We continue our review of 2024 together with top managers and experts from the gaming industry (and related fields). Up next is an interview with Dmitry Bobrov, CEO of ZiMAD.

How would you sum up the year for the company? What achievements would you like to highlight?

Despite the rather turbulent situation in the industry and the world, the year can be described as stable for the company. Our internal product priorities shifted as some products grew faster than others, but the established portfolio has proven to be very resilient. The more than 1.5x growth in active users on the Domino Online from January to December suggests that this time was well spent for the company.

Domino Online

Additionally, this fall we celebrated the anniversary of Art of Puzzles, which has already reached several million installs. We also launched two new board games globally, which are expected to develop and grow in the near future.

Art of Puzzles

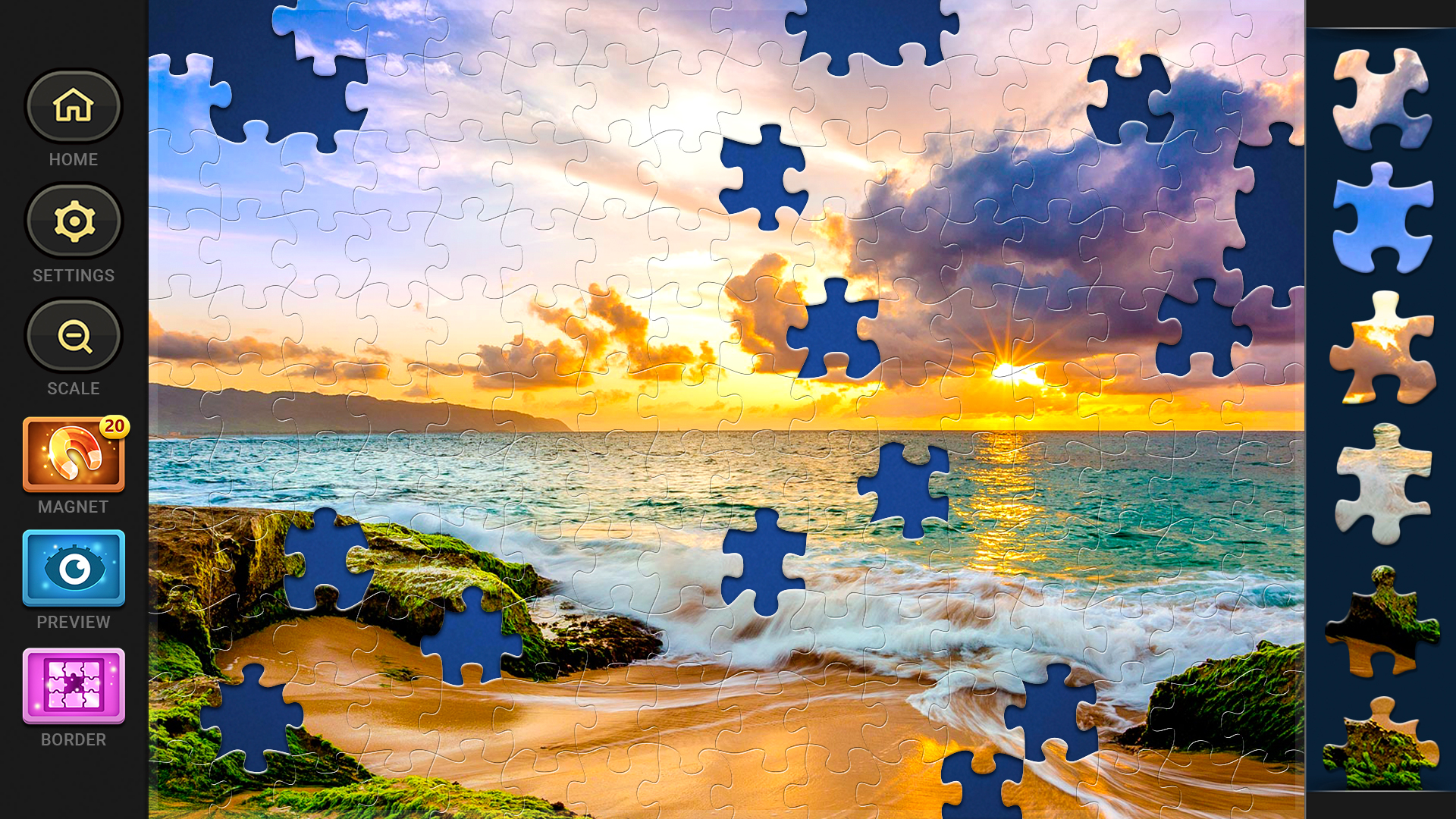

Magic Jigsaw Puzzles, as usual, featured many exciting innovations and major events. Most notably, I would highlight the impressive results of our collaboration with Dots.Eco: players demonstrated a high level of interest and engagement with the cause, actively participating in the charitable campaign both through gameplay and direct involvement.

Magic Jigsaw Puzzles

What changes have you noticed in the games market?

The market for classic mobile games continues to consolidate around major players. Time and again, we are surprised to learn that yet another studio, once considered independent, is actually a subsidiary of a larger company. There have been cases where a seemingly interesting game from an indie team turned out to be a side project of a well-known publisher with a development budget of several million dollars.

A noticeable trend is the increase in the target payback period for traffic in casual games — we now see target payback periods of six months, a year, or even longer. This adds the challenge of long-term predictive analysis of payback to the already complex task of profitable user acquisition. The market is becoming more competitive and demanding, and to continue running a successful gaming business, one must meet an increasing number of requirements and challenges.

LLM-based services have made significant strides this year. These tools have permeated all aspects of game studio operations: from generating art and code to testing features and moderating communities. Even student projects from young programmers, which previously stood out for their clumsy graphics, have suddenly become visually appealing thanks to asset generation. This is the new reality for mobile game developers.

How did the year shape up for the genre you focus on?

In the niches of classic puzzles and board games, the balance of power has remained virtually unchanged over the past year. The main competition is between three to five key players, and much like in professional sports, even a slight edge in a metric or optimization can temporarily secure higher installation rankings within the genre.

There have been attempts by new studios to challenge the top players, but they failed to achieve long-term success. Some ran out of momentum or investor trust, leading to a decline in installs. Others, avoiding direct competition, managed to enter adjacent genres with solid metrics but remained single-product companies despite having financial resources and multiple prototypes created.

What new trends do you expect to intensify or emerge in your niche in 2025?

We expect the trend toward hybrid monetization models to continue. Developers are exploring ways to generate over 30% of revenue from in-app purchases and subscriptions, even in relatively simple games that traditionally relied on ads. This is a response to increasing competition, various market regulations, a decline in overall performancе, where ad monetization alone can no longer fully offset user acquisition costs.

At the same time, we can observe growing professionalism among teams, with an increasing number of articles and presentations in the mobile game development community about effectively converting a mass audience into initial and repeat payers.

In addition to hybrid monetization methods, we are also seeing the hybridization of game mechanics. Developers are experimenting boldly: attracting players with one mechanic and then, after several levels, activating a completely different one that cannot be skipped. It’s a form of mislead — but not narrative-based, rather a game design technique.

What are your plans for 2025?

We plan to expand the number of puzzle and board games in our portfolio while continuing to deepen the monetization of our existing products. Our goal is to release both simple, classic games and more complex casual ones. With strengthened development and marketing teams, we expect a significant breakthrough in 2025.

We plan to focus on analyzing user behavior, enhancing content personalization in our products, and striving to deliver a tailored gaming experience for each player.