GDC has released its annual survey on the state of the games industry. Here are the key takeaways about developers’ perception on layoffs, GenAI, and trending business models.

Over 3,000 developers took part in the survey. 58% of them are from the US, followed by the UK (7%), Canada (6%), Australia (3%), Poland (1.6%), and Brazil (1.6%), so keep that in mind when looking at certain data.

- According to GDC’s 2025 State of the Game Industry report, 32% of devs work at indie studios, followed by AAA (15%) and AA (10%) companies. Interestingly, 21% of respondents are solo developers, while 18% work at studios with over 500 people.

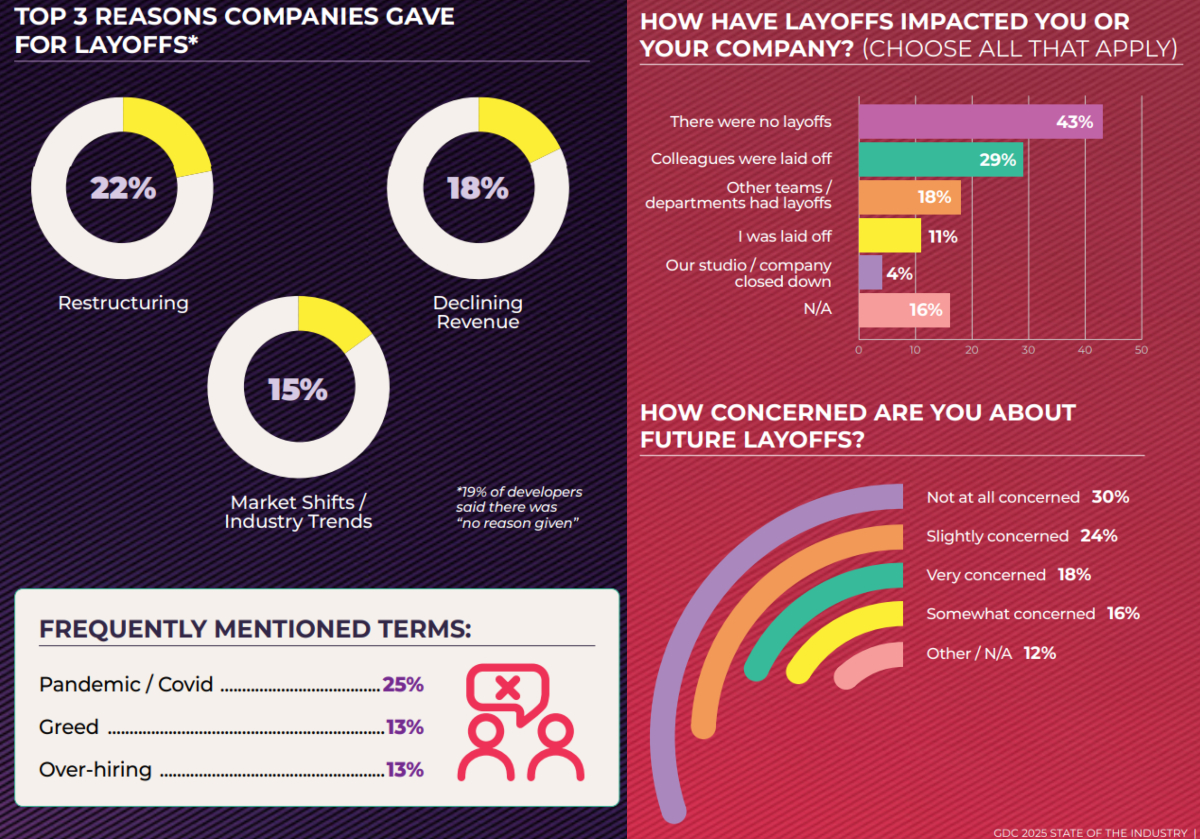

- 41% of game developers were impacted by layoffs in 2024, up from 35% in GDC’s previous survey, and 4% said their studios were closed. It is worth noting that while 43% of respondents reported no layoffs at their companies, that percentage is down from 53% in the 2024 report.

- Job cuts affected professionals in various roles and departments: narrative (19% of respondents impacted by layoffs), production & team management (16%), visual arts (16%), programming/engineering (12%), game design (9%), and business & finance (6%).

