Sony has published its annual business briefing. Here are the key takeaways about the performance of the PlayStation business and updates to the company’s gaming strategy.

PS5 generation highlights

Hermen Hulst and Hideaki Nishino, the two new heads of SIE, shared the updated strategy in a presentation on the company’s Game & Network Services (G&NS) segment.

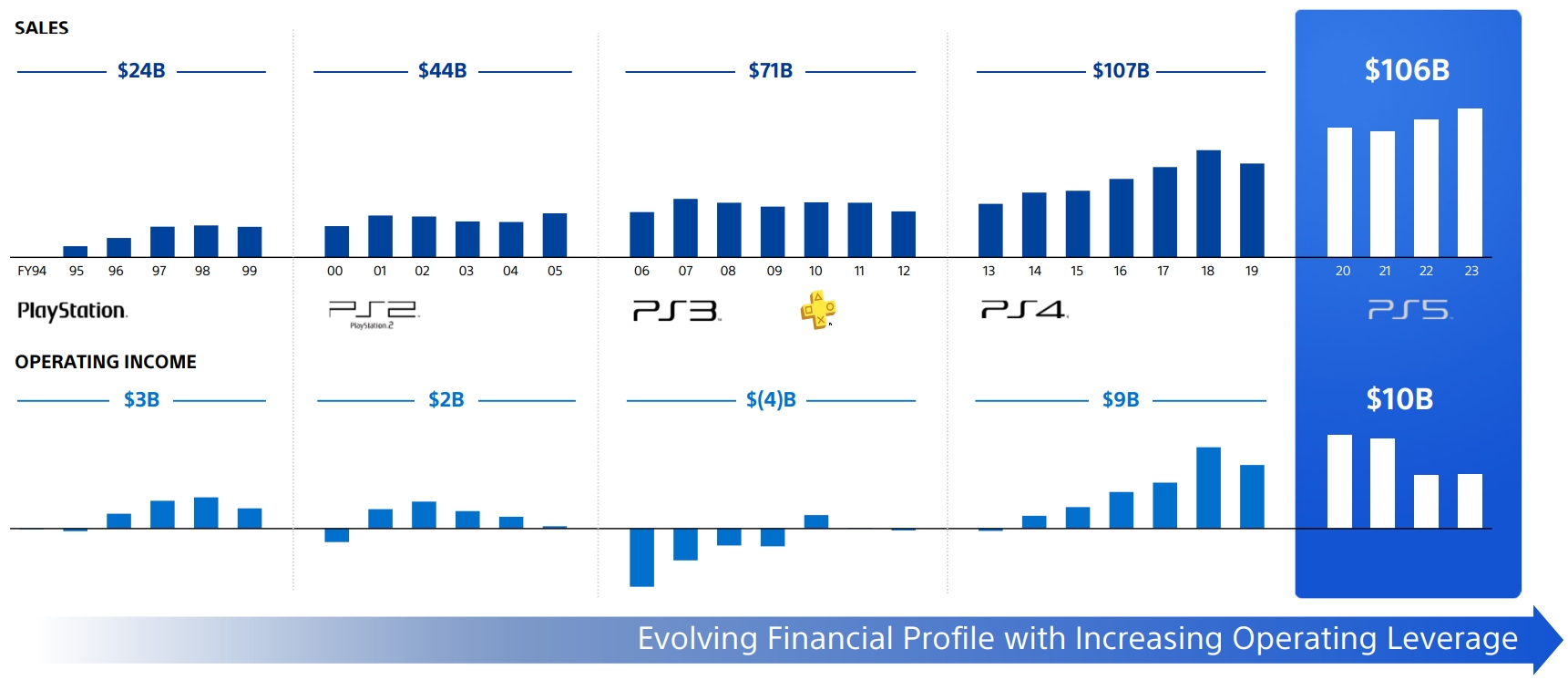

- In less than four years of its life cycle, PlayStation 5 generated $106 billion in revenue. That is almost on par with what PS4 made over the seven years of its console generation — $107 billion.

- PS5 is already the most profitable console in the history of SIE, with $10 billion in operating profit to date. It is followed by PS4 ($9 billion), PS1 ($3 billion), and PS2 ($2 billion), while PS3 posted an operating loss of $4 billion.

