Sensor Tower has released its State of Gaming 2024 report. Here are the key takeaways, including revenue and download data, as well as the main trends across various genres and regions.

Honkai: Star Rail (left), Monopoly Go! (right)

Mobile games market in 2023

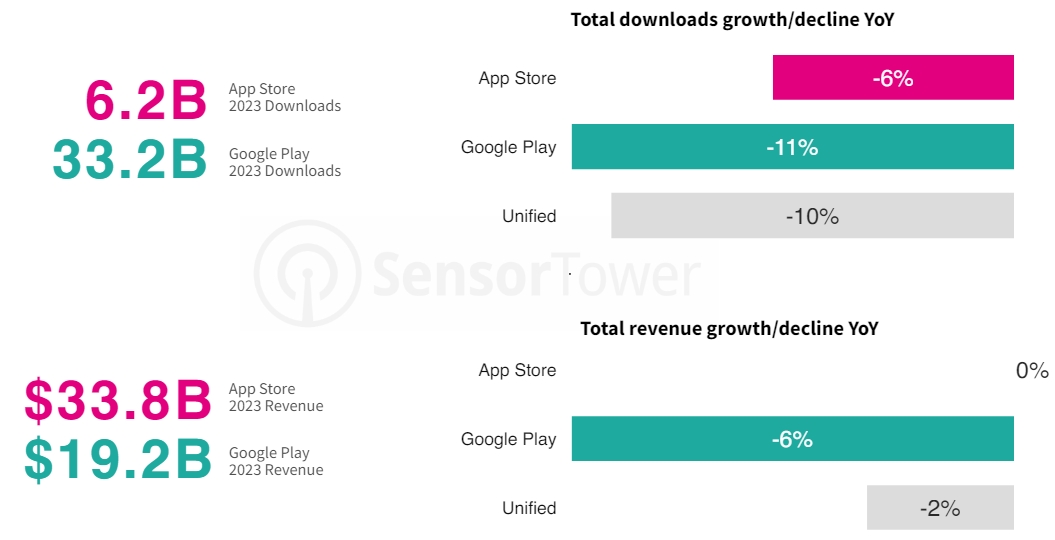

- According to Sensor Tower’s State of Gaming 2024 report, the mobile games market generated $53 billion in revenue last year, down 2% compared to 2022. App Store spending remained flat year-over-year, while Google Play declined by 6%.

