Michał Nowakowski, senior VP of business development at CD Projekt, has sold a portion of his stake in the company. Overall, he sold 50,000 shares.

CD Projekt shared the news on November 30, Nowakowski notified the company and submitted an order to the brokerage house regarding the sale of his shares.

He made two transactions for a total of PLN 6.6 million ($1.46 million). As pointed out by WirtualneMedia, Nowakowski sold 35,991 shares on November 29 and 14,009 shares on November 30.

This amounts to around 0.049% of CD Projekt’s total share capital. Nowakowski’s total stake in the company remains undisclosed.

Who is Michał Nowakowski?

- Nowakowski started his career at the Polish branch of Danish media corporation Egmont Group where he worked from 1999 to 2002.

- After that, he became an editor and licensing manager at Axel Springer. He worked with video game magazines and acquired licenses for games bundled on CDs accompanying these publications.

- In 2005, Nowakowski joined CD Projekt as managing director of publishing. He has been a member of the company’s board of directors since 2011.

- Nowakowski also currently serves as a senior vice president of business development, overseeing CD Projekt’s sales and publishing policies.

The shareholder structure of CD Projekt

Who are the main shareholders of CD Projekt?

- According to the company’s official website, its total share capital is divided into 100.7 million shares with a nominal value of PLN 1 per share.

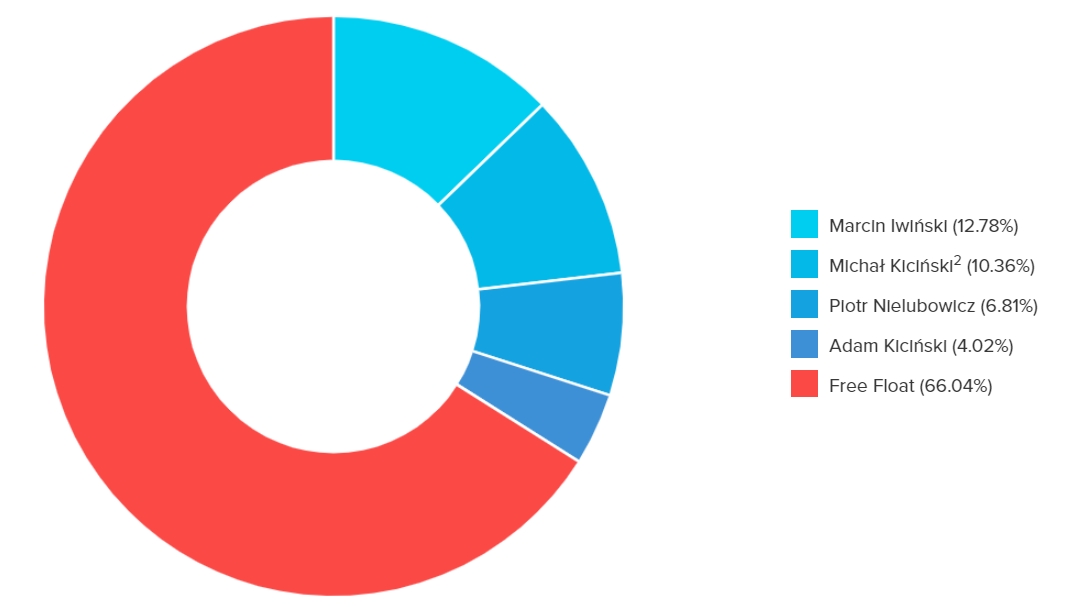

- CD Projekt founders, Marcin Iwiński and Michał Kiciński, remain the largest shareholders. They control 12.78% and 10.36% of the capital, respectively.

- In October, Iwiński stepped down as the joint CEO of CD Projekt to take on the new non-executive role.

- Other key shareholders include CFO Piotr Nielubowicz (6.81%) and president/CEO Adam Kiciński (4.02%).

- These four people have a 33.97% combined stake in the company. The remaining 66.04% of shares are distributed among other shareholders.