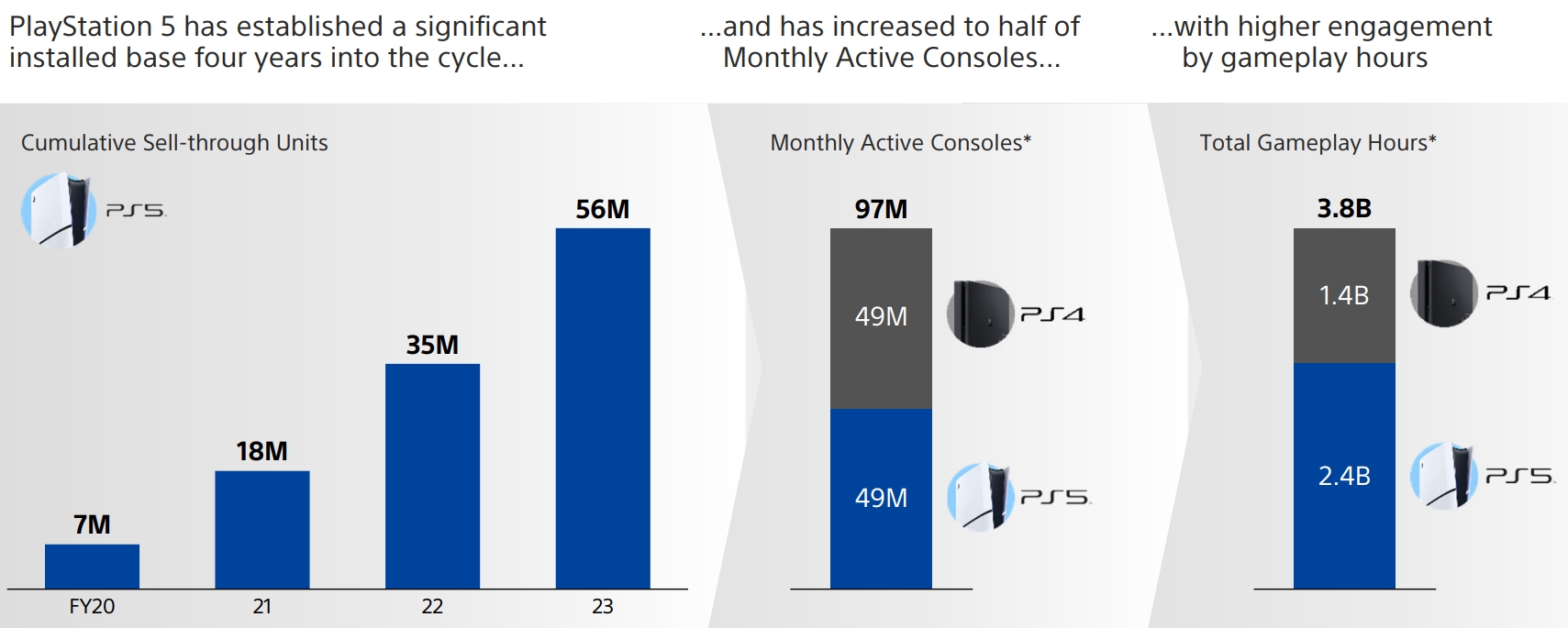

- As of April 30, 2024, Sony had 97 million monthly active consoles, and the audience is equally split between PS4 and PS5. However, PS5 users are more engaged — 2.4 billion gameplay hours vs. 1.4 billion for PS4 users.

