The last days of December are the best time to reflect on what happened this year. This time, we are doing it with representatives of prominent game-related companies. We begin this series with Roman and Kirill Gurskiy, managing directors at GEM Capital.

How did 2025 turn out for your business? What key results would you highlight—both successful and unexpected?

Kirill: This has been an incredibly eventful year. Many of our portfolio companies delivered outstanding results. Mundfish released the third DLC for Atomic Heart, titled ‘Enchantment Under the Sea,’ which received a glowing reception from players, boasting a 95% Steam rating. I have to admit, the song ‘V Sinem More, V Beloy Pene’ (‘In the Blue Sea, in the White Foam’) has been on repeat for me all year! 🙂 In 2025, the Atomic Heart soundtrack showed impressive results: over 1.1 million listeners from 177 countries spent a total of more than 630,000 hours listening to the tracks. And that’s on Spotify alone!

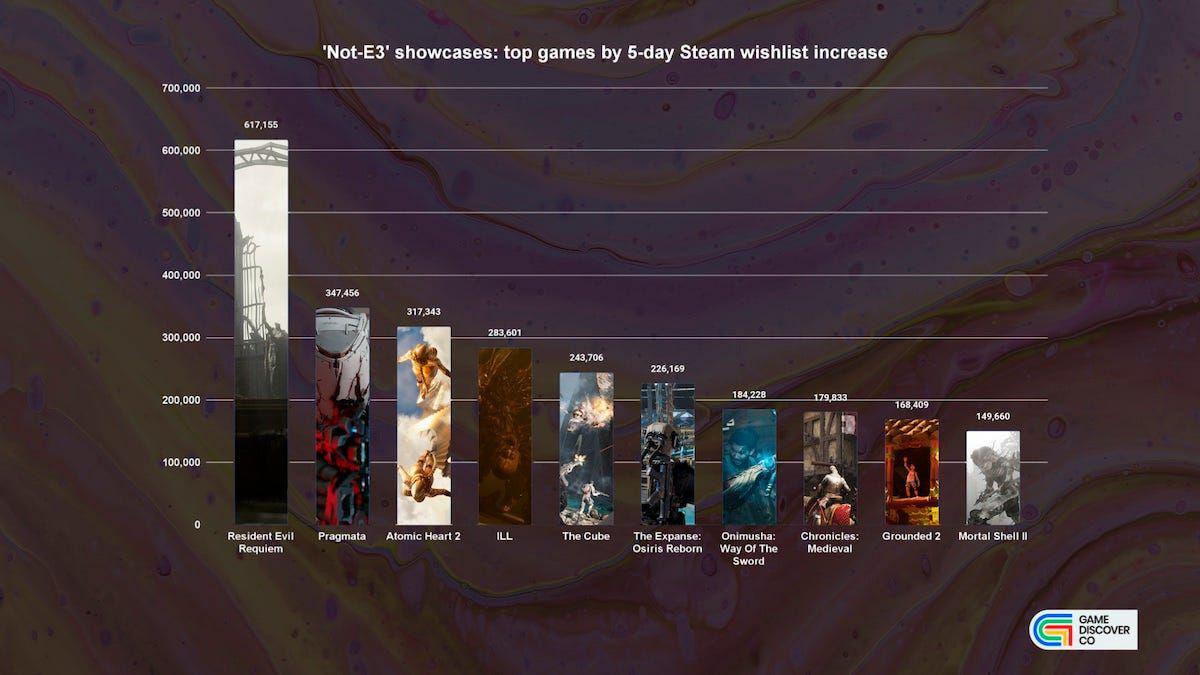

Furthermore, Mundfish essentially stole the show at Summer Game Fest. They announced the launch of Mundfish Powerhouse and unveiled trailers for three massive upcoming titles: the MMO RPG shooter The CUBE, the horror game ILL (in partnership with Team Clout), and, of course, Atomic Heart 2. All three games ranked in the top 5 most-wishlisted titles among everything showcased this summer.

