Square Enix has released its report for the first fiscal quarter ended June 30, 2024. The Japanese company posted a huge increase in operating profit despite weak sales.

Final Fantasy XIV: Dawntrail

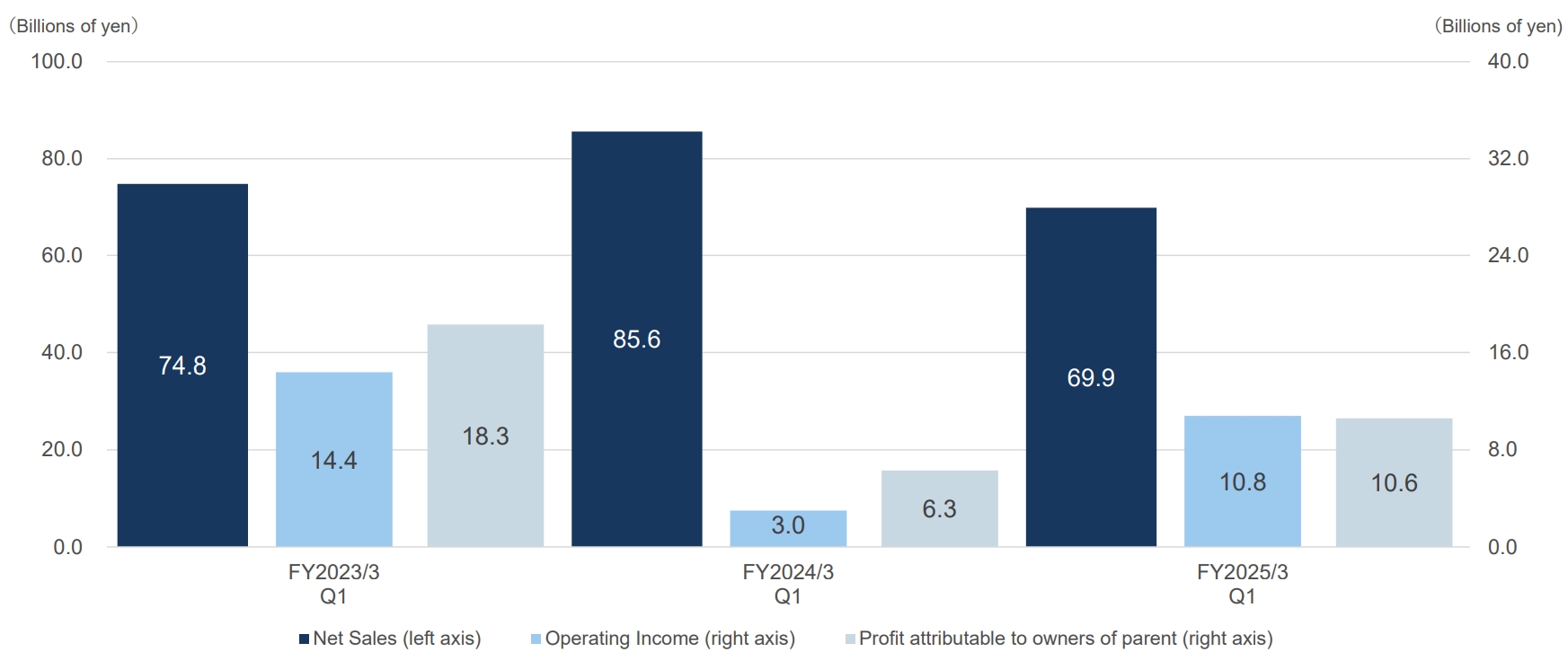

- According to its new earnings release, Square Enix reached ¥69.9 billion ($482 million) in Q1 revenue, down 18.4% compared to the same period last year.

- Operating profit more than tripled year-over-year, up 260%, to ¥10.8 billion ($74.5 million).

