Amid ongoing stock price turmoil, the Guillemot family is considering various options for the future of Ubisoft. This includes a potential sale of the company to Chinese tech giant Tencent.

Assassin’s Creed Shadows

Tencent and Guillemot Brothers Ltd., which is owned by Ubisoft founders, is currently in talks with advisors on the company’s future. Anonymous sources familiar with the matter told Bloomberg that they are considering the following scenarios to stabilize the business:

- Company buyout;

- Potentially teaming up to take Ubisoft private.

The talks are at early stages, so it is unclear whether they will lead to a deal. According to Bloomberg, the parties are also considering alternative options. Both Ubisoft and the Guillemot family declined to comment.

This comes just weeks after one of Ubisoft’s minority shareholders, AJ Investments, publicly called for taking the French publisher private or selling it to a strategic investor, in addition to other possible actions such as hiring a new CEO instead of Yves Guillemot.

AJ Investments, which gathered support from 10% of the company’s shareholders, proposed such radical changes after Ubisoft’s market value has more than halved since the start of 2024. The launch of Star Wars Outlaws led to one of the biggest share price drops, with analysts raising concerns over the Ubisoft’s pipeline. As a result, its stock has plunged to its lowest level since 2013.

Last week, Ubisoft revised its financial targets for FY24/25. It currently expects to reach €1.95 billion in annual net bookings and “around break-even” operating profit. This decision was made due to lower-than-expected launch of Star Wars Outlaws and the delay of Assassin’s Creed Shadows to February 14, 2024.

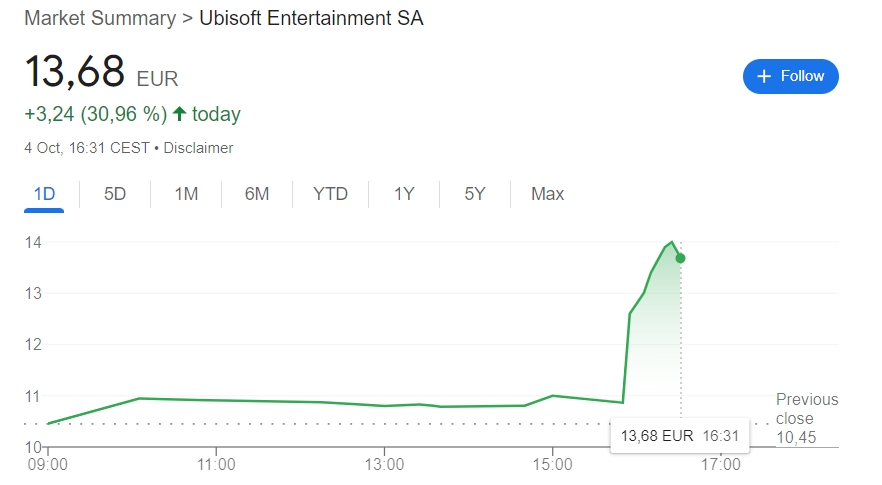

Shortly after Bloomberg published its report, Ubisoft shares rose 33.97% to €14.00 per share. It is the biggest single-day gain since the company went public in 1996. At the time of writing, the price is down slightly to €13.68.

In 2022, Tencent acquired a 49.9% stake in Guillemot Brothers Ltd. for €300 million amid rumors of Ubisoft’s buyout, also increasing its stake in the French publisher.

It is worth noting that Tencent and the Guillemot family are minority shareholders in Ubisoft, currently holding 9.2% and 20.5% of net voting rights. So they will have to gain support from other stakeholders before entering into any deals, whether a buyout or other options.