Market intelligence platform InvestGame has analyzed gaming deal activity in the first quarter of 2024. Here are the key trends for various segments, including acquisitions and private investments.

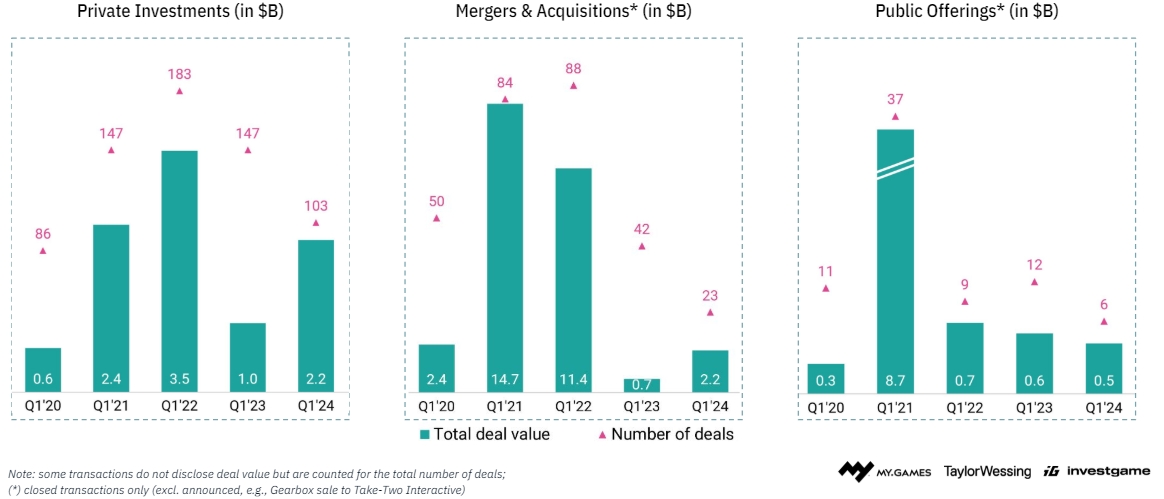

- According to InvestGame’s new Gaming Deals Report, the total value of deals in the games industry reached $4.9 billion in Q1 2024, up 113% from $2.3 billion in the same period last year.

- The number of transactions decreased by 34% year-over-year, from 201 to 132. Given the higher values of closed deals, this could be a sign of improvement.

- The biggest deal of the quarter was Disney’s $1.5 billion investment in Epic Games. It is followed by CVC Capital’s $1 billion acquisition of Jagex.

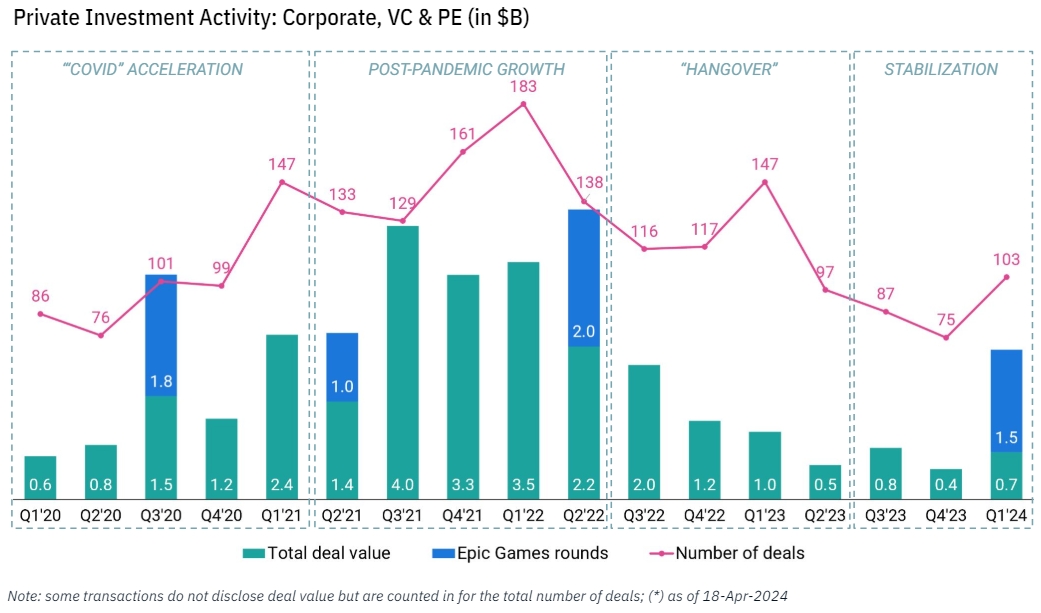

- When looking at transactions by segment, there were 103 private investments in the first quarter worth $2.2 billion. However, excluding the Disney x Epic deal, the amount of capital raised was 30% lower than in Q1 2023.

- Although VCs remain cautious and make fewer investments, there is an increase in pre-seed and seed activity. They also tend to join forces and share rounds with corporate capital.