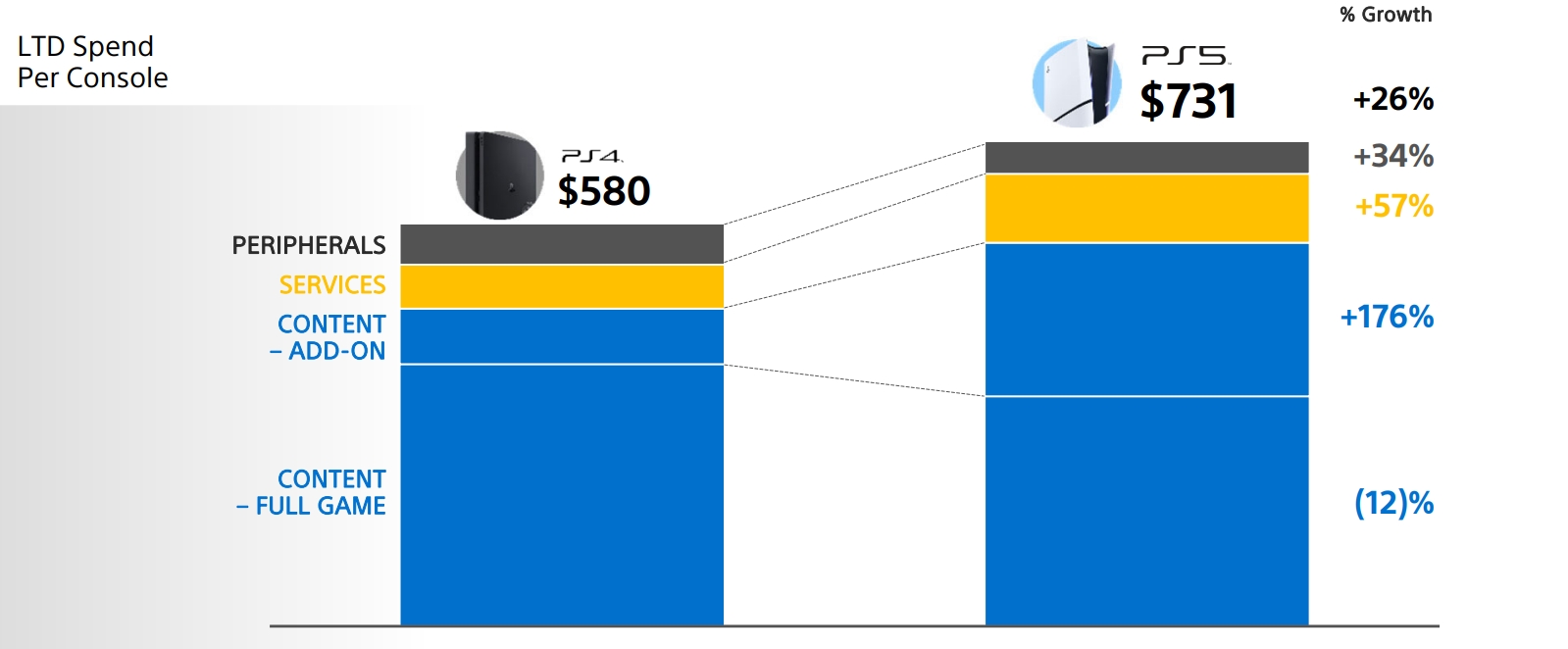

- The reason for PlayStation 5’s leading position becomes clear when looking at the comparison of its life-to-date user spend per active console over the first four years of its life cycle with that for PS4. While spending on full-game content fell 12%, other segments posted impressive growth, with in-game purchases/add-on content up 176%, services up 57%, and peripherals up 26%.