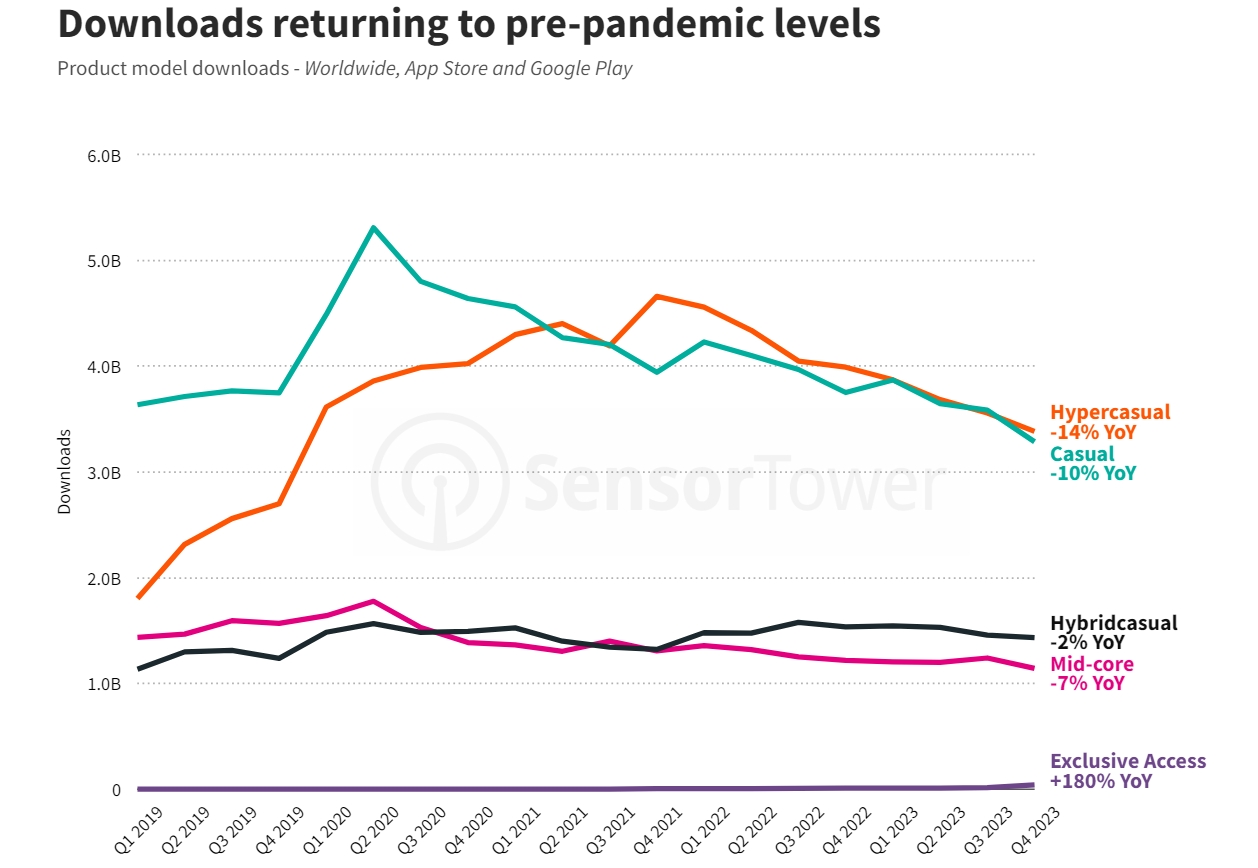

- Worldwide downloads fell 10% year-over-year to 39.4 billion. Google Play accounted for most of the installs (33.2 billion, -11%), and the App Store generated 6.2 billion installs (-6%).

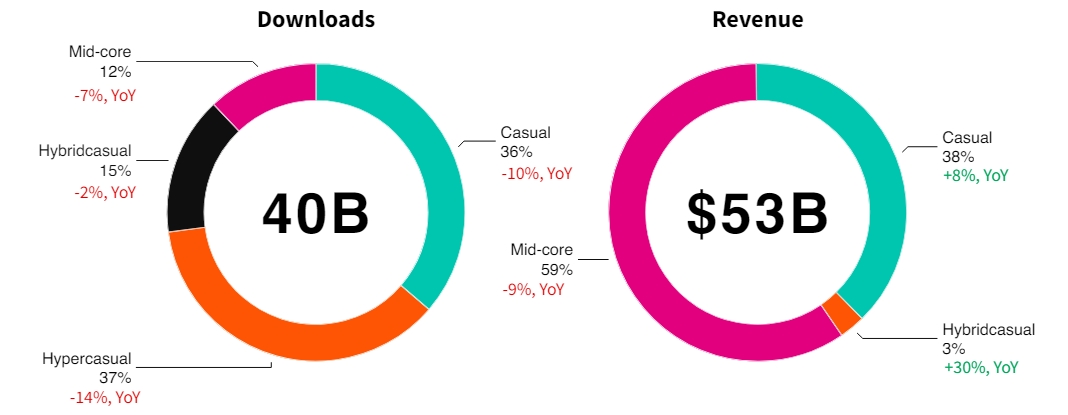

- Hypercasual games accounted for 37% of worldwide downloads in 2023, but a 14% decline in the number of installs indicates the end of their domination. They are followed by casual (36% of the total), hybridcasual (15%), and mid-core (12%) titles.

- Mid-core was the number one category by revenue, accounting for 59% of the total. It is followed by casual (38%) and hybridcasual (3%) games.

