Newzoo has updated its 2023 forecast for the global games market, also analyzing the top 10 game publishers by revenue. Tencent, Sony, and Apple remain the leaders, but big shifts are expected in the second half of the year due to the completion of Microsoft’s acquisition of Activision Blizzard.

Global games market forecast for 2023

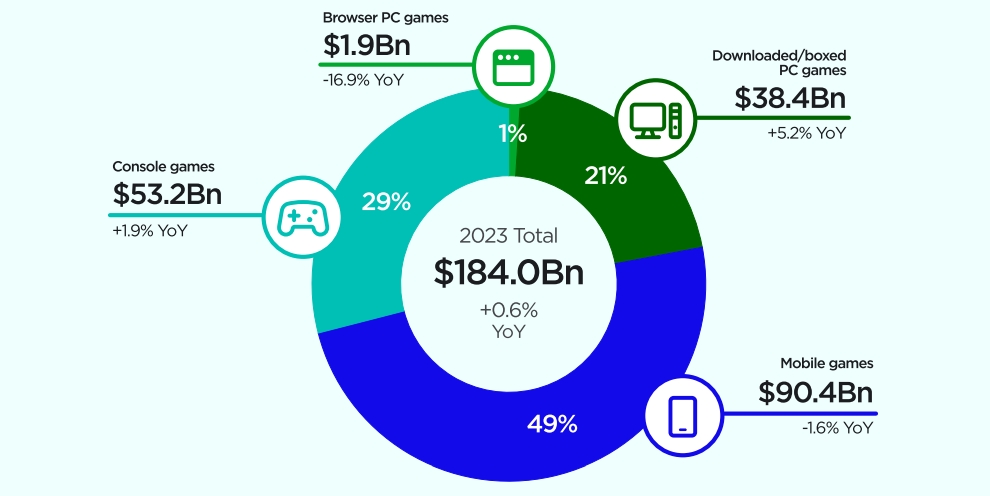

- According to the latest update to Newzoo’s 2023 market report, the global games market will generate $184 billion, up 0.6% year-over-year.

- Despite the projected 1.6% decline, mobile games will have the biggest share with $90.4 billion in revenue, followed by console ($53.2 billion, +1.9%), PC ($38.4 billion, +5.2%), and browser games ($1.9 billion, -16.9%).

Global games market revenue per platform

- The growth in the console and PC segments is driven by a large number of commercially successful AAA releases, many of which were delayed to 2023 due to disrupted development schedules during the COVID-19 pandemic.

- However, Newzoo notes that the “growth of these premium and hybrid titles has come at the cost of the ongoing success of live service hits like Fortnite, Rocket League, and others for which engagement and monetization saw a decline so far in 2023.”

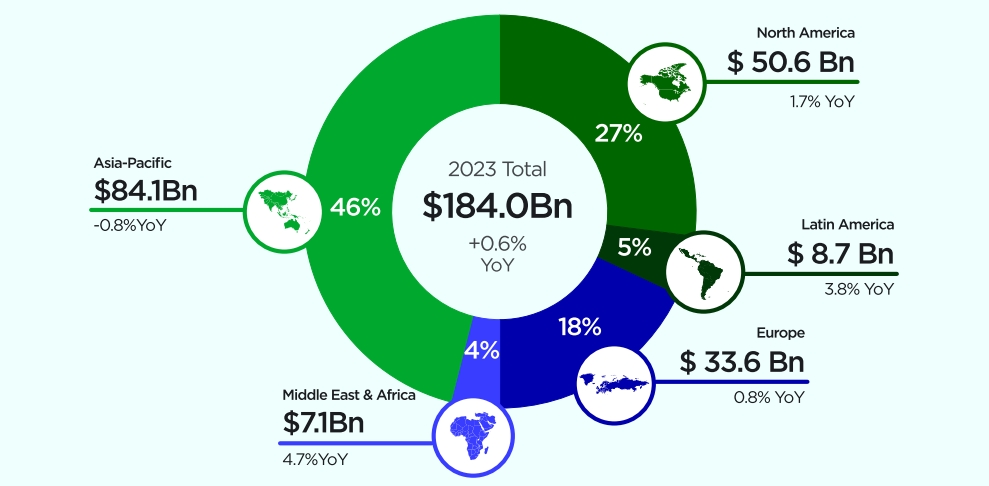

- Asia-Pacifc is expected to account for 46%, or $84.1 billion, of global games market revenue, followed by Norta America (27%), Europe (18%), Latin America (5%), and MENA (4%).

