Newzoo has released a report on the state of the global video game market in 2024. It contains new revenue forecasts and explores key industry trends.

Helldivers 2

Key takeaways

- According to its new Global Games Market report, Newzoo expects the number of paying gamers to reach 1.5 billion this year, up 5% from 2023. This represents 43.8% of the total 3.42 billion players globally.

- The global video game market will generate $187.7 billion in 2024, up 2.1% year-over-year. It will grow on a 3.1% CAGR to $213.3 billion in 2027.

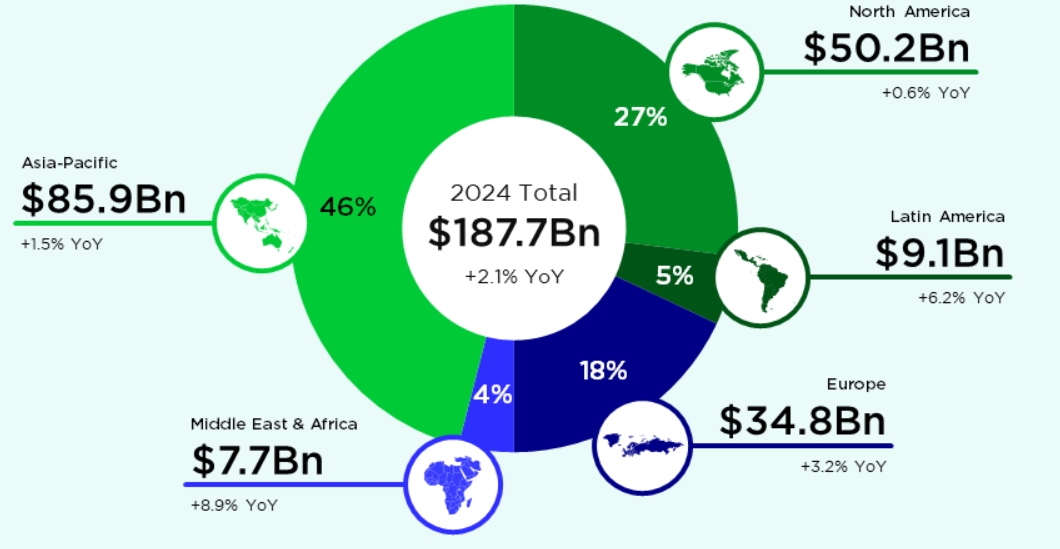

- In 2024, Asia-Pacific will remain the top region by revenue, with $85.9 billion (+1.5% year-over-year). It will be followed by North America ($50.2 billion, +0.6%), Europe ($34.8 billion, +3.2%), Latin America ($9.1 billion, +6.2%), and Middle East & Africa ($7.7 billion, +8.9%).

Global games market revenue by region

- Newzoo noted that 49% of total gaming revenue will come from the US ($47 billion) and China ($45 billion).

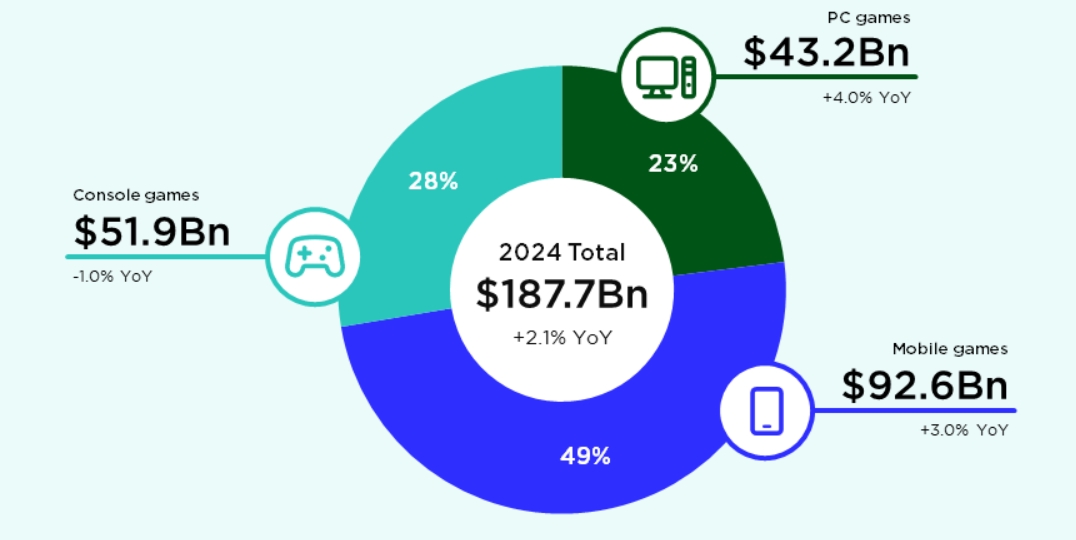

- Although the PC market will remain the smallest segment by revenue, it will outgrow mobile and console revenues in 2024, reaching $43.2 billion (+4% year-over-year). The growth will be driven by successful evergreen titles, cross-platform releases, and a lack of major console games.

- Mobile revenues will grow 3% year-over-year to $92.6 billion, while the console games market will fall 1% to $51.9 billion.

- According to analysts, console revenues will start growing again in 2025 thanks to a new Nintendo hardware and major releases like GTA VI.

Global games market revenue by segment

8 video game market trends

- Shift towards cross-platform games: Sony and Microsoft explore more opportunities to bring their games to other platforms, with new Newzoo saying that PC benefits from this shift the most and that “current development costs make it increasingly difficult to break even on a single platform.”

- Picking the right size for single-player games: to survive in today’s market, large companies may choose a new strategy of making more compact games to “maximize returns and create runway for more extensive project.”

- Mobile platform holders are forced to make their ecosystems more open: regulators have pressured Apple to allow third-party app stores and alternative payment methods, with companies like Microsoft and Epic Games announcing their mobile expansions.

- Early Access is the ultimate form of community management: working with the community and building the trust before launch is key to success in today’s market (especially on PC, where Steam offers its Early Access system).

- Most live service games fail to reach and retain players: Newzoo noted that “playtime has consolidated further [around evergreen hits], user acquisition costs are high, and conversion rates for new titles are low.”

- Market downturn creates gaps for indie and AA games: 2024 is a year of successful releases from smaller studios as AAA companies struggle to adapt to rising costs, a more entrenched player base, declining playtime, retention, a saturated live service market, and other challenges.

- The industry has yet to fully understand the impact of generative AI, including its risks, limitations, and the integration of this technology into game development.

- UGC is key to reaching new generations of players: according to Newzoo, 94% of Gen Alpha and Gen Z consumers play video games, and they also engage with this medium in more diverse ways (e.g. viewing and creating game-related content). Understanding and working with this audience could help companies scale their player base.

More data and insights can be found in the full report.