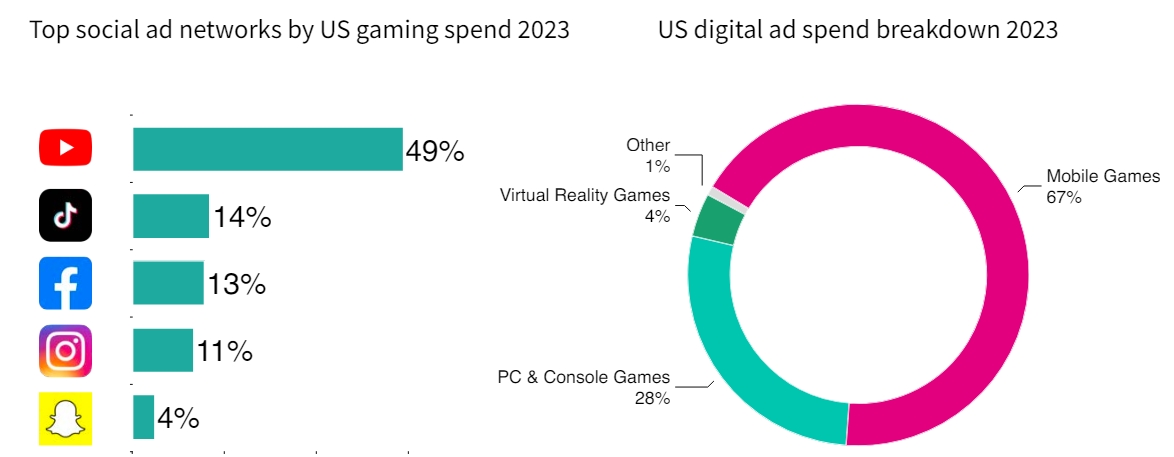

- Mobile games accounted for 67% of ad spend in the US last year, followed by PC/console (28%) and VR (4%) titles.

- The main advertising channels were YouTube (49% of the total), TikTok (14%), Facebook (13%), Instagram (11%), and Snapchat (4%).

- Publishers also actively used retargeting campaigns to drive engagement in their top titles. In April 2023, Gardenscapes saw its downloads and revenue skyrocket by 270% and 64% year-over-year. And World of Tanks Blitz experienced an increase in downloads (+75%) and revenue (+6%) in December 2023.

Downloads by genre and product model

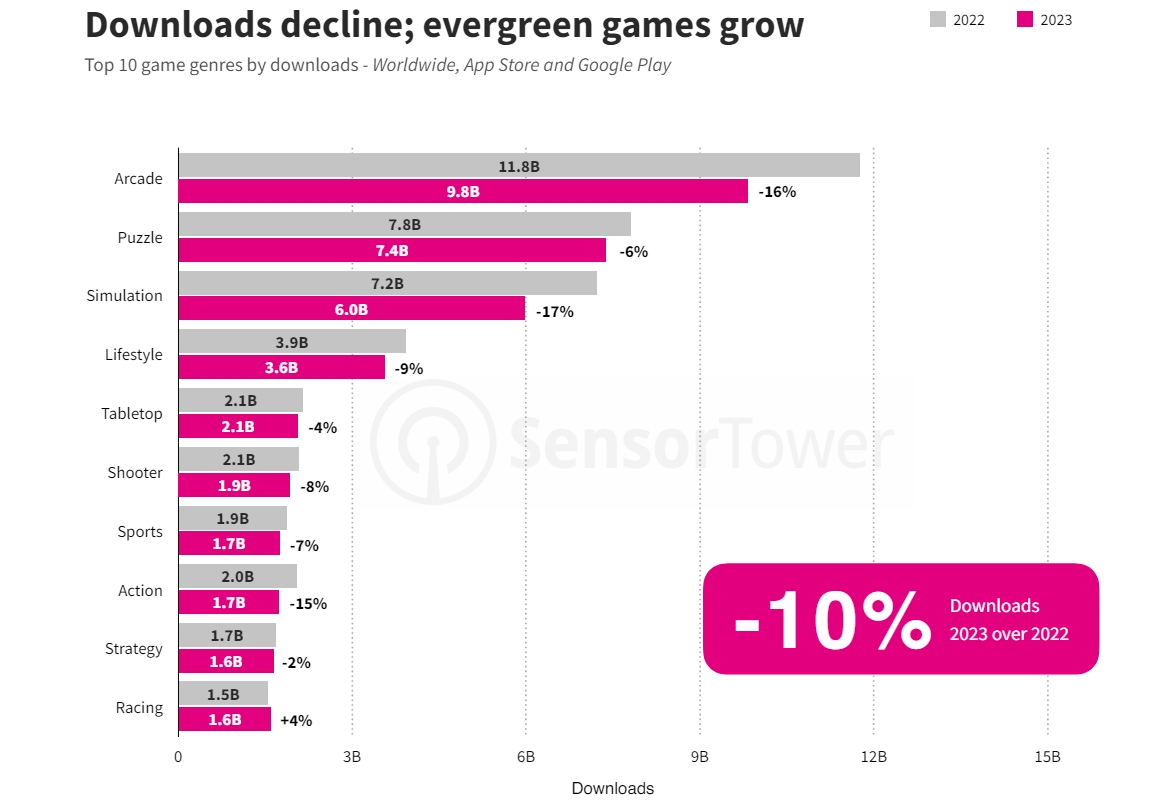

- Racing was the only genre that experienced growth in downloads in 2023. Installs increased by 4% year-over-year to 1.6 billion.

- Other genres saw declines, with Simulation, Arcade, and Action games down 17%, 16%, and 15% respectively. As Sensor Tower explained, “these genres, traditionally fueled by Hypercasual downloads, are the most affected in part because increased CPI (Cost Per Install) affects smaller margin games the most.”