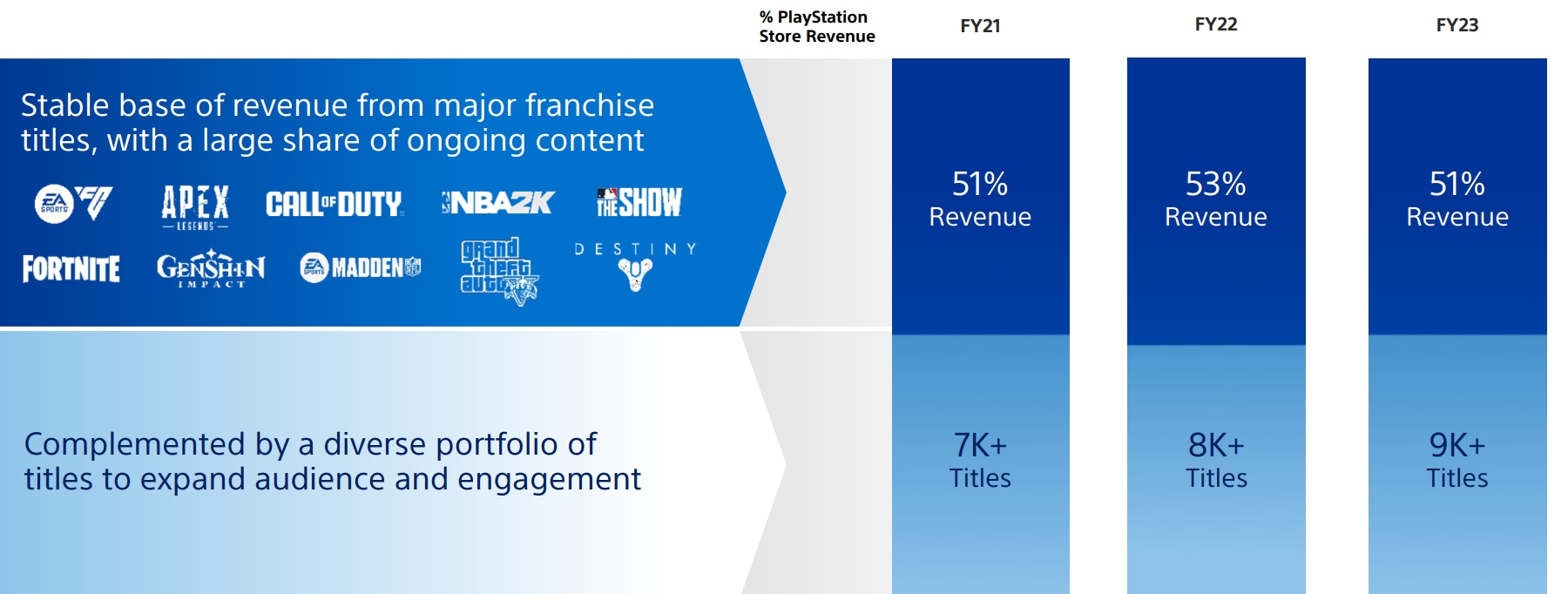

- In FY23 (ended March 31, 2024), 51% of PlayStation Store’s revenue came from major third-party franchises and popular live service titles such as EA Sports FC, Apex Legends, Call of Duty, Fortnite, Genshin Impact, Destiny, and GTA V.

New strategy for the coming years

In the first three years of the PS5 generation (FY21-23), Sony successfully achieved its goal of establishing a “leading position in this console generation.”

Moving forward, the G&NS segment’s strategy will focus on driving “sustainable & profitable growth and [investing] thoughtfully in the future of play.” This phase will last through FY26 ending March 31, 2027. Here are its main goals:

- Platform Business group (hardware and services) — expand the install base, drive consistent revenue from content/services/peripherals segments, invest in key innovation areas;

- Studio Business group (video games, studios) — create strong release schedule, continue to execute its live service roadmap, expand franchise reach beyond video games, achieve early returns from past investments and acquisitions.

