According to Niko Partners, in 2021, Tencent has already closed over 50 deals by May. It makes the Chinese company the absolute leader in the gaming investment market. But what makes it act so actively?

In its latest article, analyst company Niko Partners explained why Tencent is so aggressive when it comes to investments and acquisitions. Here’s what the analysts found out (it’s worth noting that all data is provided as of May 10, 2021).

Key data

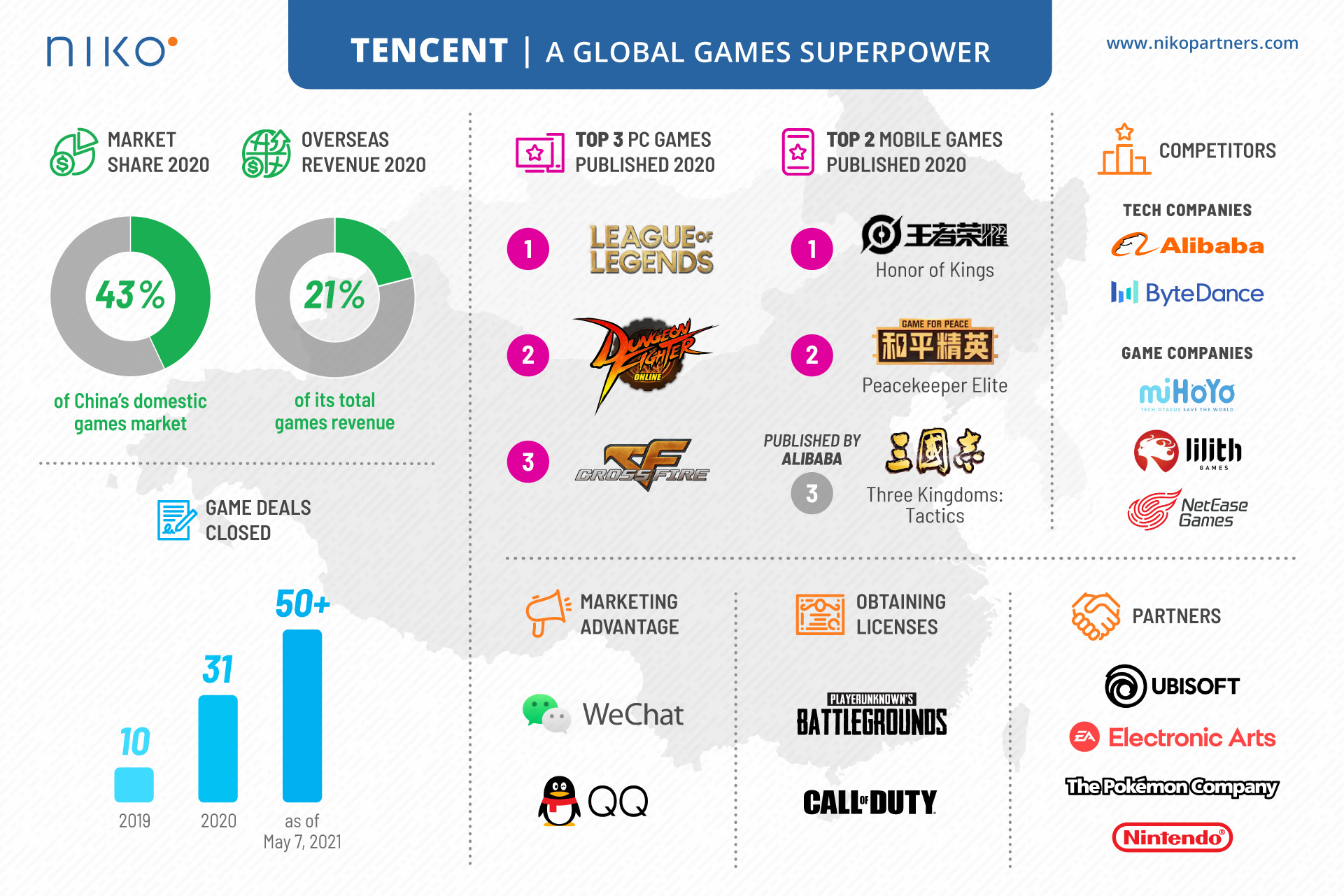

- In 2021, Tencent invested in 51 game companies, compared to 31 and 10 M&A deals it made in 2020 and 2019 respectively.

- 39 of these 51 deals were made with other Chinese companies. Tencent also invested in 5 South Korean companies but hasn’t closed any M&A deals in the US yet (the reason might be the geopolitical issues with the American authorities).

- Although Tencent always preferred to invest in mobile developers, the company decided to change the direction. Almost half of M&A deals in 2021 were made with PC and console studios.

- The Chinese tech giant also started investing in growth segments, closing 14 deals with developers of anime games or titles for female gamers.

Image credit: Niko Partners

Why does Tencent act so aggressively in the market?

- The main reason Tencent became more aggressive in 2021 is its competition with ByteDance and Alibaba, which began to invest in game companies more often. For example, the TikTok owner recently bought mobile studio Moonton (the company is valued at $4 billion).

- According to Niko Partners, Tencent sees a huge potential (and threat) in hit games developed by smaller studios. Genshin Impact from miHoYo is a good example, as the game has already reached over $1.5 billion in revenue across all platforms.

- Tencent also wants to become a global gaming giant, planning to have 50% of its audience overseas. In 2020, only 21% of the company’s revenue came from outside China, so Tencent has ambitions to increase the share.