- Mobile game downloads are returning to pre-pandemic levels, with hypercasual and casual categories hit the hardest. Hypercasual games, which combine ad revenue with the IAP monetization, continue to strengthen their position in the market despite a 2% decline.

- Interestingly, Sensor Tower highlighted a 180% growth in downloads of so-called “Exclusive Access” games (e.g. titles available to Netflix subscribers). However, their market share remains minor.

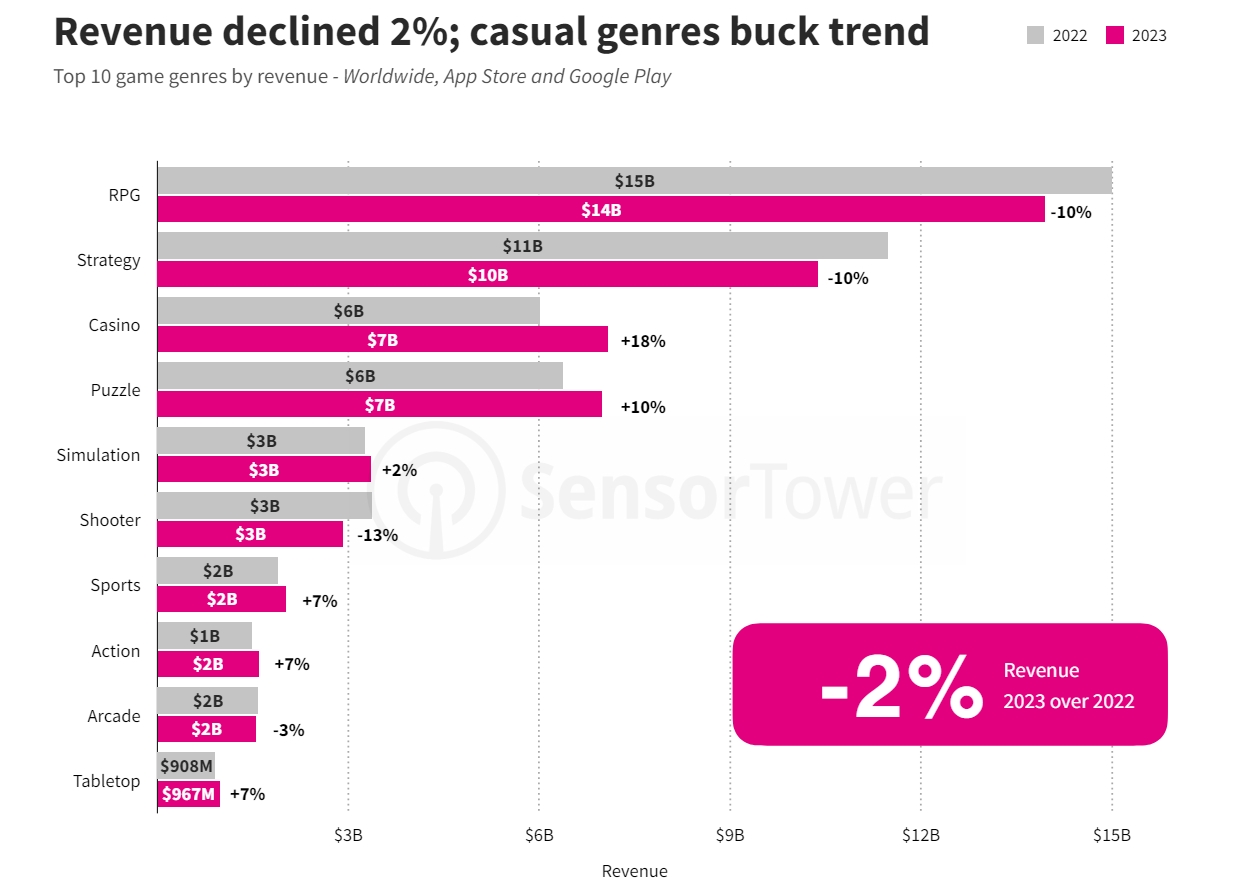

Revenue by genre and product model

- Casino and Puzzle genres saw the biggest revenue growth last year, with player spending up 18% and 10% respectively. The main drivers were Monopoly Go!, Candy Crush, and Gardenscapes.

- The Shooter category experienced the biggest decline (-13%), followed by RPG and Strategy games (-10% each). Overall, mid-core titles revenue fell 9% from 2022.

