InvestGame has published a report on deal activity in the games industry in 2022. Analysts highlighted the biggest trends and offered their investment forecasts for the near future.

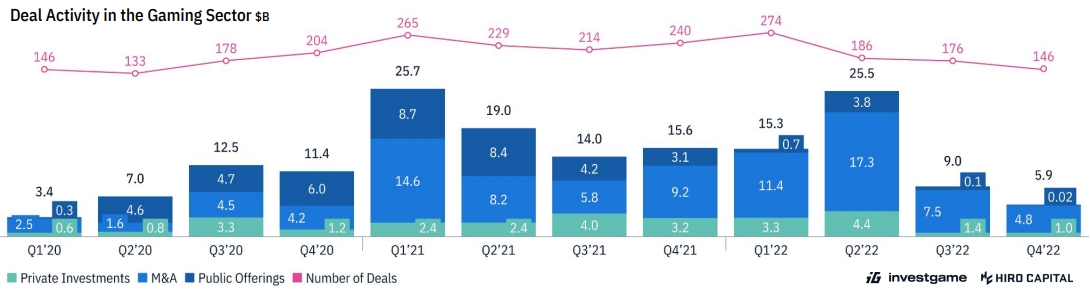

- According to the latest InvestGame report (spotted by GI.biz), there were 782 closed deals in 2022, totaling $55.7 billion. This doesn’t include Microsoft’s proposed acquisition of Activision Blizzard, which has yet to be cleared by antitrust regulators, or any other announced deals.

- M&A deals grew 7% year-over-year to $41 billion, followed by private investments ($10.1 billion, down 16% year-over-year) and public offerings ($4.6 billion, down 82% year-over-year).

- The deal activity in the games industry has slowed down since peaking in 2021, but InvestGame thinks that “there is potential for a few significant deals to occur in 2023, as the industry continues to consolidate, supported by strong investors’ interest and enough cash to pursue transformative deals.”

- Public offerings (IPO, SPAC, etc.) experienced the biggest decline, with activity in this segment last year almost zeroing compared to 2020-2021 levels.

- Citing decline in share prices and overall macroeconomic factors among the main reasons, analysts expect a partial recovery in the second half of 2023.

- The top closed deals between 2020 and 2022 by media coverage include Microsoft’s acquisition of ZeniMax (Bethesda, Arcane, id Software, etc.), Sony’s acqusition of Bungie, Take-Two’s acquisition of Zynga, and Unity’s merger with ironSource.

- Makers Fund was the most active VC gaming fund in 2022, with 14 deals totaling $533 million. It is followed by Index Ventures (3 deals, $300 million), Lightspeed Ventures (6 deals, $273 million), and Andreessen Horowitz (11 deals, $248 million).

- InvestGame expects VC funds to continue its hunt for early-stage gaming companies in 2023, as they have billions of cash to deploy.

- Late-stage investments, on the other hand, are now slowing down, with just 16 deals with $900 million in disclosed value closed in 2022. Compared to 2021, it is a 2x and 4.7x decline in deal count and value, respectively.

More insights, including data on Web3 gaming deals and corporate investment activity, can be found in the full report.