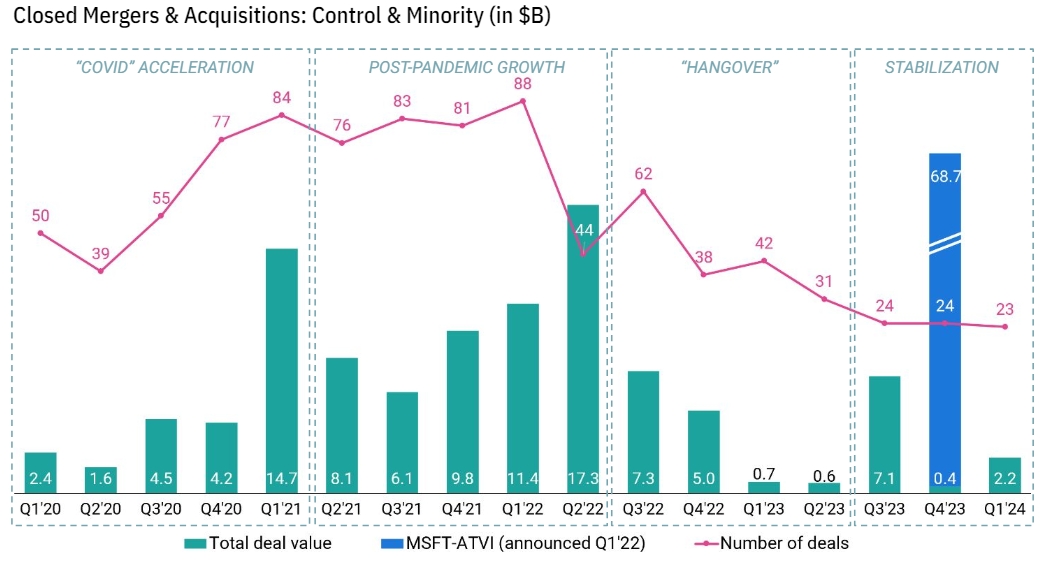

- The global games market also saw 23 M&A deals in the first quarter. The total value increased by 214% year-over-year to $2.2 billion.

- Despite some positive signs, the sector remains unstable. “Major public players, holding substantial cash reserves, are not rushing to make acquisitions (public buyers historically account for c.80% of M&A volume) and are actively making share buybacks,” InvestGame noted.

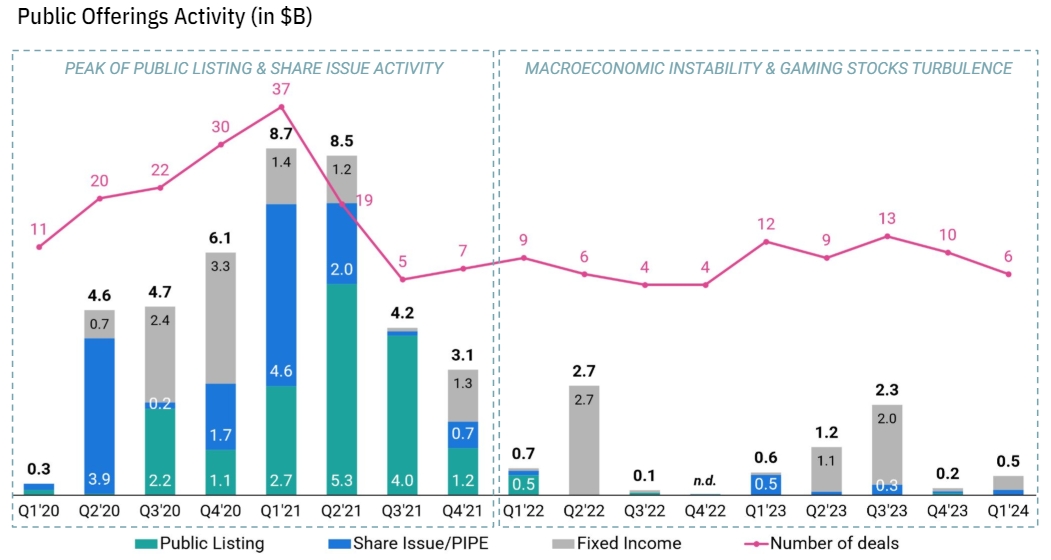

- In Q1 2024, there were six public offerings worth $500 million, with the IPO activity remaining muted. The biggest deals in the area were Take-Two’s $350 million sale of senior notes and the issuance of $93 million of new bonds by Stillfront.

- InvestGame also noted that most companies that went public from 2020 to 2021 are now trading below their IPO prices, and there have been no significant stock launches since mid-2022.

InvestGame expects 2024 to “establish a new ‘norm’ in transaction activity, likely exceeding pre-pandemic levels.” The number of early-stage investments and M&A deals of $1 billion or less is likely to increase. However, companies that raised early-stage funding between 2020 and 2023 “may struggle to secure subsequent funding, leading to shutdowns or ‘acqui-hire’ exits.”

More data and insights into the state of the PC (Steam) and mobile games markets can be found in the full report.