Microsoft has published its financial report for the second quarter of FY24 ended December 31. This is the company’s first earnings release since completing the Activision Blizzard deal, so it is interesting to see how the acquisition impacted its gaming business.

- According to Microsoft’s Q2 report, Xbox content and services revenue increased by 61% year-over-year of net impact from the Activision Blizzard acquisition.

- Xbxo hardware revenue grew 3% year-over-year.

- The company’s total gaming revenue grew 49% compared to the same period last year, but without taking into account Activision Blizzard, the growth would have been only 5%.

- This is in line with what Microsoft said in its Q1 report, when CFO Amy Hood noted that the company expected its gaming revenue to grow in the “mid to high 40s” in the second quarter.

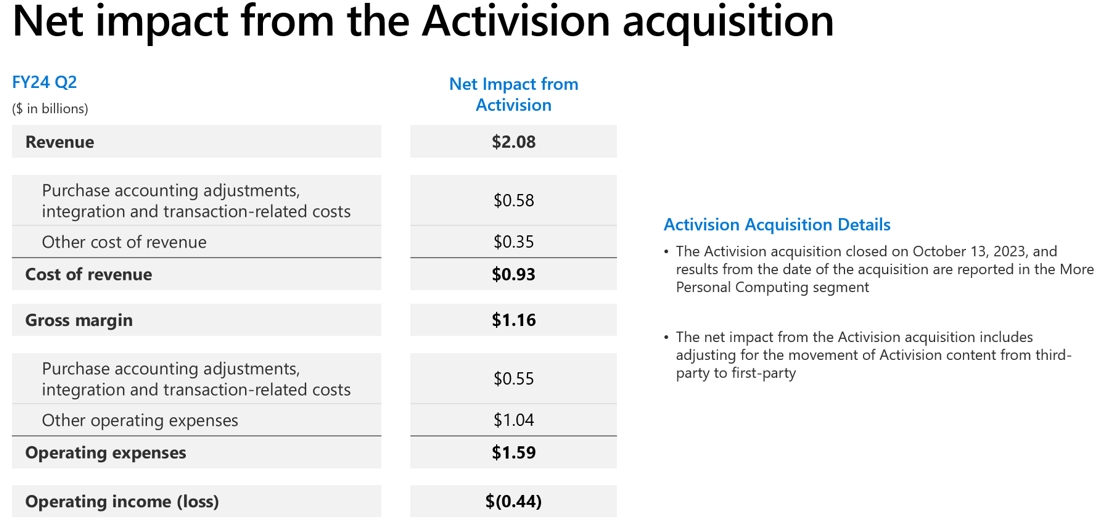

- Overall, the net impact of the Activision Blizzard deal in the second quarter was $2.08 billion in revenue and $440 million in operating loss.

- As Microsoft explained, the net impact of the acquisition also includes the change of Activision content from third-party to third-party.

- Journalist Stephen Totilo noted that “gaming, without the boost from the Activision deal, would be one of the slower-growing parts of Microsoft,” citing it as one of the possible reasons why the company laid off 1,900 employees at its gaming division last week.

- During an earnings call, Microsoft CEO Satya Nadella noted that in Q2, the company set all-time records for monthly active users (MAU) on Xbox, PC, and mobile. Thanks to Activision Blizzard King, it currently has over 200 million MAU on mobile alone.

- When looking at Activision’s previous financial reports, King was its biggest operating segment by MAU with 238 million, followed by Activision (92 million MAU) and Blizzard (26 million MAU). So it is unclear how many monthly active users Microsoft currently has across all platforms, including its own Xbox division.

- According to its new SEC filing, Microsoft noted that a total price of the Activision Blizzard acquisition was $75.4 billion, consisting primarily of cash. It will now become a part of its More Personal Computing segment.