Although coloring and paint-by-number games generate around 30 million downloads every month, this subgenre remains underdiscussed. We have reached out to Beresnev Games, ZiMAD, and Belka Games to find out what’s really happening in this niche and whether it is worth entering for mobile developers.

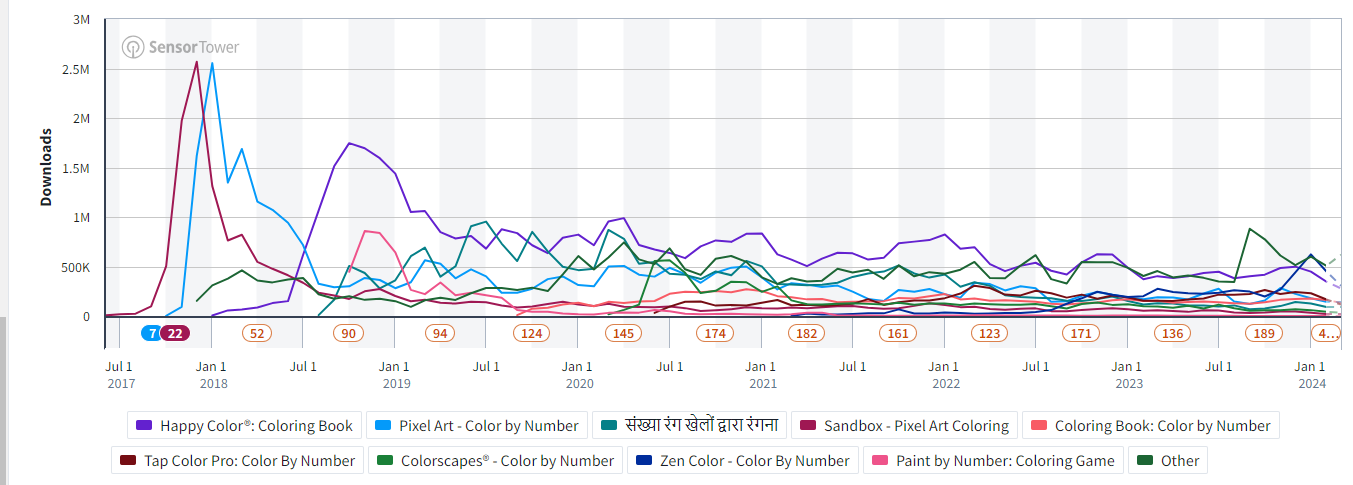

What’s the current landscape in the coloring genre? It appears that not much has changed in the past five years. The cumulative downloads of the top 10 games in the category have stabilized at around 16-18 million per month.

Oleg Beresnev, owner and CPO of Beresnev Games

The genre has indeed stabilized. Attracting new users to the genre has reached its peak as I believe that audience size exhausted its growth potential.

Anastasia Pavlyuchenko, lead marketing manager at ZiMAD

Installations within the genre have shown no significant growth, indicating a state of stagnation. The leaders in the classic paint-by-number and pixel coloring games segment have remained unchanged, with new entrants struggling to break into the top rankings unless they bring innovation to the table. There’s a noticeable trend of projects emulating each other’s creative approaches, resulting in landing graphics that resemble those of genre leaders.

Apart from traditional coloring games, there are variations incorporating decorative elements and narratives, but their audience tends to be narrower compared to classic offerings.

If we look at some of the classic coloring titles, certain applications stand out by integrating player motivation features.

For example, Vita Color for Seniors, branded as puzzle game for seniors, is also adapted for people with vision problems, with all UI elements enlarged.

Another is example is Zen Color, branded as relaxation coloring title. Creatives are similarly sharpened for this type of motivation, using meditative pictures. Released in 2021, Zen Color is not a new game, but its audience is currently growing, and since the beginning of 2024, the number of installations of the game has been higher than that of Happy Color in the US.

Downloads of the top coloring games in the US (via Sensor Tower)

How strong is the competition in the niche? And what happens to the price of traffic in it?

Oleg Beresnev, owner and CPO of Beresnev Games

The competition is quite strong, and it’s especially difficult to compete with coloring games that have large audiences. Some players in the market have long established themselves in this genre and have considerable resources for scaling and promotion.