- Sensor Tower attributes this to challenges in mobile advertising, with publishers shifting towards casual audiences. As a result, hybridcasual titles experienced a 30% revenue growth thanks to a combination of hypercasual visuals and gameplay with mid-core monetization strategies.

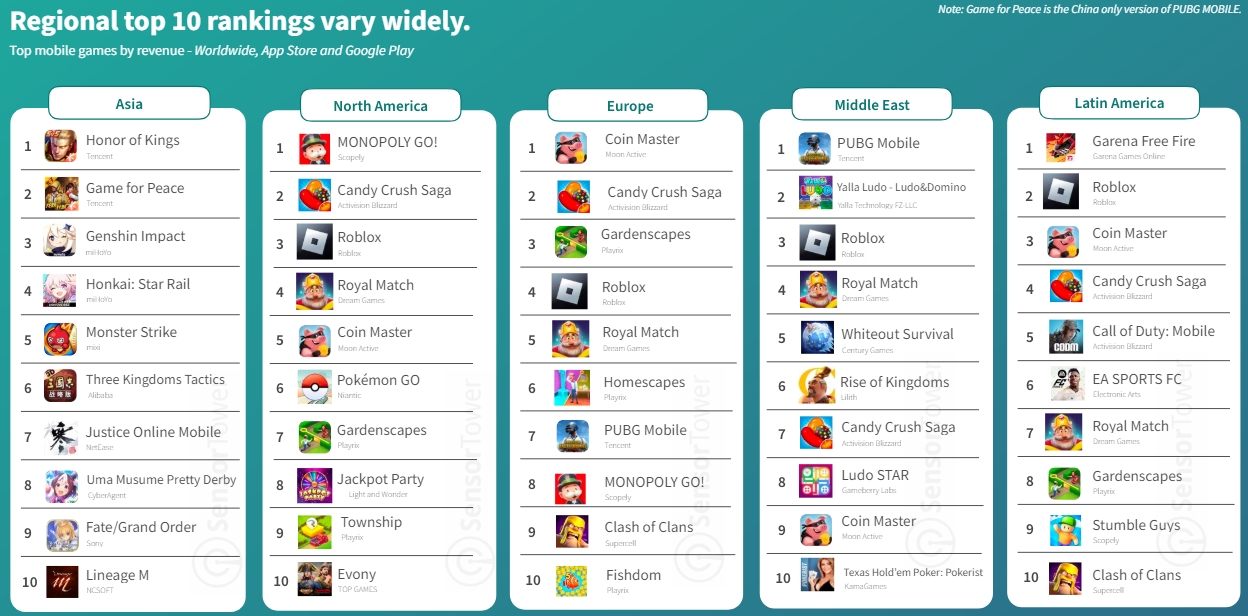

- Despite the general trends, players are leaning towards different product models depending on the region. In 2023, casual games accounted for the majority of revenue in North America (60%) and Europe (52%), while users in Asia (79%), Latin America (54%), and Middle East (53%) spend more on mid-core titles.

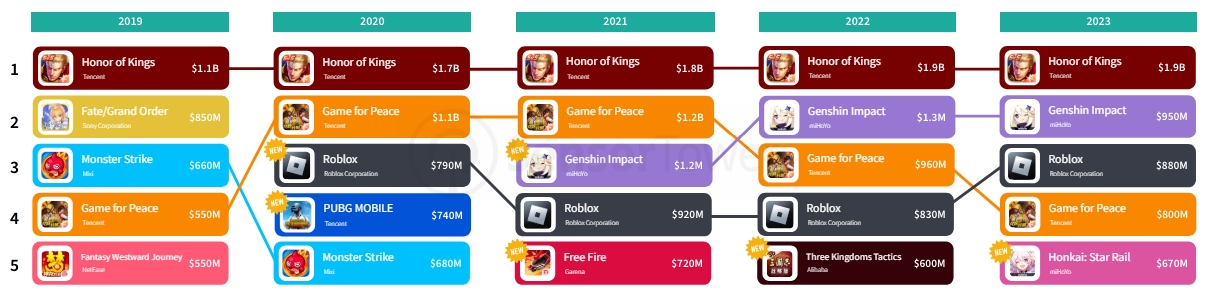

- Different regions also had different revenue leaders: Honor of Kings (Asia), Monopoly Go! (North America), Coin Master (Europe), PUBG Mobile (Middle East), and Garena Free Fire (Latin America).

