Mobile games industry has embraced hyper-casual genre relatively recently, but it is already outperforming casual gaming in a number of ways. GameAnalytics compares the two categories against the backdrop of the more established genres.

When comparing hyper-casual and casual, the study looked at the following parameters:

- the number and duration of gaming sessions;

- DAU;

- retention.

Oh, and of the purposes of this study, GameAnalytics prefers the term “Arcade” over “Hyper-casual” since the latter is not listed as a separate category in mobile stores. Otherwise, these two are synonymous.

Sessions

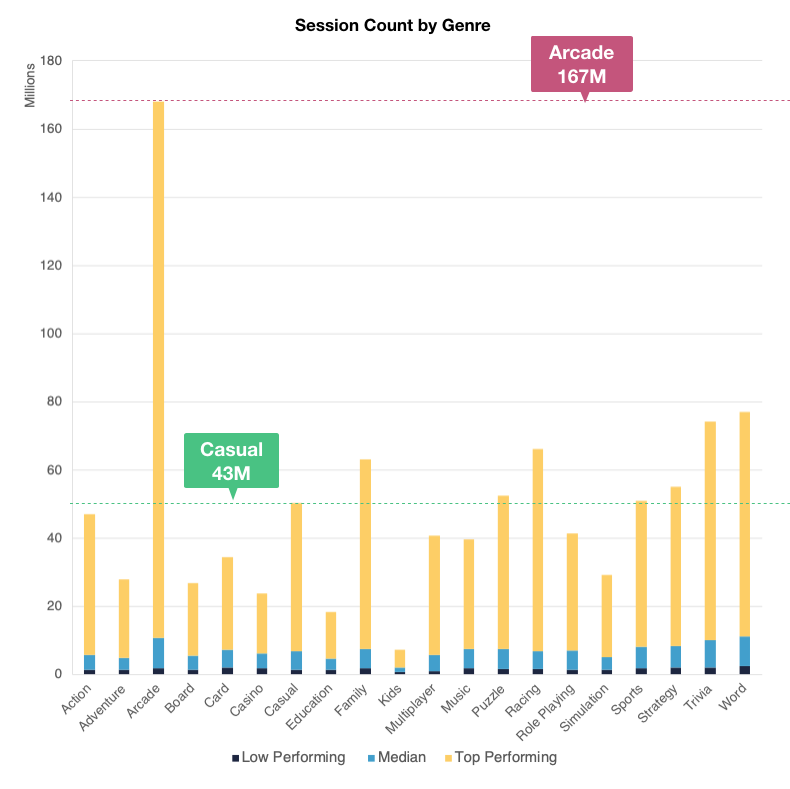

- Casual genre accounts for 43 million gaming sessions per year. Arcade/Hyper-casual gets almost four times as much traffic: 167 million sessions per year.

- However, the average session length for casual games is twice as long as that seen for hyper-casual. In fact, if we look at top 20 mobile genres by session length, hyper-casual comes in second to last.

- Median gaming session across the industry is 14mins 30secs. For hyper-casual, it’s 6mins 42secs.

- Is that frustratingly short? Nope. It’s actually quite adequate since hyper-casual is all about high session count and short impulsive gameplay.

DAU

- Hyper-casual games are in the lead, with DAU stats reaching 94K players for top-performing titles. This is the highest result across the mobile market: top-performing hyper-casual games are 3.5x more popular than the industry average. However, there has been a decline in average DAU across hyper-casual category.

- Casual games, on the other hand, are seeing their DAU stats grow. Casual audience has grown by half over the past year. Top performers in this category are getting DAU of 26K.

Retention

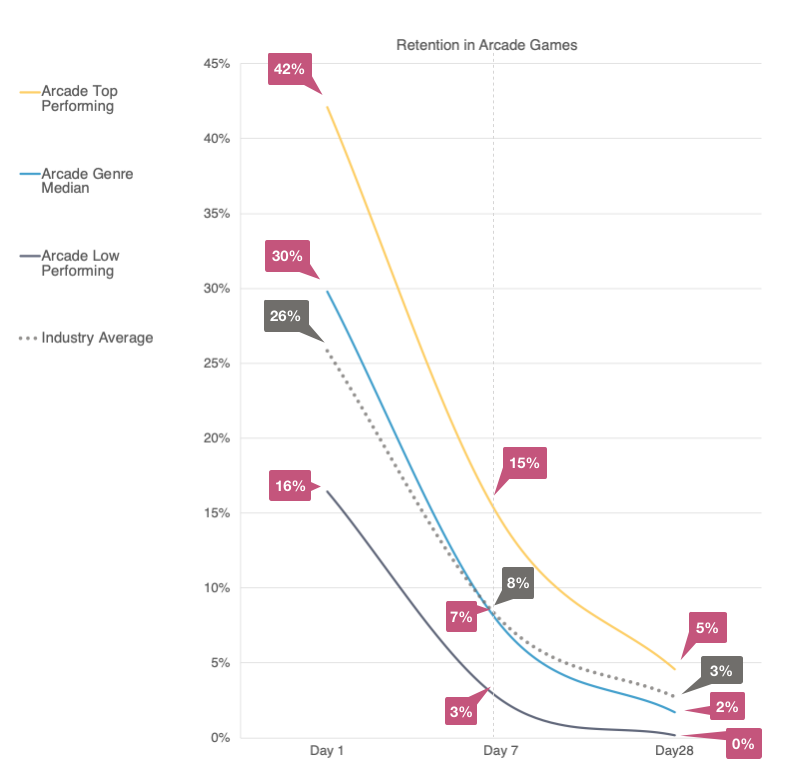

- Hyper-casual games again come out on top, even if their edge is only marginal. For the most popular hyper-casual titles, D1 retention is 42%. For casual games, this metric is 40%.

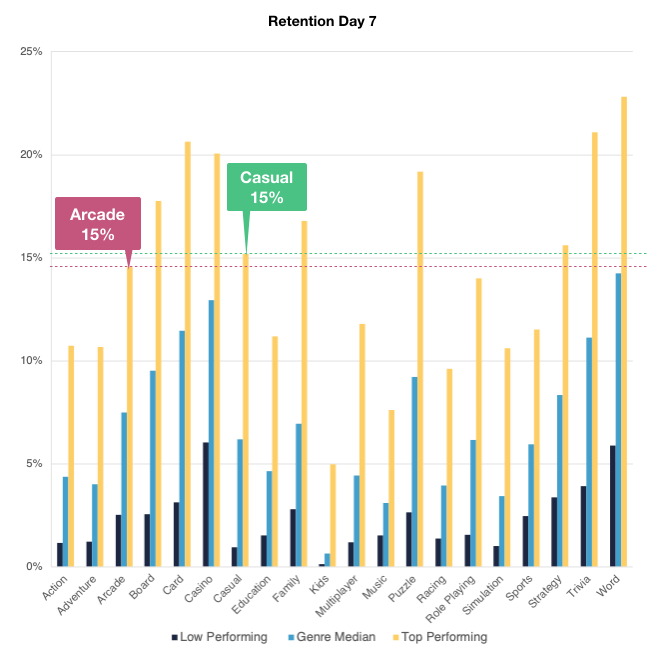

- D7 retention for both hyper-casual and casual titles is 15% (again, this is achieved only by the most popular representatives of both genres). After a week of gameplay hyper-casual games usually lag behind puzzle and word games and fall to the 10th place among other genres in terms of retention. However, developers can gradually improve retention by restructuring and polishing the core loop and optimizing ad monetization.

Methodology

The study looked at 3 billion players around the globe and 70K games across 20 genres. Data was collected from Q2 2018 to Q1 2019.