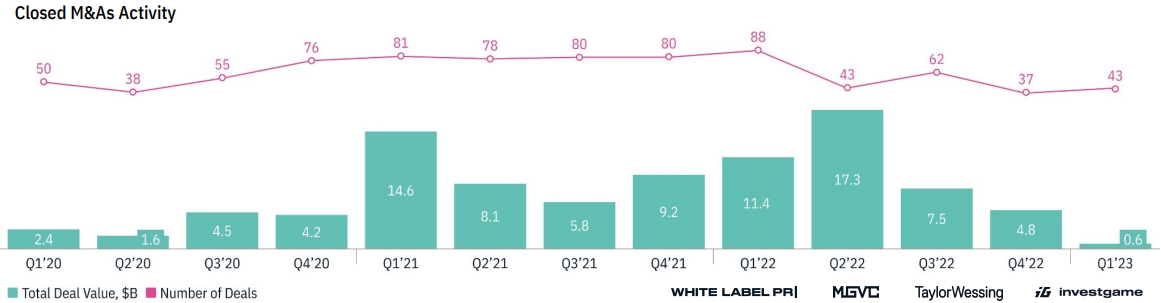

- M&A deals experienced the biggest decline, falling 94% year-over-year to 43 closed deals valued at $600 million. There were also 141 private investments ($1 billion, down 71%) and 9 public offerings ($500 million, down 20%).

- InvestGame noted that M&A activity has hit its lowest point, but analysts expect a recovery in the future. This is largely due to the already announced deals: Savvy Games Group’s acquisition of Scopely for $4.9 billion and SEGA’s acquisition of Rovio for $800 million.

- Despite a YoY decline, private investments showed increased compared to the previous quarter. “The Early-stage market continues to be robust and is expected to be a significant driving force behind the emergence of new unicorns in the next 3-5 years,” InvestGame said.

- There were 77 deals directly related to video game developers and publishers with a total value of $400 million. Other transactions were related to esports and platform companies.

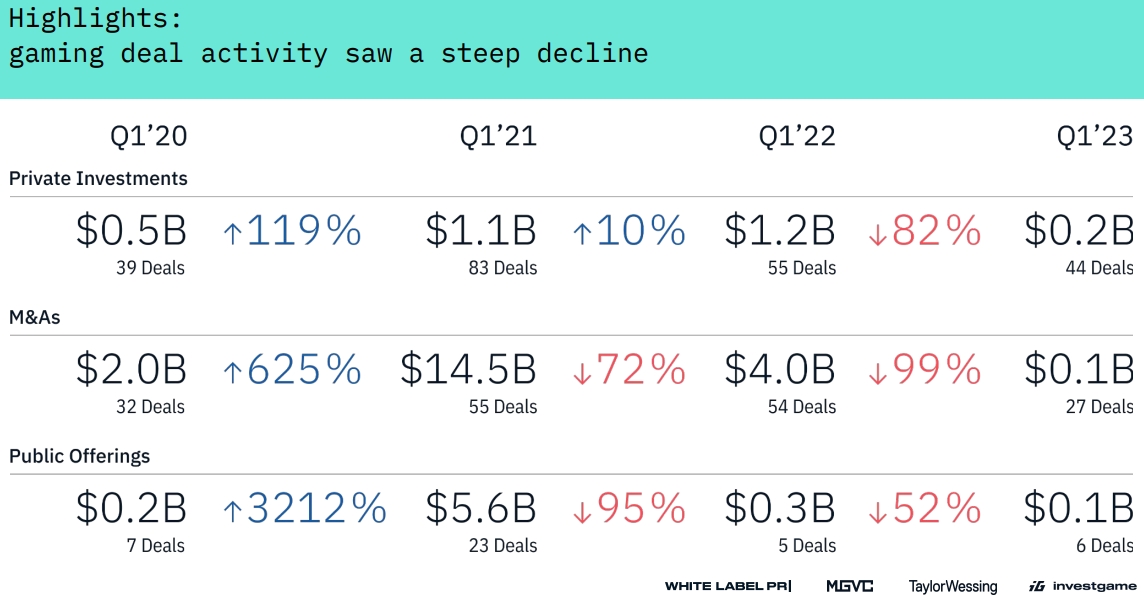

- When it comes to gaming deals, ther were 44 private investments ($200 million, down 82% year-over-year), followed by 27 M&A deals ($100 million, down 99%) and six public offerings ($100 million, down 52%).

- Andreessen Horowitz was the most active VC fund in gaming, with nine closed deals worth $177 million). It is followed by Makers Fund (seven deals, $66.4) and Bitkraft Ventures (seven deals, $150 million).

More data and insights can be found in the full report.