Aldora, a new data platform launched by SuperData co-founder Joost van Dreunen, has released its forecast for the interactive entertainment market. Here are the key takeaways.

Image credit: Soumil Kumar, via Pexels

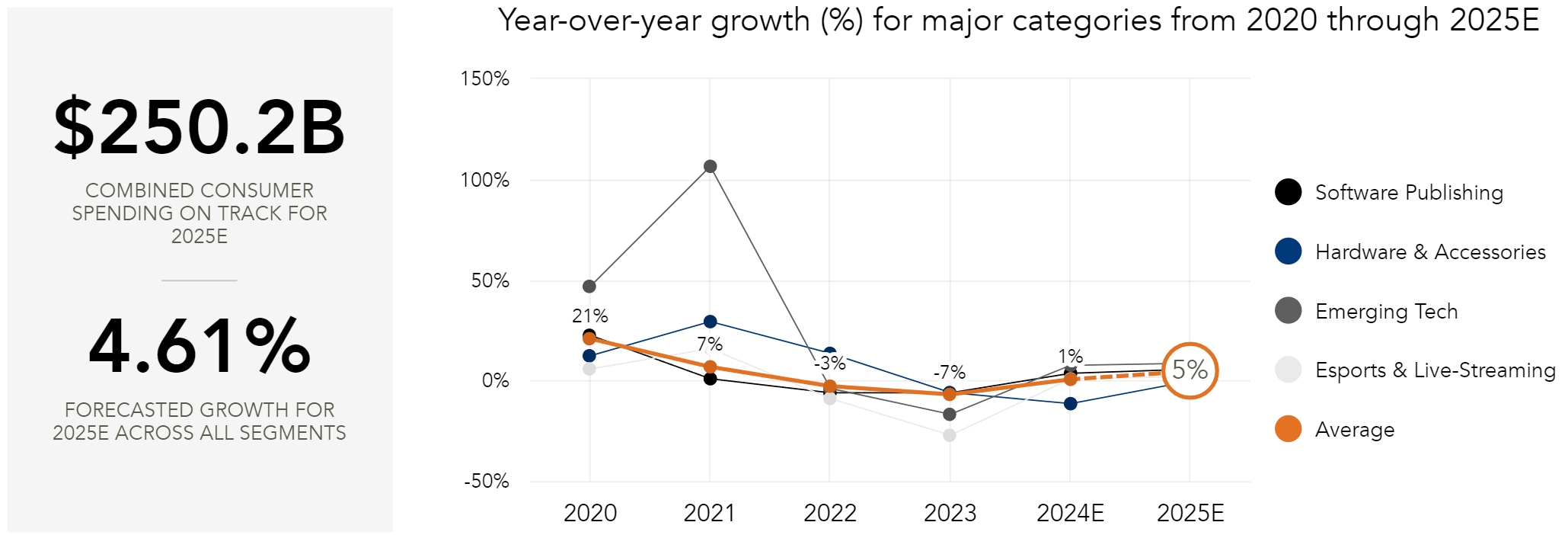

- According to Aldora’s global market sizing & forecast, the interactive entertainment market will generate $250.2 billion in 2025, up 4.6% year-over-year. By “interactive entertainment,” the firm means video games (software), hardware, accessories, esports, live streaming, and emerging technology like VR.

- Consumer spending on video games is expected to grow 3.6% year-over-year to $186 billion in 2024. The growth will continue in 2025, with the segment reaching $196.6 billion in revenue, up 5.7%.

- In 2025, Mobile will remain the largest segment with $115.7 billion (+5.51% from 2024), followed by console ($46.8 billion, +4.2%) and PC ($34 billion, +8.1%).