- Restructuring (22%), declining revenue (18%), and market shifts / industry trends (15%) were the most common reasons for layoffs cited by companies. Developers themselves, on the other hand, blame the increasing number of job cuts on the Covid pandemic (25%), greed (13%), and over-hiring (13%).

- 36% of respondents use GenAI in their work, and “older developers are more likely to use Generative AI than younger ones.” However, only 9% of devs who don’t use GenAI say they’re interested — down from 15% last year. And 27% said their companies have no interest in these tools.

- 64% of developers said their companies had some form of AI policy, with 16% not allowed to use any GenAI tools in their professional work.

- Although adoption of GenAI continues to rise, more devs — 30% vs. 18% last year — now believe this technology is having a negative impact on the games industry. “When asked to cite their specific concerns, developers pointed to intellectual property theft, energy consumption, the quality of AI-generated content, potential biases, and regulatory issues,” GDC noted.

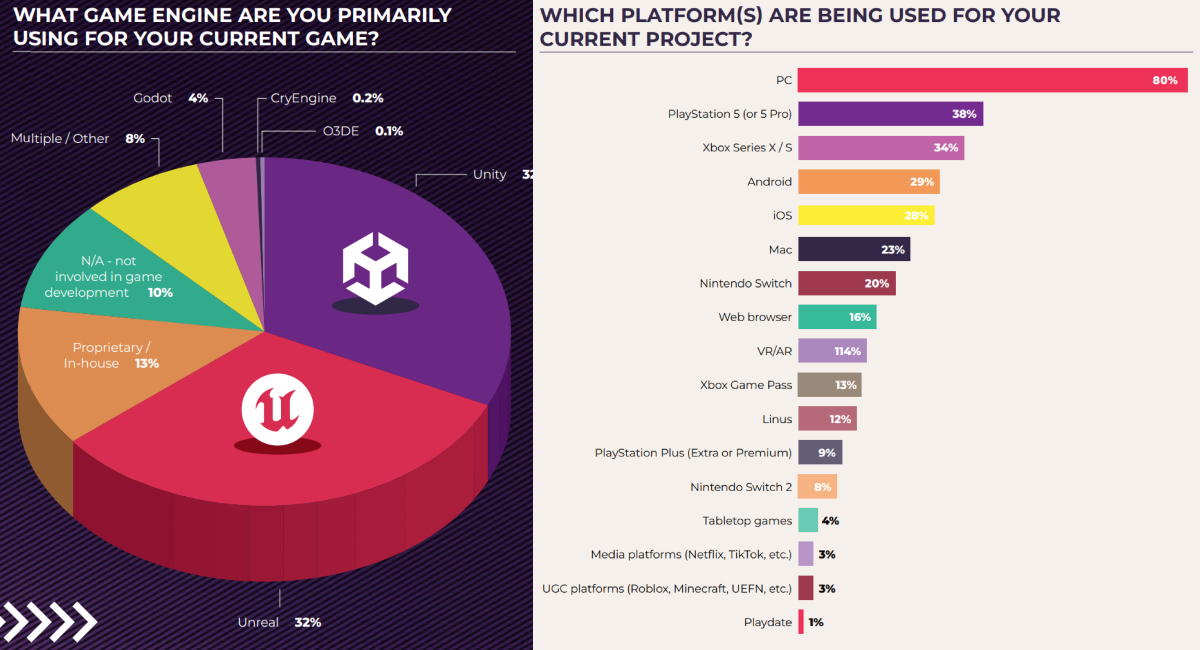

- PC remains the most popular target platform, which is not surprising giving the percentage of indie developers. Its share increased from 66% last year to 80%.

- PlayStation 5 leads among consoles, with 38% of developers currently making games for this platform. It is followed by Xbox Series X|S (34%), Android (29%), and iOS (29%).

- Interestingly, there’s a sudden increase in the number of people making browser games — 16% vs. 9% in 2024 and 11% in 2023.

- Unity and Unreal remain the most popular game engines, tied at 32% each. 13% of developers use proprietary tools, followed by Godot (4%), CryEngine (0.2%), and 03DE (0.1%).

- When it comes to various business and monetization models, around 16% of devs said they already work on live service games. However, that share increases to 33% for AAA developers.

- Respondents cited stable CCU base, as well as percentage of daily active users and monetized players, as the top metrics to measure the success of a live service project. When it comes to the main issues of this model, devs mentioned market oversaturation, creative stagnation, and professional burnout.

More data and trends, including VR development, publishing models, financing, advocacy, can be found in the full report.