Tencent recently released its FY23 financial report, posting weaker-than-expected revenue growth. What’s really important is the Chinese tech giant’s reported plans to make fewer games based on licensed franchises in favor of in-house production.

Financial highlights

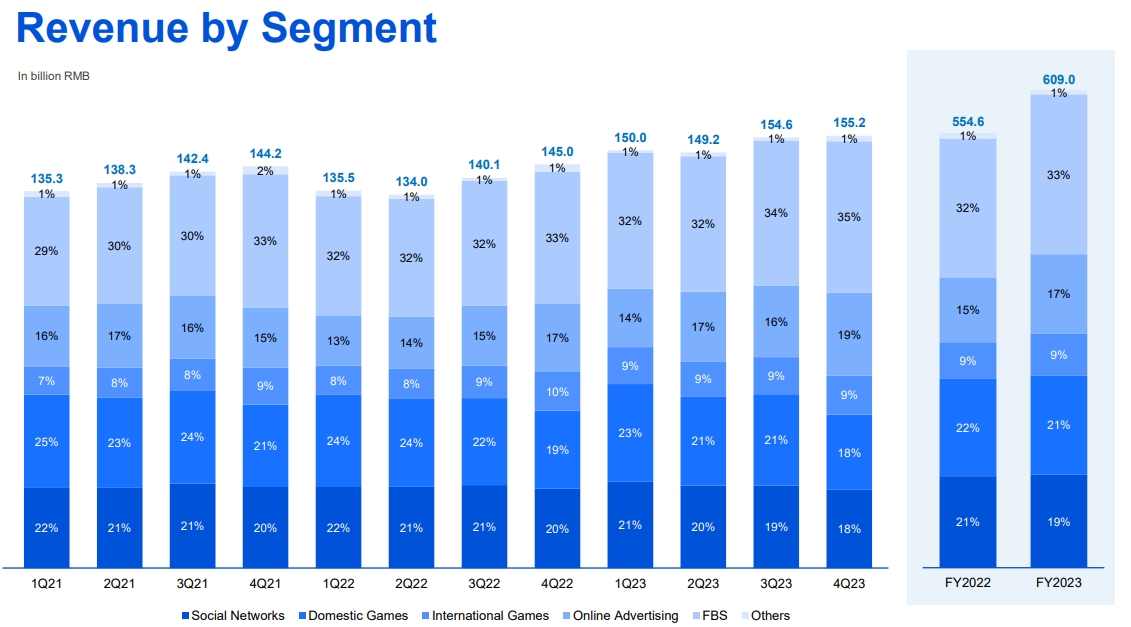

- According to its 2023 earnings release, Tencent reached 609 billion yuan ($86 billion) in revenue last year, up 10% compared to 2022.

- Its gross profit increased 23% year-over-year to 293.1 billion yuan ($41.4 billion).

- The Domestic Games segment brought in 126.7 billion yuan ($17.8 billion) last year, up 2% year-over-year.

- In China, the number of Tencnet’s “major hit games” increased from six in 2022 to eight in 2023. These are the titles with the average quarterly DAU of over 5 million on mobile and 2 million on PC.

- However, the segment’s Q4 revenue declined by 3% compared to the same period last year. The decline was due to decreased contributions from Honor of Kings and Peacekeeper Elite, the Chinese version of PUBG Mobile.

- The International Games segment reached 53.2 billion yuan ($7.5 billion) in revenue last year, up 14% year-over-year. It accounted for a record 30% of the company’s total gaming revenue, with strong performance from PUBG Mobile and Valorant.

- Despite impressive full-year growth, the segment’s revenue increased only 1% in Q4, or declined 1% when excluding currency fluctuations (“reflecting Supercell repositioning some of its games”).

- In 2024, the company plans to launch several mobile titles with potential for success, including RPG DnF Mobile, racing game Need for Speed, as well as fighting games Honor of Fight and One Piece.

Tencent is preparing changes to its gaming strategy

- According to Reuters, Tencent has plans to move away from big-budget mobile games based on third-party franchises and focus more on first-party titles.

- “We’re focusing on fewer bigger budget games,” Tencent chief strategy officer James Mitchell said during an earnings call. “Typically, we’re seeking to make the biggest bets around games that either iterate on a successful IP … or games that are iterating around proven gameplay success within a niche and taking those to a more mass market.”

- The Chinese tech giant has a rich history of making games for major publishers, from Call of Duty: Mobile to PUBG Mobile. However, these projects are very expensive to produce, not to mention that Tencent must pay royalties to IP owners (15-20%) in addition to mobile app stores’ 30% cut.

- One of the sources told Retuers that the company is now also “pushing for royalty fees to fall to under 10% of sales in some negotiations.”

- One sign of the strategy shift is the redeployment of “hundreds of people” from the team working on Assassin’s Creed Jade to the company’s own party title DreamStar. As a result, the upcoming mobile game based on Ubisoft’s major IP is now expected to launch in 2025 rather than this year.

- Another reason that forced Tencent to change its strategy is a string of major setbacks related to working with third-party IPs, including the cancellation of Apex Legends Mobile and a mobile title based on the Nier franchise.

- According to Kantan Games CEO Serkan Toto, “mobile games studios have learned that IP is not the magic bullet for user acquisition it once was.”

- Tencent is also not immune to failures in in-house production. Reuters cited Undawn, a cross-platform zombie shooter for PC and mobile developed by its first-party team Lightspeed Studios and published by its Level Infinite label.

- The game reportedly had a budget of close to 1 billion yuan ($142 million) and involved a team of more than 300 devs. Despite huge investment and a marketing campaign starring Hollywood star Will Smith, Undawn “flopped spectacularly.”

- Earlier this year, Tencent CEO Pony Ma told employees that gaming remains the company’s flagship business. But it is time to act because “we have found ourselves at a loss, as our competitors continue to produce new products, leaving us feeling having achieved nothing.”

- That’s why Tencent recently launched the Spring Bamboo Shoots Project to incubate in-house games by offering budgets of up to $42 million per project.