Nintendo’s stock has been on the rise for more than a week. Several positive factors are helping Japanese publisher reach a new all-time high.

Image credit: Nintendo

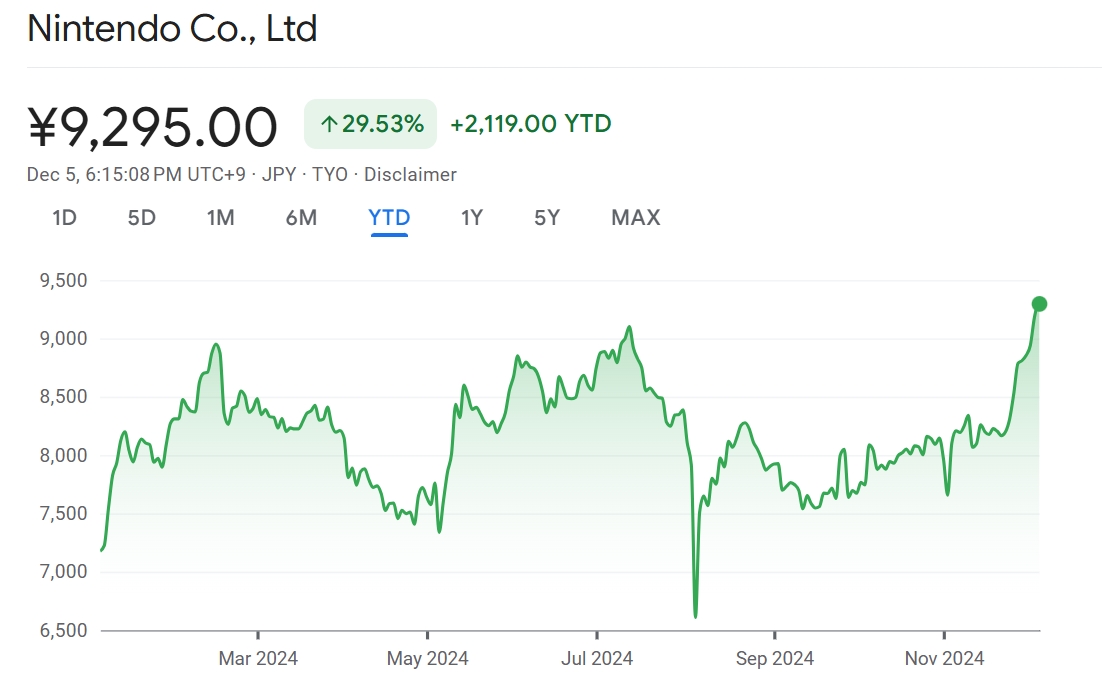

As reported by Automaton, Nintendo’s stock rpice reached ¥9,210 ($61.19) per share on December 4, having increased by more than ¥1,000 ($61.76) over the last eight days.

At the time of writing, Nintendo shares are trading at ¥9,295 ($) per share, with a market cap of more than ¥12 trillion ($79.7 billion). The company’s stock has risen 29.53% year-to-date, indicating strong performance.

Here are the main reasons why market analysts cite such impressive results:

- Saudi Arabia’s Public Investment Fund recently cut its stake in Nintendo to 5.26%, which had a positive impact on investor sentiment;

- According to new speculation, Nintendo plans to present a successor to its Switch console in January and release it into the market in March, supporting investor expectations that 2025 will be a strong year for the company;

- Sony’s proposed acquisition of Kadokawa became a catalyst for Nintendo shares to rise — experts believe that if the deal goes through, it will force Nintendo to reevaluate its portfolio and continue developing its own IP.

FY25 has been a mixed year for Nintendo so far, with the company facing declining Switch sales and a lack of new major hit games. In H1, its net revenue and operating profit fell 34.3% and 56.6% year-over-year, respectively. Nintendo also revised its financial outlook for the full year ending March 31, 2025, expecting to reach around $8.4 billion in revenue and $2.3 billion in operating profit.