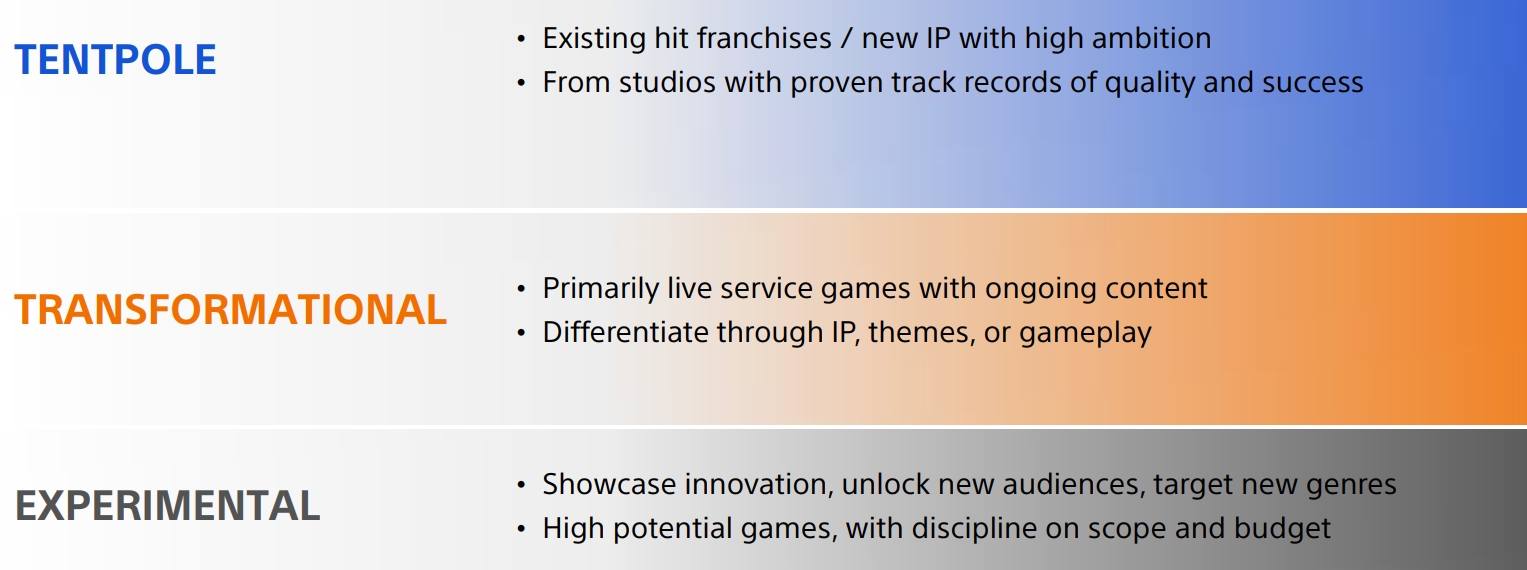

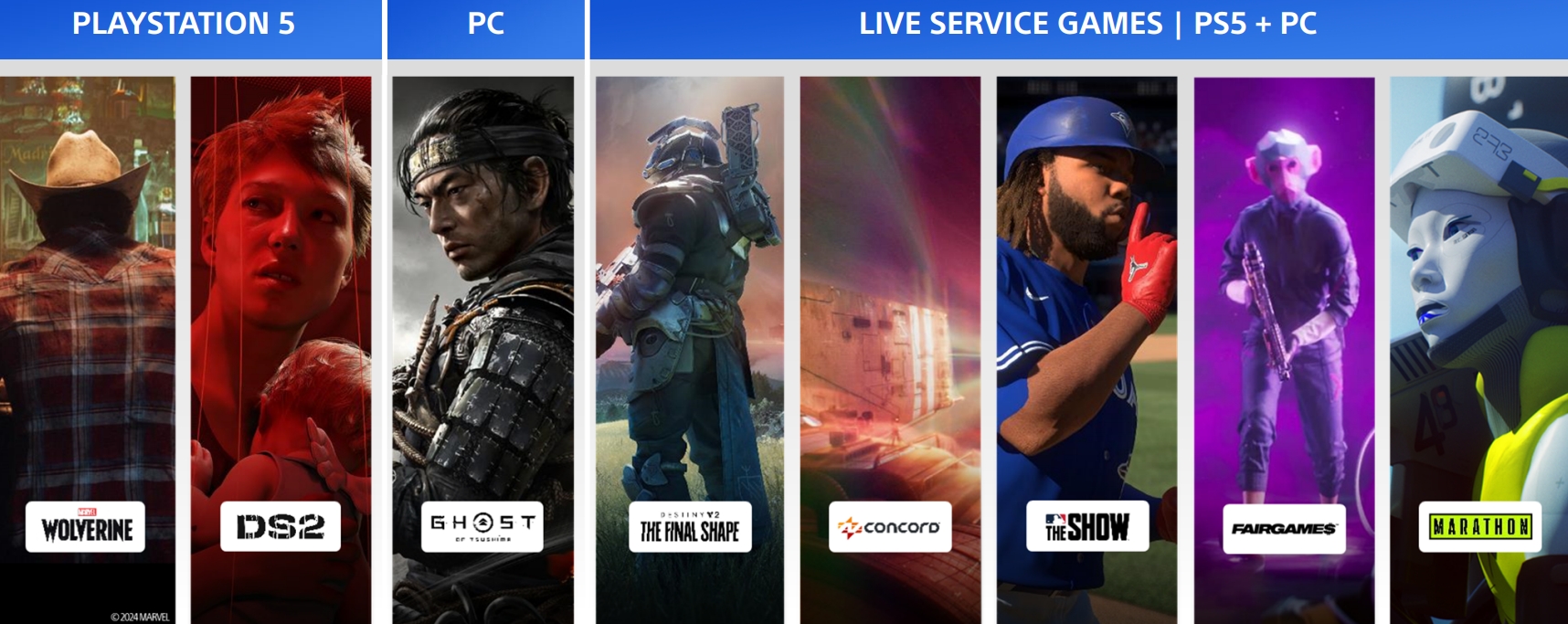

Single-player games will remain the backbone of PlayStation’s business. The company plans to expand its existing franchises and create new IPs with the help of studios “with proven track records of quality and success.”

Following the success of Helldivers 2, SIE will continue to executive its live service strategy by creating games with ongoing content support. Its pipeline currently includes titles like Concord, Marathon, and Fairgame$.

