Embracer Group has released its financial report for the second quarter ended September 30, 2024. The Swedish holding company continues to divest its assets, also posting declining video game revenues.

Dead Island 2

Financial highlights

- According to its interim report, Embracer’s net loss amounted to SEK 390 million ($35.5 million), an improvement from SEK 562 million ($51.1 million) in the same period last year.

- The company’s net sales reached SEK 8.5 billion ($778.3 million), down 21% year-over-year.

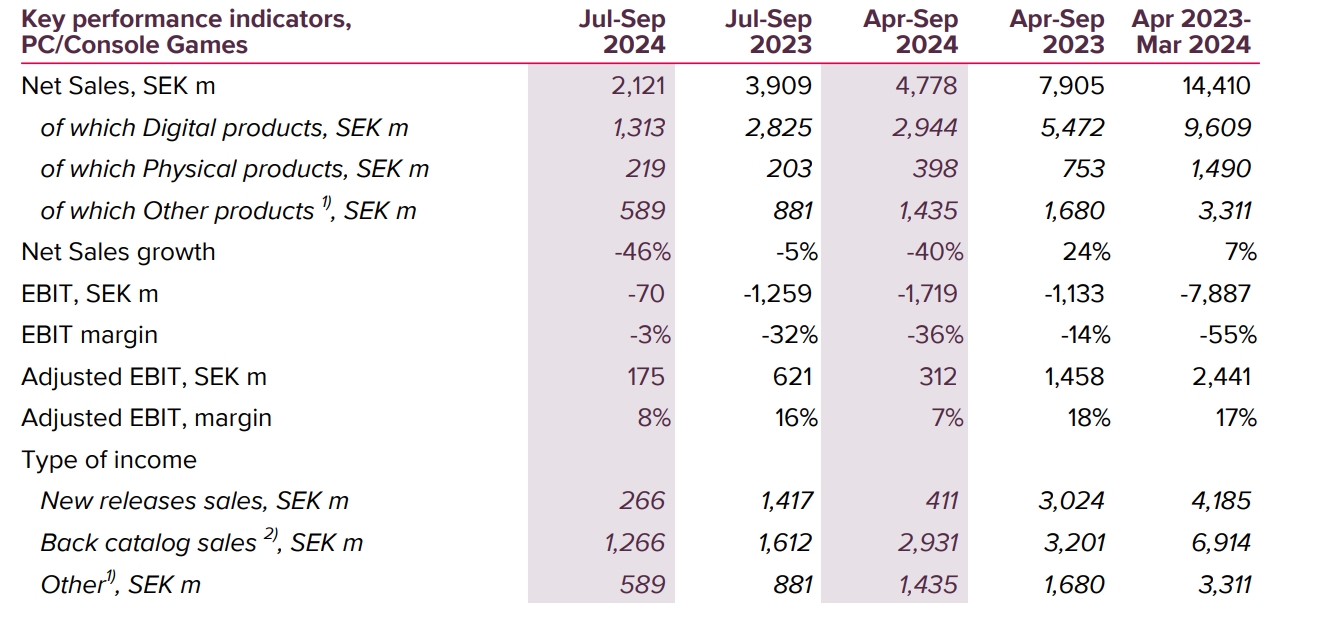

- Despite a 6% year-over-year decline, Tabletop Games remained the biggest segment by revenue, with SEK 3.82 billion ($348.2 million). PC and Console Games fell 46% to SEK 2.1 billion ($193 million), while Mobile Games dropped 10% to SEK 1.35 billion ($113.5 million).

Embracer is selling Easybrain

- On November 14, Embracer Group announced the divestment of mobile developer Easybrain. The subsidiary will be sold to Miniclip for $1.2 billion.

- The deal is expected to be closed in the first months of 2025.

- As Embracer CEO Lars Wingefors pointed out, the Easybrain divestment puts the company in a much stronger position to drive value both in the short and the long term.

- “We will become a better and more resourceful owner of our remaining companies, enabling them to make better business and decisions on an ongoing basis,” he said. “The transaction will also allow for our future stand-alone entities to be separated with strong balance sheets.”

- Easybrain founders Oleg Grushevich, Peter Skoromnyi, and Matvey Timoshenko will remain Embracer shareholders.

- The Swedish company acquired Easybrain in 2021, paying $640 million in shares and pledging an additional $125 million based on the studio’s financial performance. In the fiscal year ended March 31, 2024, Easybrain generated SEK 3.4 billion ($308.9 million) in revenue.

- As of September 30, Embracer’s net debt was SEK 13.2 billion ($1.2 billion). The company expects it to shrink to SEK 500 million ($46 million) following the Easybrain divestment.

- Excluding the debt ringfenced to Asmodee, which amounts to around SEK 9.4 billion ($850 million), Embracer’s net cash would be SEK 8.9 billion ($805 million).

Game results

- Sales of new games for PC and consoles amounted to SEK 266 million ($24.1 million), down 81% year-over-year. Such a decline was mainly due to a lack of new successful releases like last year’s Remnant II and Payday 3.

- The main revenue drivers were Satisfactory (1.0 launch), Monster Jam Showdown, Nobody Wants to Die, and Disney Epic Mickey: Rebrushed. The latter came out late in the quarter and “performed below management expectations,” but Embracer expects a “solid performance” during the holiday season.

- Satisfactory, on the contrary, performed above expectations, reaching over 200k concurrent players across Steam and the Epic Games Store. The game peaked at 186k CCU on Steam alone, meaning the EGS accounted for a much smaller portion of its CCU count.

- Back catalog titles generated SEK 1.26 billion ($114.7 million) in revenue, down 21.4% year-over-year. The decline was due to the divestment of Gearbox Entertainment and Saber Interactive.

- The top 10 games by revenue were Remnant II, Dead Island 2, Star Trek Online, Kingdom Come Deliverance, Deep Rock Galactic, MX vs. ATV Legends, Welcome to Bloxburg, Goat Simulator 3, Payday 3, and Neverwinter Online.

- The Other segment, which includes work-for-hire and other game development projects, fell 33% to SEK 589 million ($53.3 million). Strong contribution from Crystal Dynamics/Eidos, partly due to newly signed deals, was offset by the divestment of Gearbox and Saber.

- Embracer is now betting on upcoming titles, including its “key game release” of FY24/25 Kingdom Come: Deliverance II.

- Other games in the company’s pipeline are Deep Rock Galactic: Rogue Core, Gothic 1 remake, Killing Floor 3, Tomb Raider IV-VI Remastered, Titan Quest 2, and Wreckfest 2.