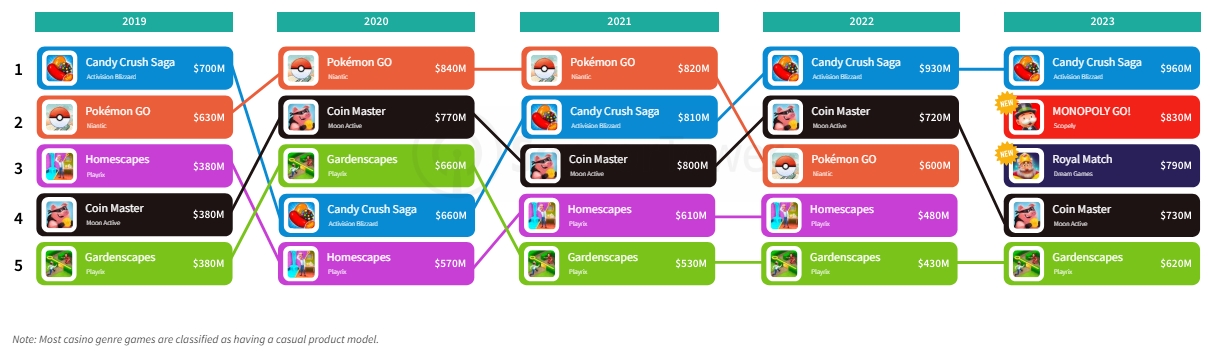

- The Casual category saw two new games breaking into the top 5 by player spending — Royal Match ($790 million) and Monopoly Go! ($830 million). It is worth noting that Scopely recently announced that Monopoly Go! has already surpassed $2 billion in revenue.

- Honor of Kings remained the highest-grossing mid-core game globally last year, with $1.9 billion in player spending. With Honkai: Star Rail ($670 million) breaking into the top 5, Chinese publishers now have four titles in the top 5.

Other notable data

- Six of the top 10 publishers by revenue growth launched a new game in 2023, including Scopely (Monopoly Go!), miHoYo (Honkai: Star Rail), and Century Games (Whiteout Survival).

- In December, Monopoly Go! dethroned Honor of Kings as the top mobile game by worldwide monthly revenue ($153.6 million vs. $142 million).

- Scopely’s Stumble Guys leveraged event collaborations with popular brands, with downloads jumping by 600% in July 2023 thanks to its partnership with Mr. Beast.