- Interstingly, Asia-Pasific is the only region that is projected to experience the decline (-0.8%). This is largely due to slower-than-usual growth in China, where the “ripple effect of the previous freezes and slow license issuing are echoing throughout [the market].” Analysts also point out the negative impact of the termination of NetEase’s partnership with Activision Blizzard on PC game revenues in the country.

Global games market revenue per region

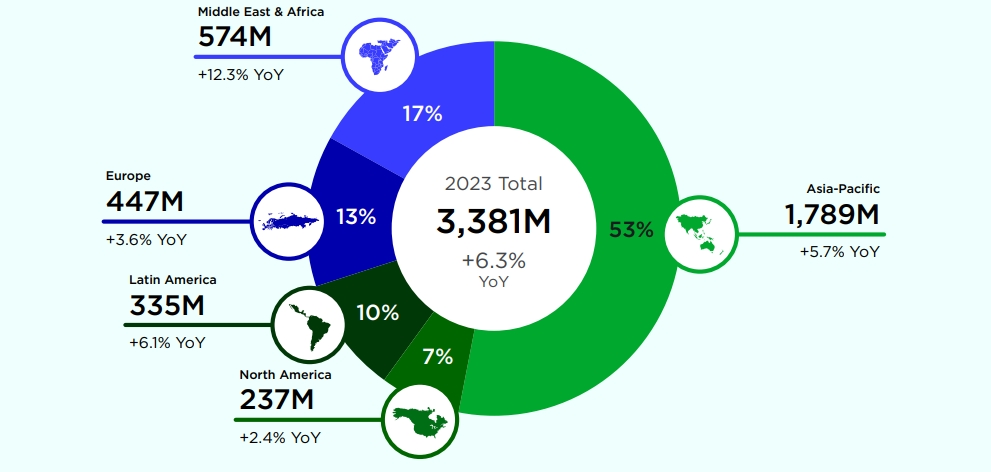

- The number of players globally will increase by 6.3% year-over-year, to 3.38 billion in 2023. Most of them will be on mobile — 2.85 billion, followed by PC (892 million) and console (629 million).

The number of players per region

- Overall, Newzoo believes that the industry is “continuing to stabilize after some pandemic-induced turbulence.” Analysts expect global games market revenue to reach $205.7 billion in 2026, with the number of players reaching 3.79 billion.