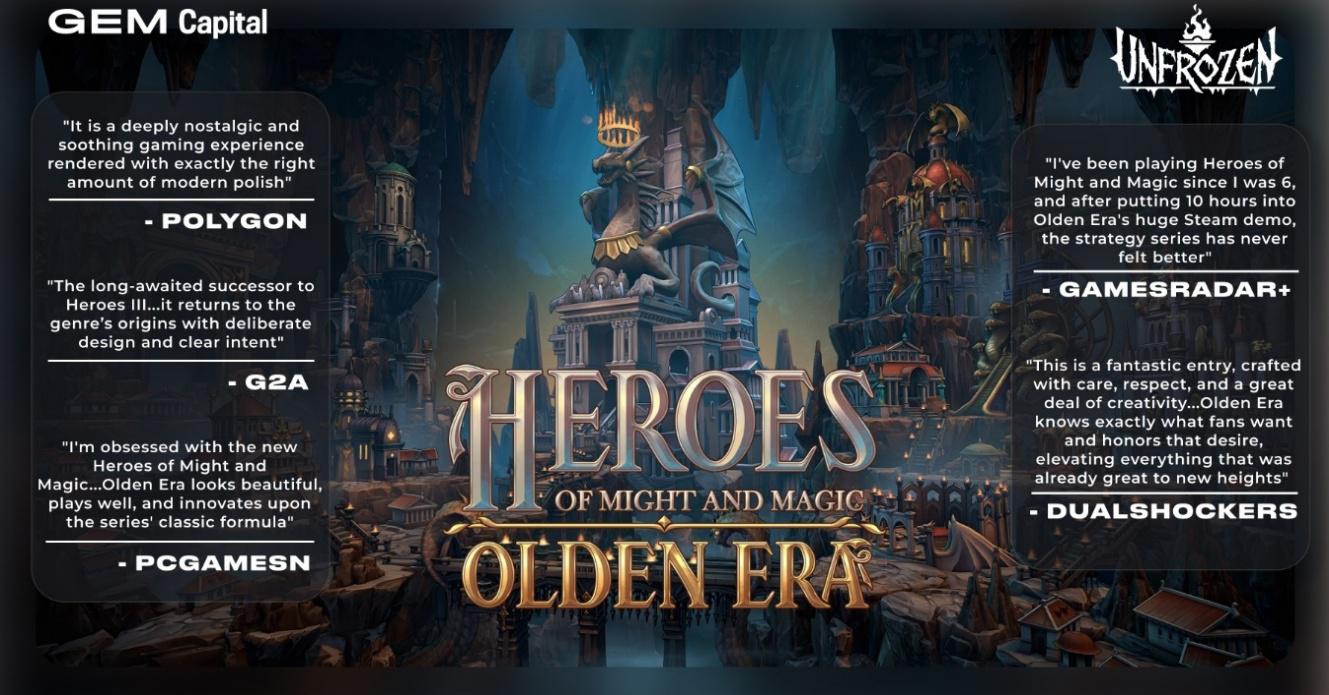

Roman: Unfrozen released a demo of Heroes of Might & Magic: Olden Era, which became one of the standout hits of the October Steam Next Fest. It reached a peak of over 24,000 concurrent players, ranking Olden Era 16th among the most popular demos in Steam history — positioned between Stellar Blade and Monster Hunter Rise. These would be impressive metrics for a full release of any game… but Olden Era achieved them with just a demo, not even in Early Access. A truly fantastic result!

Gaming journalists have highly praised the game:

- “I’ve been playing Heroes of Might and Magic since I was 6, and after putting 10 hours into Olden Era’s huge Steam demo, the strategy series has never felt better”, — GamesRadar+

- “This is a fantastic entry, crafted with care, respect, and a great deal of creativity by developers who know the series inside and out”, — DualShockers

- “Olden Era is a deeply nostalgic and soothing gaming experience rendered with exactly the right amount of modern polish”, — Polygon

The game has already surpassed 1 million wishlists, currently holding the #11 spot among the most anticipated games worldwide.

Also this year, we made a publishing deal between Unfrozen and Hooded Horse, and we are thrilled to have them on board for the Olden Era journey! All partners — Unfrozen, Ubisoft, Hooded Horse, and GEM — are incredibly passionate about the project and are doing everything possible to honor the fans’ trust and establish Olden Era as a new star in the strategy genre. We take great pride in helping our portfolio companies secure deals that are significant for them and the entire gaming market. This is certainly not the first time we’ve done this, and it definitely won’t be the last.

Kirill: Sad Cat has announced that their highly anticipated cinematic 2.5D platformer, REPLACED, is set to launch on March 12, 2026. As they say — save the date! We can’t wait for players to finally experience this creation, into which the team has poured their heart and soul. In the words of IGN: “REPLACED is what could be an all-time indie classic in the same category as Limbo, Braid, Inside, Balatro, etc.”

Currently, over 600,000 people have wishlisted REPLACED, and it holds the #60 spot on the Steam Wishlist charts. We are thrilled to see five projects from our portfolio companies among the top 150 most wishlisted games:

- Heroes of Might & Magic: Olden Era (#11)

- ILL (#16)

- REPLACED (#60)

- Atomic Heart 2 (#104)

- The CUBE (#138)

What makes this even more remarkable is that Atomic Heart 2 and The CUBE have only released one trailer each so far. We fully expect all of our portfolio games to climb even higher in the rankings as their release dates draw closer.

Roman: Weappy has launched their Hollywood studio management sim, Hollywood Animal, into Early Access, and it has already surpassed the 3,500 reviews mark on Steam. A dedicated community continues to grow steadily around the project.

