Data analytics firm PricewaterhouseCoopers (PwC) has shared a new report on the US video games and esports market. Here are the key figures and takeaways, as well as a forecast for the next five years.

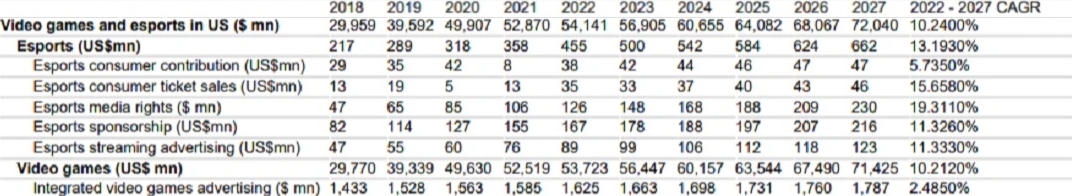

- According to PwC data shared by GamesBeat, in 2022, the video games and esports market in the US grew 2.4% year-over-year to $54.1 billion. This is the lowest growth rate in five years, following a boom during the COVID-19 pandemic.

- For comparison, the YoY growth of the US market in 2020 and 2019 was 26.1% and 32.1% respectively.

- Video games accounted for over 99% of total 2022 revenue, while the esports segment generated only $455 million in 2022. However, the esports market is expected to reach $662 million in 2027.

- Despite the overall slowdown, analysts expect gaming and esports revenue to reach $72 billion in 2027, representing a 5.9% CAGR.

- In 2022, traditional gaming (console and PC segments) accounted for just 27.6% of the US market’s total revenue. It was down 0.8% year-over-year and is expected to grow at a 1.9% CAGR and reach $16.5 billion in 2027.

- Console games generated $9.48 billion in the US last year. Although physical sales still represent 44% of the sector’s total revenue, PwC expects a further decline in favor of digital sales and microtransactions.

- For example, online/microtransaction console titles are expected to grow from $1.87 billion in 2022 to $3.15 billion in 2027.

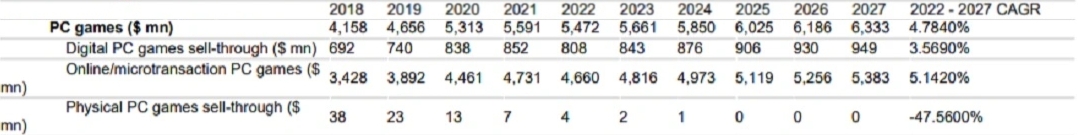

- In the US, physical sales of PC games are pretty much non-existent, and the market is driven by online/microtransaction titles, which accounted for 85% of the total $5.4 billion generated last year.

- The PC segment was also down 2.1% year-over-year, but growth is expected to resume in 2023. The market is also said to reach $6.3 billion in 2027.

- According to PwC, Steam accounts for between 50% and 70% of all global PC games’ downloads, so Valve’s platform is really a dominant force there.

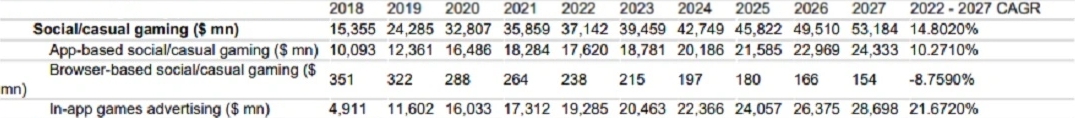

- Social/casual gaming (mobile and browser titles) grew 3.7% year-over-year to $37.1 billion in 2022. The segment is expected to reach $53.1 billion in 2027.

- In-game advertising was the largest revenue generator, with $19.2 billion, or 52% of the entire social/casual gaming sector.

More data insights from PwC can be found in the full GamesBeat report.