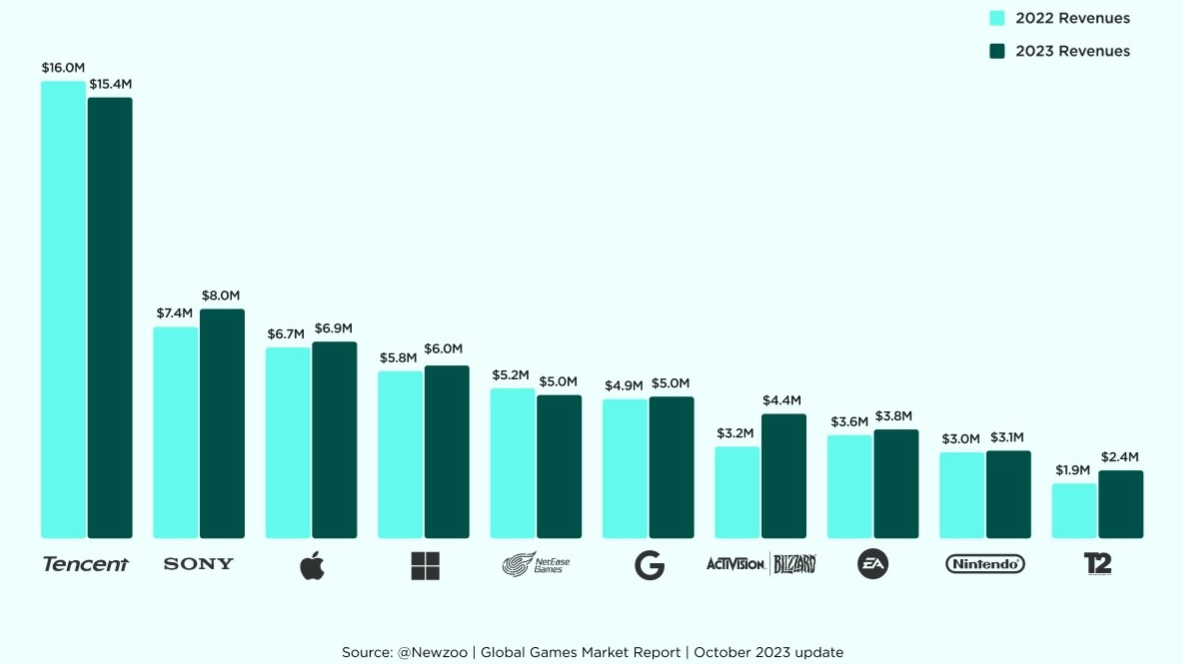

Gaming giants dominating the market

In a recent blog post, Newzoo noted that the top 10 game publishers have already generated $54.4 billion in the first half of 2023. That represents 29.5% of projected full-year revenue for the entire global games market.

Below are the top 10 companies by gaming revenue in H1 2023:

- Tencent — $15.4 billion (-3.6% year-over-year);

- Sony — $8 billion (+8.7% year-over-year);

- Apple — $6.9 billion (+3.2% year-over-year);

- Microsoft — $6 billion (+3.5% year-over-year);

- NetEase — $5 billion (-3.8% year-over-year);

- Google — $5 billion (+2% year-over-year);

- Activision Blizzard — $4.4 billion (+35.5% year-over-year);

- Electronic Arts — $3.8 billion (+5.5% year-over-year);

- Nintendo — $3.1 billion (+3.3% year-over-year);

- Take-Two — $2.4 billion (+26% year-over-year).

Even with the 3.6% decline, Tencent remains the market leader by a wide margin. This is largely driven by its hits like Honor of Kings, PUBG Mobile, and Goddess of Victory: NIKKE. In addition, Valorant “continued to enjoy revenue growth in H1” and finally received a publishing license in China.

According to Newzoo, Sony’s growth in the first half of 2023 was largely driven by third-party premium releases like Hogwarts Legacy, Star Wars: Jedi Survivor, Street Fighter 6, and Diablo IV, as well as an increased supply of PS5 and differences in foreign exchange rates.

Image credit: Newzoo

Speaking of Microsoft, analysts cited Game Pass as one of the factors behind the company’s growth in H1. Xbox also “enjoyed a cut of ongoing revenues from live-service games like Fortnite, FIFA 23, and Call of Duty: Warzone 2.0.”

Activision Blizzard experienced the biggest growth of any company in the top 10. This is largely due to increased YoY revenues for its key franchises like Call of Duty, Warcraft, and Candy Crush. In H1, the company also launched Diablo IV, which generated $666 million in just five days and went on to become the highest-grossing game of the month in the US and UK.

Keep in mind that Activision Blizzard wasn’t owned by Microsoft as of June 30, 2023. If we combine their revenues, Microsoft would be the second-biggest company on the list with $10.4 billion, ahead of Apple and Sony.

Electronic Arts experienced a steady growth thanks to its sports titles (FIFA) and live service games like Apex Legends, as well as the successful launch of Star Wars Jedi: Survivor.

Nintendo continues to reap the rewards of its huge first-party releases, and The Legend of Zelda Tears of the Kingdom stands out with 10 million units sold in its first three days (as of September 30, the sales reached nearly 20 million copies).