Square Enix’s consolidated revenue and operating profit in Q1 2024

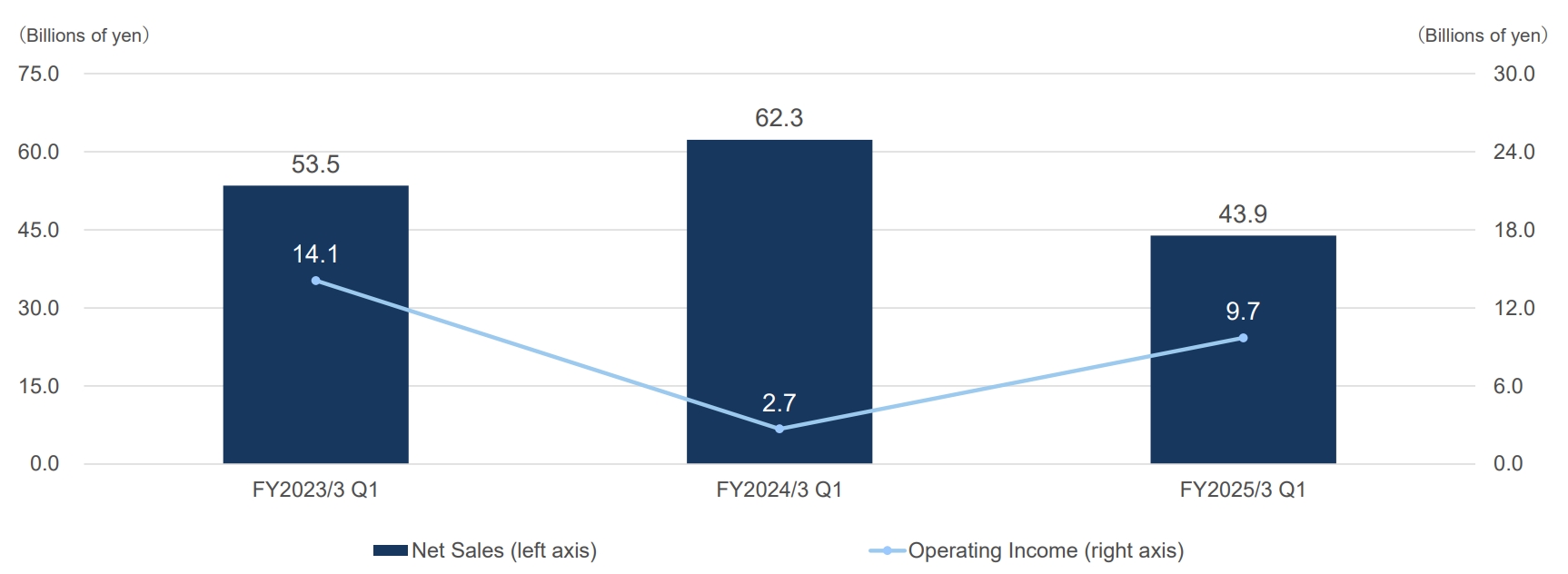

- Digital Entertainment, the company’s video game division, accounted for 63% of the total, or ¥43.9 billion ($302.8 million), down 29.5% year-over-year. Operating profit grew 259% to ¥9.7 billion ($) due to lower development cost amortization and ad expenses.

- In Q1, Square Enix sold 4.39 million copies of games, a significant decline from 7.54 million units in the same period last year. Digital sales accounted for 87% of the total.

- 67.5% of all game sales came from North America and Europe, while the share of domestic sales (Japan) was 19.3%.

Square Enix’s Digital Entertainment revenue and operating profit in Q1 2024

- Games for Smart Devices/PC Browser (mobile titles) was the number one sub-segment by net revenue, with ¥18.9 billion ($130 million). “Sales of existing titles remain weak, but operating income up on optimization of operational expenses,” Square Enix noted.

- Revenue from MMO games amounted to ¥12.5 billion ($86.2 million), up 13.6% year-over-year due to the successful launch of the Dawntrail expansion for Final Fantasy XIV.

- HD Games (PC and console titles) fell 57.4% to ¥12.3 billion ($84.8 million). Such a sharp decline is due to a lack of major releases (last year, Q1 was marked by launches of Final Fantasy XVI and FF Pixel Remaster).

- So while the lack of new games and weak sales of back catalog caused a decline in revenue, Square Enix’s gaming division remained profitable thanks to lower operating expenses.