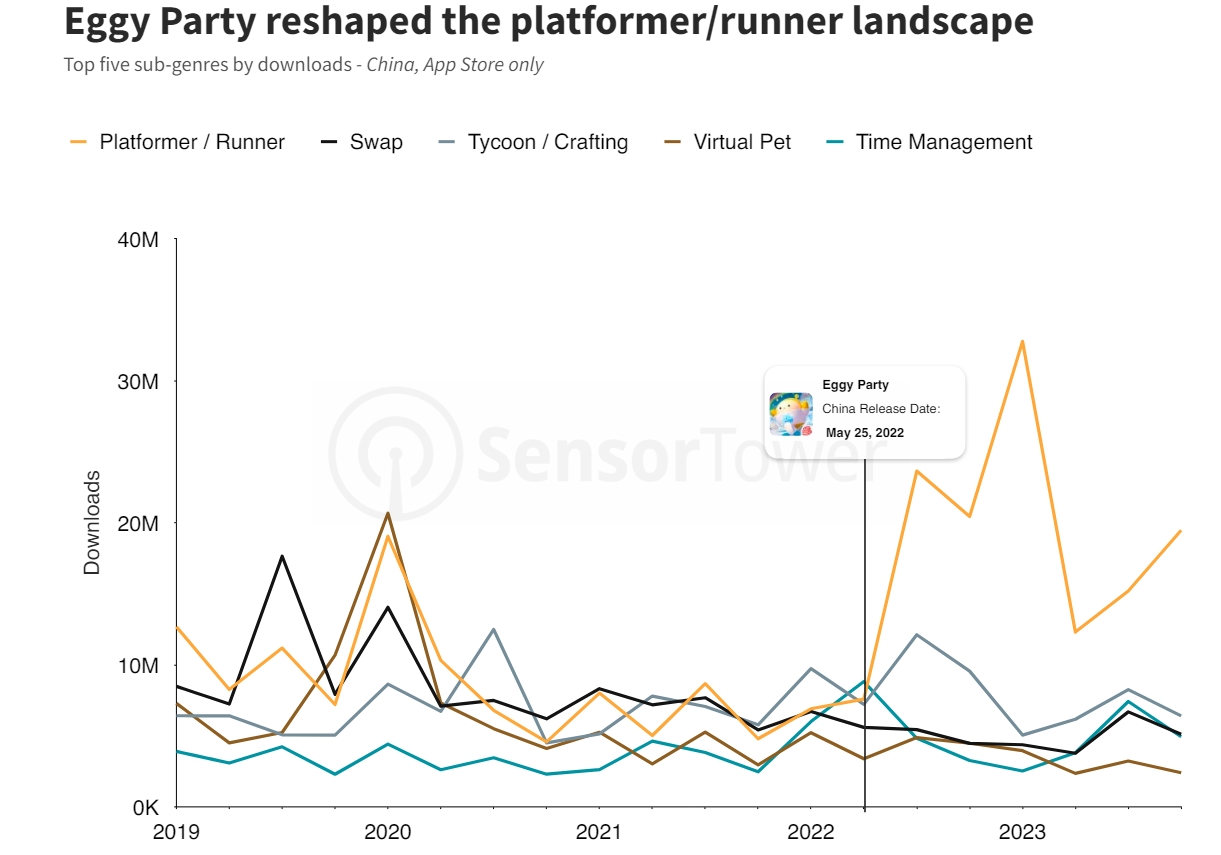

- NetEase’s Eggy Party dominated the download charts in China (App Store only), boosting total installs in the Platformer/Runner subgenre.

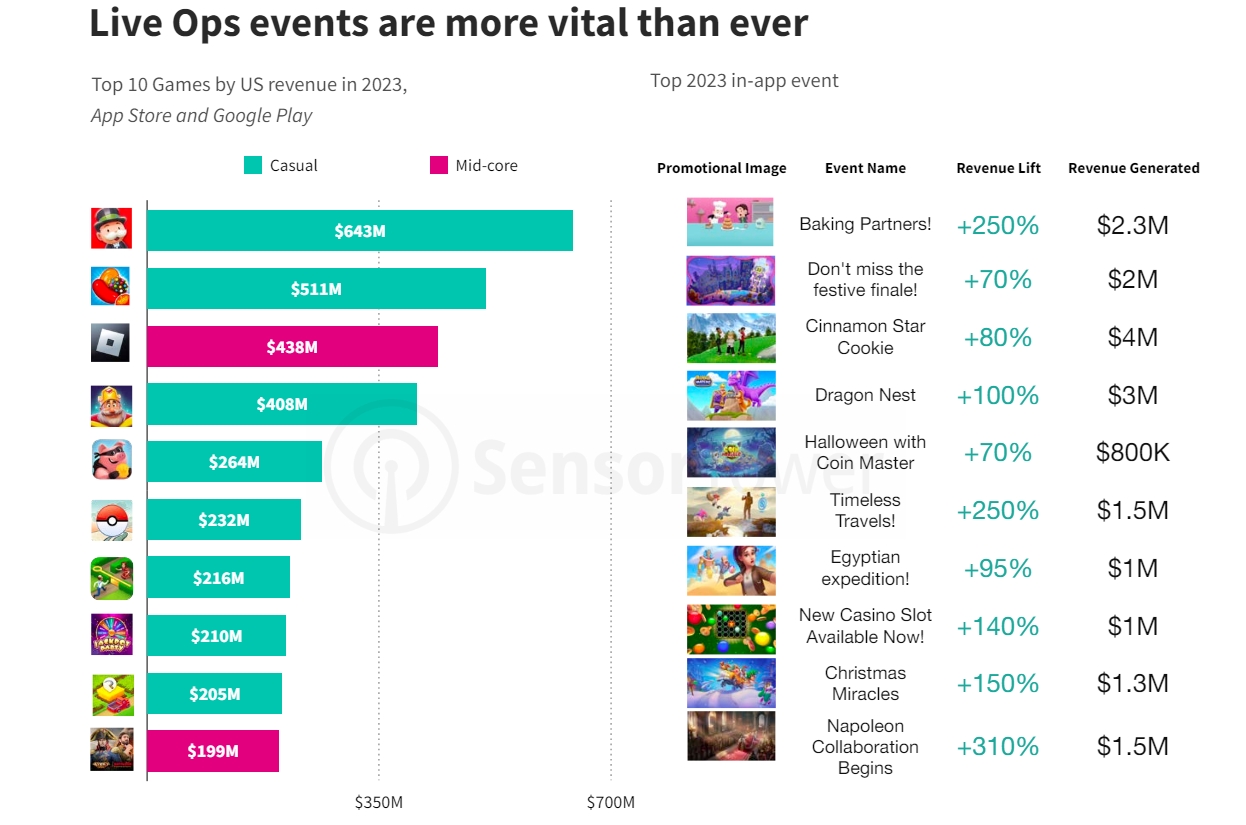

- Live Ops is more essential than ever for revenue growth: successful events can significantly increase player spending (e.g. Evony’s collaboration with the movie Napoleon boosted its revenue by 310%, and Pokémon Go saw a 250% lift in revenue within the first three days of launching the Timeless Travels event).