The press has been equally impressed:

- “The Hollywood Animal demo looks like a blockbuster in the making”, — Destructoid

- “Hollywood Animal makes you god of an early 20th century movie studio, and I need the full game now”, — TheGamer

- “Hollywood Animal is a nifty and detailed golden age simulator populated with eminently hireable alcoholics”, — RockPaperShotgun

Furthermore, Weappy has pulled back the curtain even more on their stunningly beautiful, fully hand-drawn platformer, The Eternal Life of Goldman. Media outlets that got a hands-on look at the project were absolutely thrilled. As Everyeye put it: “We found ourselves before material of marvelous craftsmanship.”

Kirill: Our mobile and gametech companies have also demonstrated excellent progress. For instance, Hypemasters raised a new investment round from Saudi Arabia’s Impact46 and announced an expanded presence in the MENA region, including opening an office in Riyadh. We put a lot of effort into facilitating this deal and are thrilled with the outcome!

Meanwhile, AppMagic announced that their revenue has doubled over the past year. The company also launched its Steam analytics tool, which has been highly praised by clients and the gaming community for its accuracy and depth. In addition to revenue and download data, AppMagic now provides insights into DAU/MAU, Average Daily Playtime, Daily CCU, Retention, and more.

This is a major step toward the company’s long-term strategy of building a unique, cross-platform analytics suite covering the entire game and app ecosystem. And Steam is just the beginning; AppMagic is already working on similar solutions for Xbox and PlayStation. On a personal note, being able to analyze the metrics of one portfolio company using the tools of another is a proud moment for any investor!

Roman: All in all, it’s no surprise that AppMagic earned an Honourable Mention at the Mobile Games Awards 2025 in the ‘Best Analytics / Data Tool’ category. The same goes for another of our portfolio companies, the alternative mobile game store Skich, which was recognized in the ‘Best App Store’ category. Notably, Skich outperformed major players like the Samsung Galaxy Store, Oppo Software Store, and TapTap.

The gaming community has rightfully acknowledged the immense progress the Skich team made over the past year. In March 2025, Skich became one of the first alternative stores on iOS in Europe (as reported by TechCrunch), and by August, it launched for Android users (GamesBeat). You could say our prediction regarding the future of alternative mobile stores, which we made in our 2024 year-end interview, has officially come true.

Kirill: We are also thrilled to welcome Studio 42, founded by former top managers of Belka Games (GamesIndustry), to our GEM Family. A big thank you to the founders and the entire team for choosing to build the future together with us!

In your opinion, how has the gaming investment market evolved in 2025 – both in terms of interest in specific segments and deal structures?

Roman: The trend toward industry consolidation is strengthening. Aream & Co. reports 130 M&A deals totaling $65B in the first 9 months of 2025, highlighted by the EA acquisition – the largest LBO ever. Asian strategics continue to lead in deal count.

Kirill: Meanwhile, the Series A market is struggling. Funding dropped from $4.2B to $1.5B year-over-year for the first 9 months of 2025, with most capital targeting AI and Turkish mobile developers. With Series A success rates falling for five straight quarters, our portfolio companies’ recent milestones are even more impressive!

What’s different now for developers looking to raise capital? Have the benchmarks, requirements, or overall approaches changed?

Roman: Funding has cooled down, making it harder to raise money. As a result, the bar has been raised for developers, and competition is much tougher. A proven track record is now more critical than ever for securing a round — teams with strong metrics clearly have the upper hand.

Increased competition for capital is driving valuations down, which makes it a ‘buyer’s market.’ For those looking to invest in the gaming industry, now is a great time to deploy capital.

Are you seeing any new or more common red flags when evaluating projects in 2025 compared to previous years?

Kirill: Yes. For instance, several gaming startups that secured funding years ago are now closing down. Not all VC cases end in success, which is normal for a high-risk, high-reward industry. But what really matters is how a company closes and how the founders, investors, and staff part ways. In these cases, we always seek feedback from those involved in the previous venture. If that feedback is negative, it’s a definite red flag for us.

Which genres and platforms are currently showing the most investment potential?

Roman: Genres and platforms are important pieces of the puzzle when making an investment decision, but they aren’t our primary focus. There have been times when we were certain we’d never touch a specific genre – only to meet a ‘super-team’ working in that very space who completely won us over and changed our minds. At its core, VC is about people. We don’t just invest in games; we invest in the teams behind them.

What changes do you expect to see in the gaming venture market in 2026?

Kirill: Much will depend on the performance of the gaming companies and startups that have raised investment over the last few years. By 2026, it will be roughly five years since the 2020-2021 gaming investment boom fueled by the COVID pandemic. The time has come to reap what was sown. If the market sees success stories from VC-backed companies, it will boost investor optimism and drive a new wave of investment.

What’s on your radar for 2026? Are you perhaps ready to disclose a target number of deals or share news regarding upcoming releases from your portfolio companies?”

Roman: We look toward 2026 with hope and cautious optimism! The coming year will be packed with releases from our GEM Family, which we are eagerly anticipating – not just as investors, but as gamers ourselves.

One thing remains constant: we will continue to invest in the best founders and the strongest teams in the gaming market. We’ll be announcing one of our newest deals very soon. Stay tuned!