For new games, gaining a competitive position in this segment is very challenging. Due to strong competition when attracting gameplay creatives, the price of traffic can be quite high. It’s important to have a traffic conversion strategy, excellent long-term retention rates, and the right balance of IAP/ad monetization.

Anastasia Pavlyuchenko, lead marketing manager at ZiMAD

Competition in the niche is fierce, with various games vying for user attention in advertising spaces. The top creatives encompass both established leaders and newer products.

The cost of traffic across all genres is on the rise. According to open sources, CPI on Android in the US starts at $1.2. With small volumes, it is possible to get installations for this price, but the price increases greatly when scaling up.

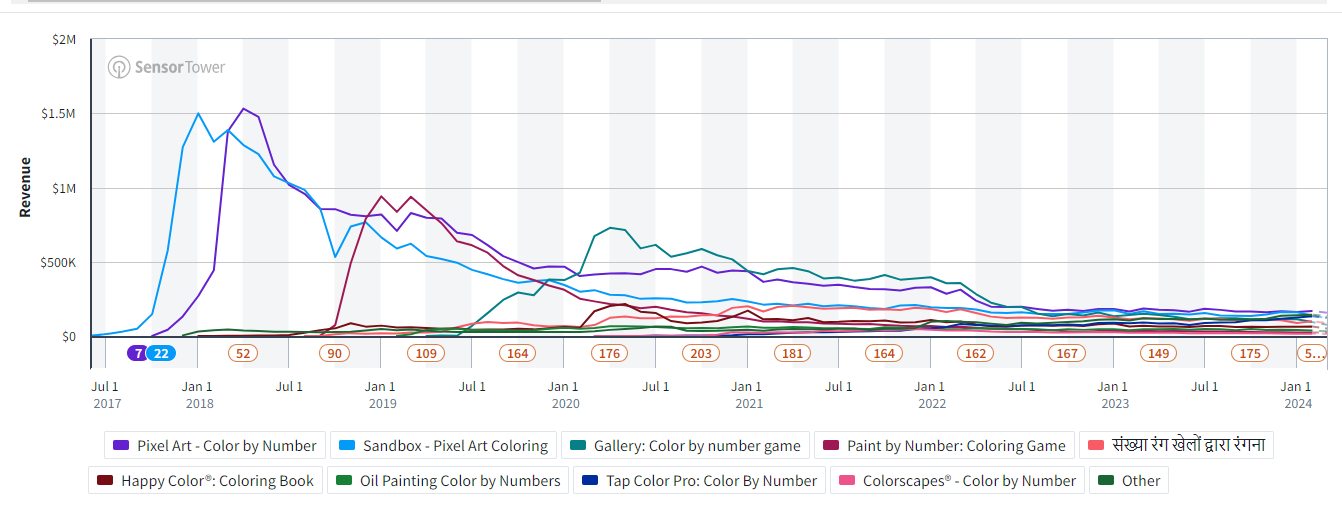

During the peak years of the genre’s popularity (2018-2019), top games earned money from IAPs, among other things. According to analytical services, the situation seems to have changed now. How successfully are such apps monetized?

Oleg Beresnev, owner and CPO of Beresnev Games

Ad monetization plays a major role. Combined with strong long-term retention, games recoup themselves through advertising. IAP monetization is based on customization, unique offers, a variety of gaming experiences, but not on losing, which significantly complicates the work with monetization and game design of projects with coloring as their core mechanic.

Anastasia Pavlyuchenko, lead marketing manager at ZiMAD

Yes, before 2020, there were games that made money on in-app purchases, and most often those were pixel coloring apps. Then, lots of new competitors began to appear, and the market gradually shifted to the ad-based monetization model.

Purchases and subscriptions, of course, remain part of the income, but in modern coloring games a large amount of content is completely free or available for in-game currency.

For some time, a coloring app with decor meta was the leader by IAP revenue (as there is more room for IAP monetization), but during the last 2 years its revenue has been on par with classic coloring titles. At the moment, games that offer subscriptions have the best IAP revenue.

Revenue of the top coloring games in the US (via Sensor Tower)

Pavel Sudakov, head of R&D at Belka Games

During the years of peak popularity, IAP revenue was sporadic. Major games in the genre contained exactly one IAP — disable advertising. They earned something from this, but at the level of error. Advertising is the engine of monetization in coloring titles.