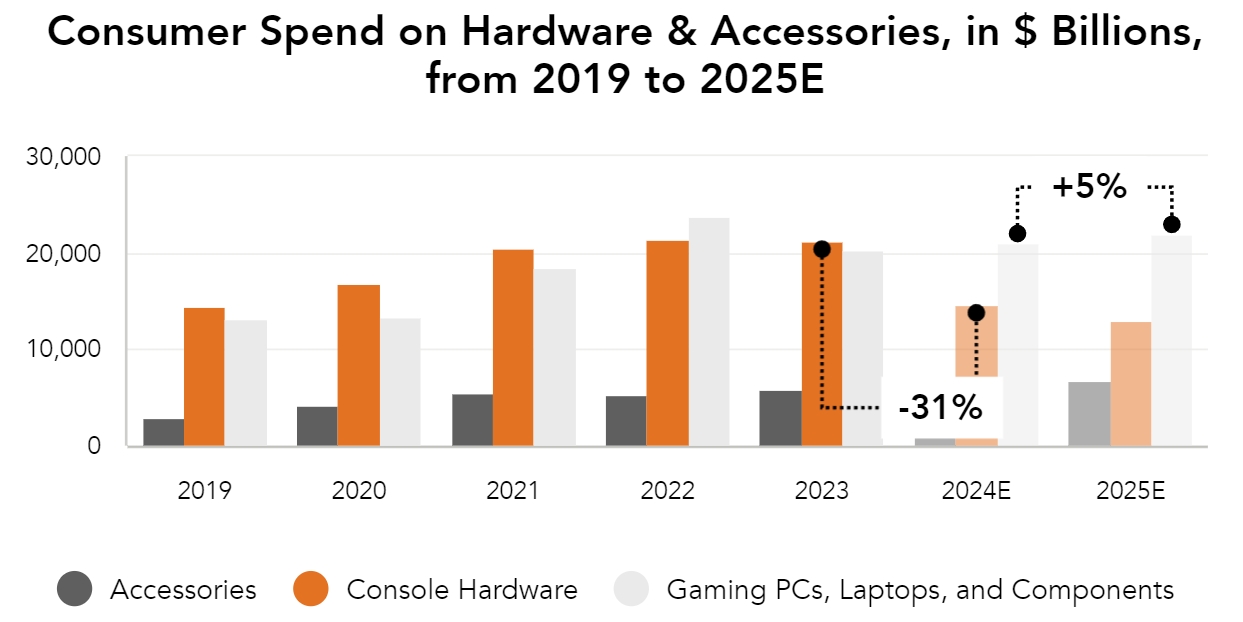

- Console hardware sales are forecasted to fall 11% year-over-year to $13 billion in 2025, following a sharp 31% decline in 2024. This marks the end of the current generation, with platform holders lowering their forecasts.

- However, other hardware segments will continue to grow gradually. Accessories will generate $6.8 billion in 2025 (+9.21%), while Gaming PCs & Components will reach $22 billion in revenue (+4.5%).

- The Emerging Tech segment is expected to reach $7.4 billion in 2025, up 8.8% year-over-year. VR will lead the growth with $3.8 billion (+10.9%), followed by Web/HTML5 games ($2.9 billion, +5.8%) and blockchain-based gaming ($700 million, +7.8%).

- According to Aldora, the segment will be driven by major investments from tech leaders like Meta and Apple.

- “Blockchain gaming, while growing at 21% year-over-year in 2024 as a result of the appreciation in major crypto-currencies remains a niche market at $651 million,” van Dreunen pointed out. “And Web-based gaming is reinvigorated, growing +5.8% to $2.9 billion in 2025E.”

- Live streaming revenue is forecasted to reach $4.4 billion in 2025, up 2.4% year-over-year, with the esports market falling 8.3% to $160 million.

- Aldora noted that live streaming platforms like Twitch “struggle with profitability due to high costs and competition,” with van Dreunen adding that the decline in esports revenue highlights “the difficulties in effectively monetizing competitive gaming audiences.”

- When looking at overall industry trends, the report highlights how major game companies are mowing towards transmedia strategies, seeking to expand their core IPs beyond video games.