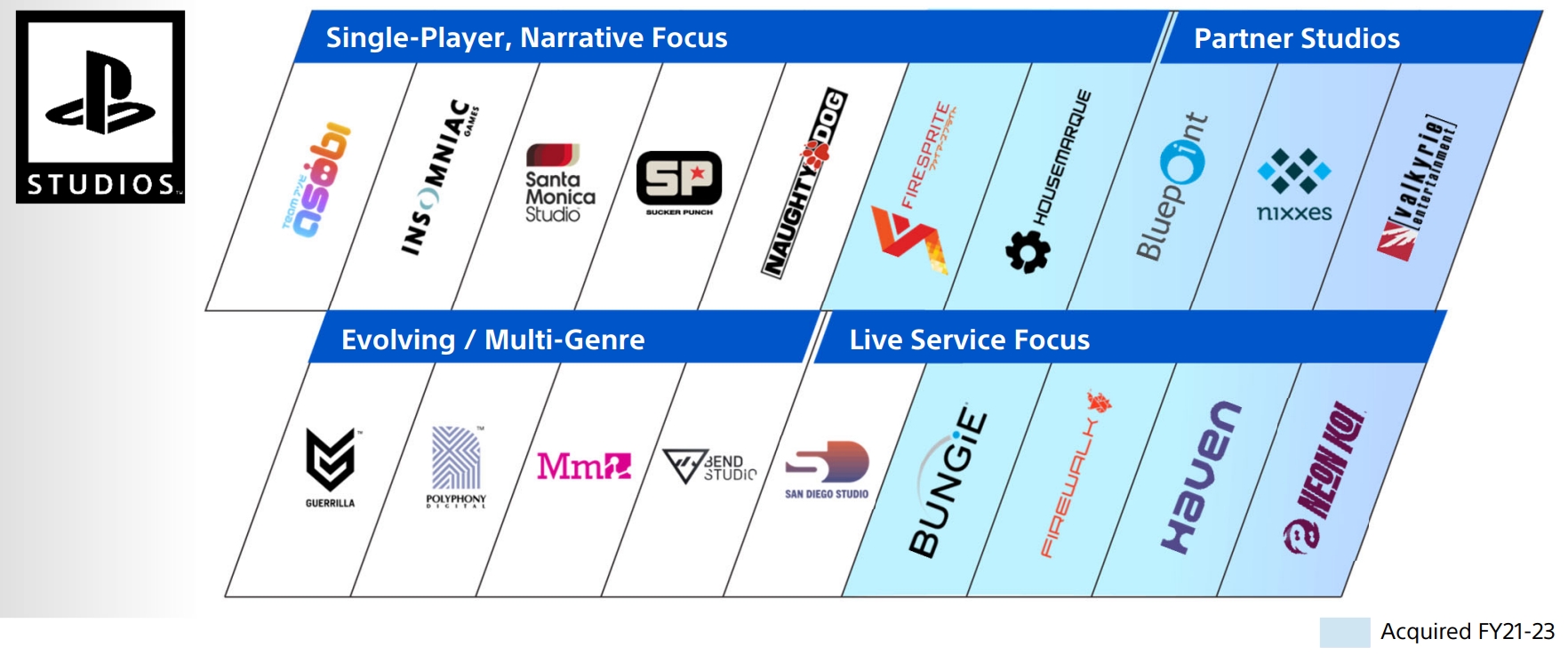

San Diego Studio, Bungie, Neon Koi (formerly Savage Game Studios), Haven, and Firewalk will focus on live service games. Guerrilla, Polyphony Digital, Media Molecule, and Bend Studio will develop multi-genre titles, while Asobi, Insomniac, Santa Monica Studio, Sucker Punch, and Naughty Dog will continue to make single-player experiences.

Multiplatform strategy and cost optimization

During the Q&A session, Hermen Hulst confirmed that its live service titles will launch “simultaneously, day and date on PlayStation 5 and PC.” But the company will use a “more strategic approach” with its single-player platform exclusives, meaning PC ports will continue to arrive with a delay.

“We’re finding new audiences that are potentially going to be very interested in playing sequels on the PlayStation platform,” Hulst said. “We have high hopes that we are actually able to bring new players into PlayStation at large, but into PlayStation platforms specifically.”

Sony hopes that delayed PC ports of platform exclusives will help the company expand its console audience by increasing the reach of its games and motivating some users to purchase a PlayStation device. “Rather than cannibalization, I think this is an opportunity for growth,” Hideaki Nishino added.

In FY23, Sony expected its annual PC revenue to reach $450 million, up 80% year-over-year. However, it is unclear whether the company achieved this goal.

PlayStation is also committed to optimizing the cost side of its business and making its investments in game development more sustainable. According to Hulst, the company is looking at outsourcing and co-development options to work with teams located in regions with lower resource costs.

This makes sense from a business perspective given exorbitant budgets of AAA games. For example, The Last of Us Part II cost $220 million to produce, while Marvel’s Spider-Man 2 had a total budget of $315 million (2x compared to Miles Morales).