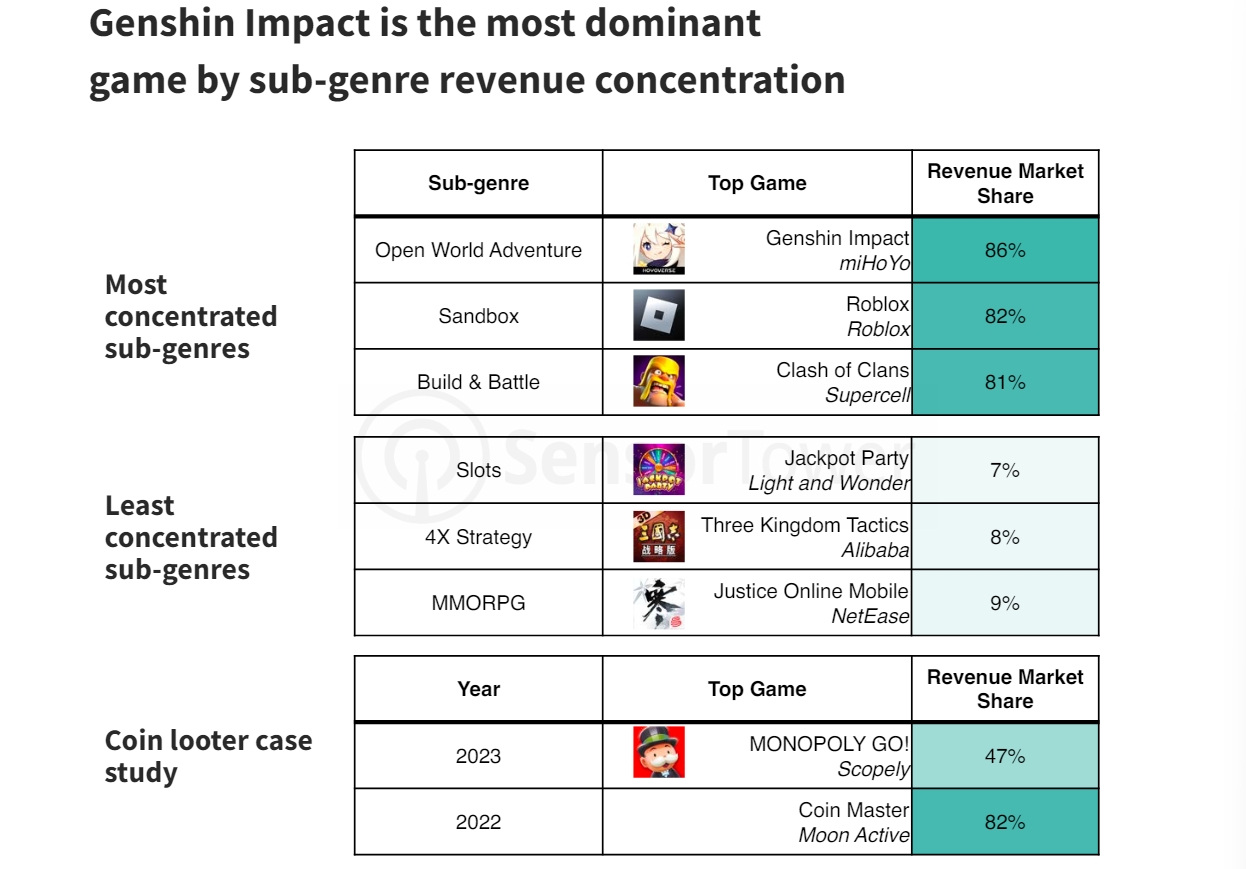

- Genshin Impact is the most dominant game in its category, accounting for 86% of total revenue in the Open World Adventure subgenre (Roblox has a 82% market share in the Sandbox subgenre, and Clash of Clash controls 81% of total player spending in the Build & Battle category);

- The biggest shift occurred in the Coin Looter category, where Monopoly Go! captured a 47% market share in 2023 (compared to 2022, when Coin Master accounted for 82% of the subgenre’s worldwide revenue).

- Downloads of Netflix games increased by 194% year-over-year, with the top genres by installs being Action (18 million), Lifestyle (14 million), Puzzle (11 million), Simulation (11 million), and Strategy (5 million).

More data and insights into the state of the mobile games market can be found in the full report.