NetEase has released its financial results for the third quarter ended September 30, 2024. Here are the key figures on the company’s video game business, including the performance of Blizzard titles in China.

Hearthstone

- According to its Q3 financial results, NetEase reached 26.2 billion yaun ($3.7 billion) in net revenue last quarter, down 3.9% compared to the same period last year.

- Gross profit was 16.5 billion ($2.3 billion), down 2.9% year-over-year, while net income fell 16.6% to 6.5 billion yuan ($931.7 million).

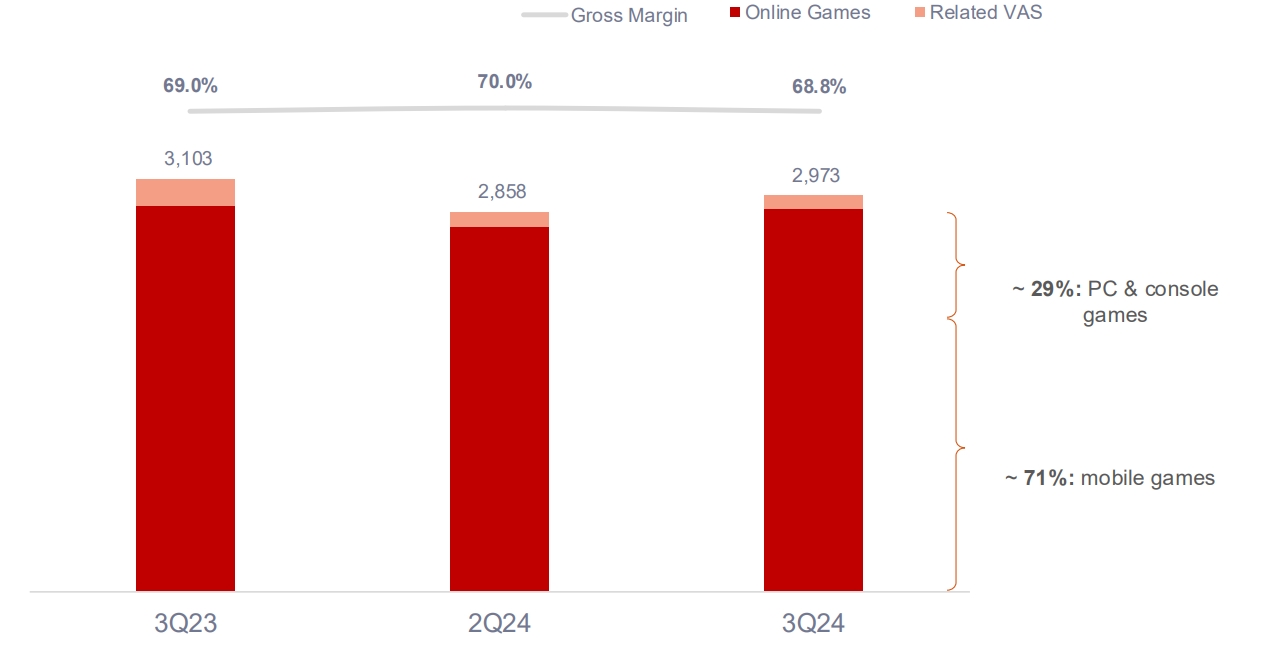

- NetEase’s gaming division generated 20.9 billion ($3 billion) in revenue, down 4.2% year-over-year. Online games accounted for 97% of the total, with the remainder coming from “value-added services” such as live streaming service NetEase CC and game-related merchandise.

- 71% of the segment’s revenue came from mobile titles, while the share of PC and console games was 29%.

- Naraka: Bladepoint Mobile has gained “significant popularity” since its launch in China in July. However, the company didn’t share any specific figures.

- Following the renewal of its publishing agreement with Blizzard last quarter, games like World of Warcraft and Hearthstone “reignited historic level of player community enthusiasm” in China. For example, WoW saw a 50% increase in daily active users (DAU) compared to levels before its temporary shutdown in January 2023, while Hearthstone experienced a 150% growth.

- “To further diversify our game portfolio across genres and expand globally, we launched a variety of new games to captivate players worldwide and achieved breakthrough milestones,” NetEase CEO William Ding said in a statement.

- The Chinese company is now working on several titles based on third-party franchises, including Destiny: Rising, the mobile adaptation of Bungie’s looter shooter, and team-based RPG Marvel Mystic Mayhem.

- NetEase’s pipeline also includes two more games, free-to-play hero shooter Marvel Rivals and open world wuxia RPG Where Winds Meet, “set for launch in December.” Both projects should contribute to the company’s revenue in the coming quarters.