Microsoft’s xCloud is estimated to become the largest cloud gaming service globally, according to data shared by the UK’s Competition and Markets Authority (CMA). Here are some findings about the market that has become a bone of contention in the Activision Blizzard deal.

TweakTown’s Derek Strickland shared new findings from the CMA’s 415-page report on Microsoft’s proposed acquisition of Activision Blizzard.

Page 218 of the document contains information from a report on the cloud gaming market. It was conducted by an independent analyst firm and provided to the regulator by one third party. Here are some key takeaways:

- PS Now was the top cloud gaming service by revenue in 2021, with xCloud, Nvidia GFN, and Amazon Luna holding “significantly smaller” shares;

- xCloud reportedly generated less than $50 million in 2021, but it is expected to become the “largest cloud gaming service by revenue in 2026” with $450 million;

- This unnamed analyst firm also expects the global cloud gaming market to grow 300% — from $400 million in 2021 to $1.05 billion in 2026;

- Taking this data into account, the global share of xCloud was probably less than 12.5% in 2021.

Even if Microsoft’s cloud gaming service will reach $450 million in revenue in 2026, that would still be extremely small compared to total global games market revenues. For example, Newzoo expects the global video game market to generate $211.2 billion in 2025 (up from $192.7 billion made in 2021). So cloud gaming is still a drop in the ocean compared to the entire industry.

This data reinforces the fact that cloud gaming isn’t necessarily a revenue-driven market, and instead leans towards providing additive value to existing offerings, products, services, and ecosystems.

It’s no wonder Stadia failed. People just aren’t spending enough on cloud.

— Derek Strickland (@DeekeTweak) May 3, 2023

It is also worth noting that data provided by different research firms may vary, especially with regard to revenue projections in emerging areas like cloud gaming. According to Omdia, the global cloud gaming market generated $3.7 billion in 2021, a stark difference compared to the data from the CMA report. And Newzoo estimated revenues for that year at $1.4 billion, expecting the global cloud gaming market to top $6.3 billion in 2024.

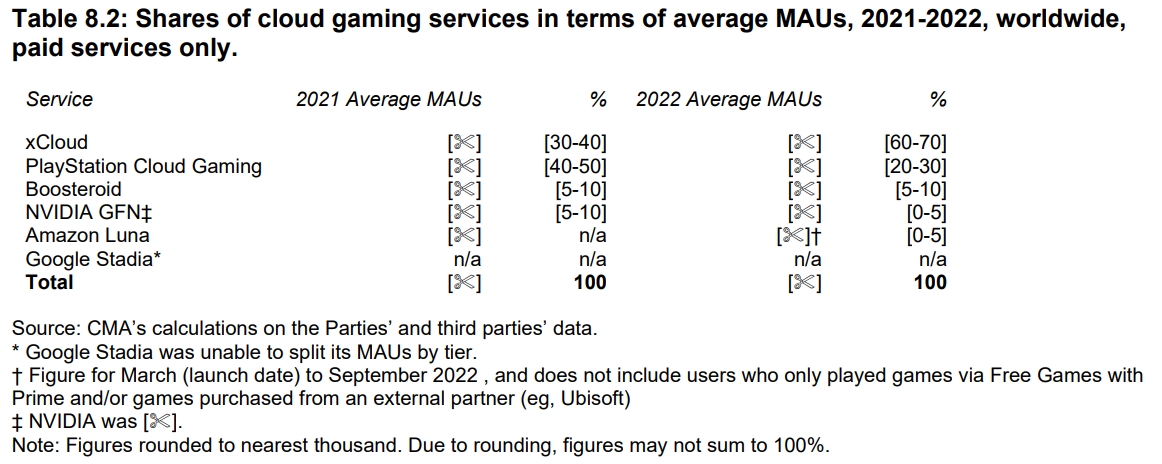

In its report, the CMA also published data on shares of paid cloud gaming services in terms of average monthly active users (MAUs) worldwide (page 216). Microsoft’s xCloud held a 30-40% share in 2021, followed by PS Now (40-50%), Boosteroid and GFN (5-10% each).

In 2022, xCloud’s share increased to 60-70%, with PS Now controlling 20-30% of total cloud gaming MAUs. When it comes to the UK alone, the CMA estimated xCloud’s share at 40-50% and 70-80% in 2021 and 2022 respectively.

Microsoft’s possible dominance in the cloud gaming market was the key reason why the UK regulator decided to block the Activision Blizzard acquisition. The CMA ruled that the merger will harm competition in the field, giving Microsoft a clear advantage through obtaining hit franchises like Call of Duty, World of Warcraft, and Diablo.