From the outside, it seems like a simple genre, but is it true? How much can it cost to develop a competitive coloring game?

Oleg Beresnev, owner and CPO of Beresnev Games

Developing a competitive game where coloring is the core mechanic will not be cheap, although it may seem so at first glance. You need to take into account additional monthly costs for the production of paintings, offers, and events. Since long-term retention is key in this genre, you will need a lot of content and a well-thought-out game flow for at least 360 game days.

It is worth noting that creating, say, a decoration meta for a coloring game adds 1.5 – 2x to the total costs.

Anastasia Pavlyuchenko, lead marketing manager at ZiMAD

From an architectural standpoint, coloring apps are relatively simple and cost-effective to develop, contributing to intense competition in the genre. Successful products require meticulous technical optimization. Many teams fail in this area and fall far behind the leaders. Effective monetization and traffic acquisition strategies are also essential for profitability, demanding expertise in traffic acquisition, monetization, and ASO. Otherwise, the budget will not add up in the case of large UA volumes. Companies with all these specialists on the team are quite rare. So it’s not as easy as it seems.

Pavel Sudakov, head of R&D at Belka Games

We once thought so too. Since then, we have never entered the coloring genre again.

The devil of coloring games is in the details (no pun intended). Pictures for them must be carefully designed and meet certain conditions for coloring.

Market leaders deliver dozens of pages of similar content every day. At the time of 2019, there were 10 artists on our team alone, and we also collaborated with contract studios. Even under such conditions, we didn’t have time to satisfy the users’ demand for new content.

Artists in this genre have specific expertise: if the game fails, it will be difficult to switch them to other studio projects.

Side note: Yes, there was no generative AI back then. But I don’t think it would have cut costs much because the main problem with using it was and remains the details.

What distinguishes the market leaders in this genre from the many copycats?

Oleg Beresnev, owner and CPO of Beresnev Games

Very strong long-term retention and a large player base accumulated at the dawn of the genre.

Anastasia Pavlyuchenko, lead marketing manager at ZiMAD

Happy Color, the undisputed leader in the genre, differs from its competitors (and attracts new audiences) through the use of content from major IPs (e.g. Disney, Marvel), collaborations, unique content timed to world events, and charity. They also foster large, engaged communities through regular in-app activities.

The recipe for a good product here is a large amount of free and diverse content (different styles of drawing, unique pictures, work with creators, promotion by story, etc.), convenient UI, and the absence of aggressive advertising.

The coloring genre has been developing very dynamically (animated pictures, pictures with glitter, pictures in parts, etc.). It is characterized by the greatest variety of content categories and classifications. These content-first games, and you can stand out by offering users something new, whether it is a game mode, a new picture style, or the formation of the player’s motivation.

Pavel Sudakov, head of R&D at Belka Games

We at Belka realized that the market leaders are distinguished primarily by their ability to acquire traffic very well and cheaply. Their games also have a large (huge) amount of content. Maybe we made wrong conclusions, but personally we will definitely not return to the niche without observing these two main points. Products themselves don’t contain any unique know-how. Most likely, it is just not needed there.

And the main question: is it worth entering this niche right now?

Oleg Beresnev, owner and CPO of Beresnev Games

I wouldn’t recommend doing this without meeting the following requirements:

- Experience in similar games to understand the weaknesses of this genre in monetizing users;

- Well-structured and optimized processes for creating a large number of paintings;

- Understanding how you will reduce the cost of reaching an audience, since attracting users through gameplay creatives is squeezed to the maximum by the current whales of the genre.

Anastasia Pavlyuchenko, lead marketing manager at ZiMAD

Entering the coloring subgenre is viable if you have a clear differentiation strategy, a focus on quality, and effective promotion.

The genre retains a sizable audience with stable retention metrics (stickiness, DAU, RR). But like all other genres, it looks like coloring games seem to have a tendency towards hybridization. At the moment, hypercasual titles with coloring mechanics have the most downloads (Color Match, Drawing Carnival, Color Page ASMR). Perhaps it is worth taking a closer look at such projects and add a little fun to classic coloring games with such mini-mechanics.

Pavel Sudakov, head of R&D at Belka Games

In my opinion, both now and then there were and remain more interesting niches. So I wouldn’t recommend investing in it.