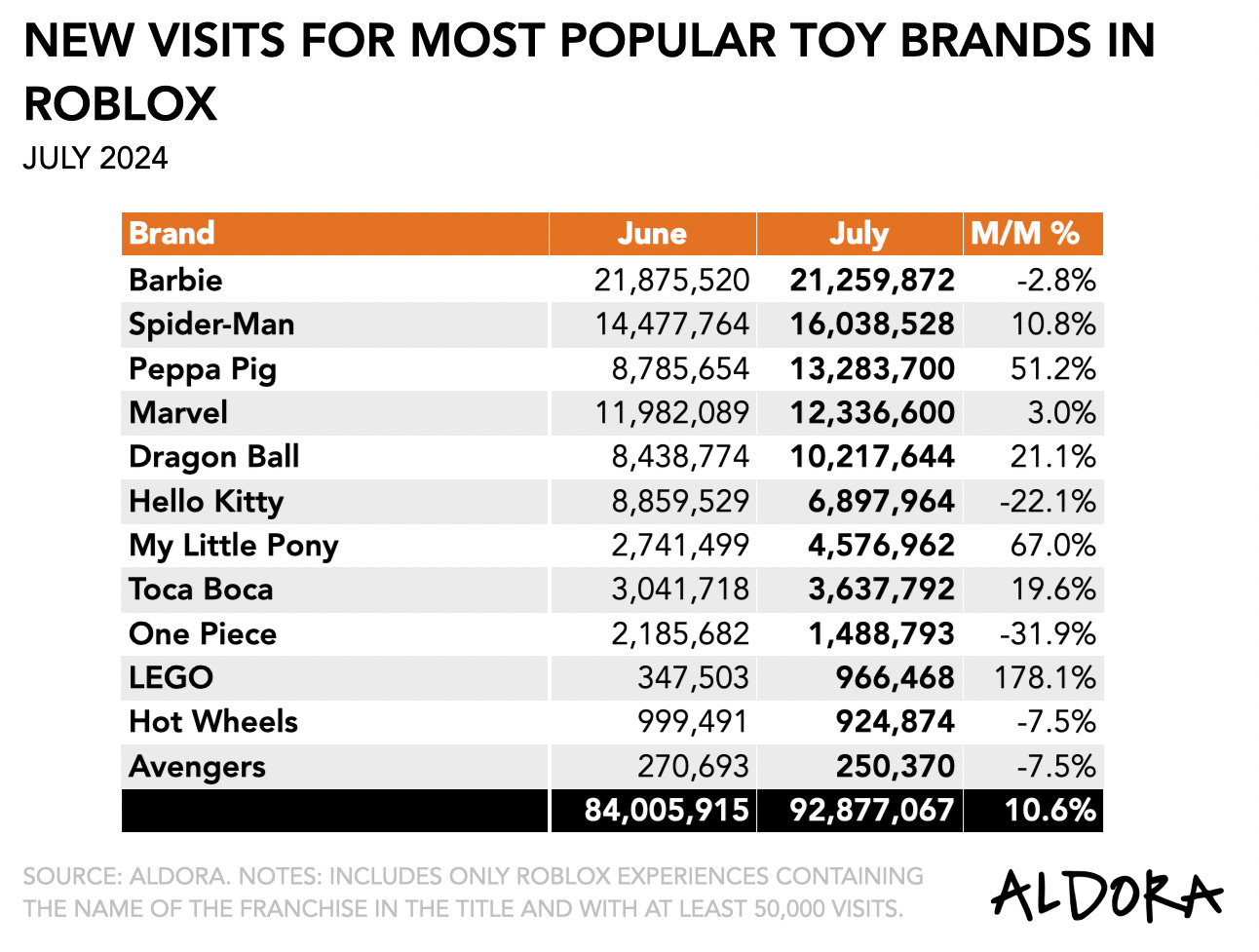

- At the same time, non-gaming brands continue to push into virtual worlds. Alodra noted that Mattel’s Barbie remains the most popular toy franchise on Roblox. Despite a slight decrease in monthly traffic in July (21.2 million new visits, -2.8%), it is still way ahead of its rivals like Spider-Man (16 million, +10.8%), Peppa Pig (13.2 million, +51.2%), and Marvel (12.3 million, +3%).

“Companies that can successfully navigate the evolving landscape, leveraging established IP across multiple platforms and embracing new technologies, will have a better chance to emerge as winners when 2025 rolls around,” van Dreunen concluded.

For more data and insights, check out the full report.