Embracer Group has reported financial results for the first quarter ended June 30, 2024. The Swedish posted a decline in revenue, but outlined a plan to improve the profitability of its PC/Console Games segment.

Kingdom Come: Deliverance II

Financial highlights

- According to its Q1 interim report, Embracer Group’s net loss narrowed from SEK 4.44 billion ($423.7 million) in the same period last year to SEK 2.19 billion ($209.3 million).

- The company reached SEK 7.9 billion ($755.7 million) in net revenue, down 24% year-over-year.

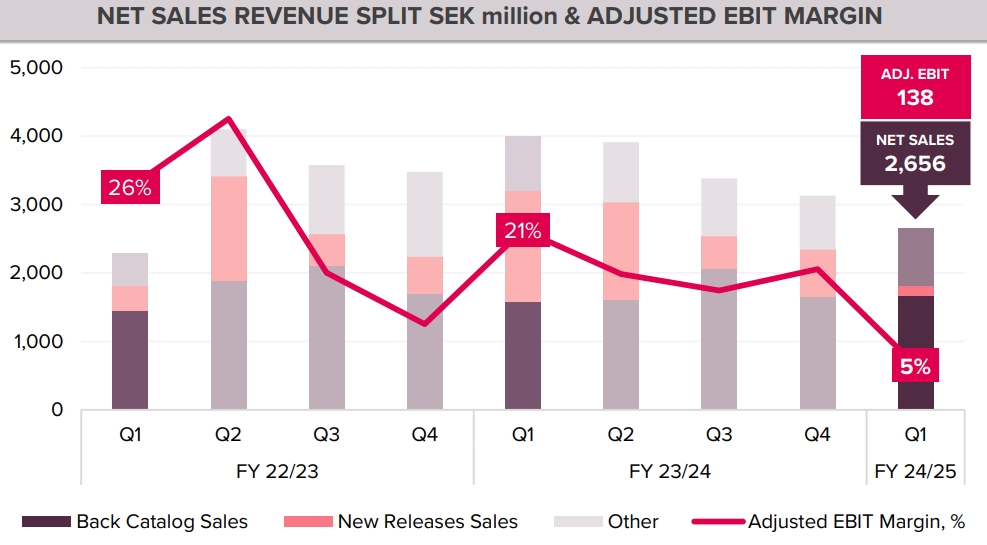

- Despite a 3% decrease, Tabletop Games remained the top segment by revenue at SEK 3 billion ($289.5 million). It is followed by PC/Console Games (SEK 2.65 billion | $253 million, -34%) and Mobile Games (SEK 1.38 billion | $132.3 million, -3%).

- Embracer noted that the spin-off process of splitting its business into three public companies is progressing according to plan. Asmodee will be first up, with the listing of “Coffee Stain & Friends” shares scheduled for 2025.

Game results and focus on key IPs

- Net sales of new games for PC and consoles fell 91% year-over-year to SEK 146 million ($13.9 million). The main revenue drivers were Homeworld 3, MotoGP 24, Gigantic: Rampage Edition, and Oddsparks: An Automation Adventure.

- Embracer attributed the decline in the PC/Console segment by a lack of new major releases and a “tough comparison” with the same period last year, when the company launched Dead Island 2.

- Back catalog sales grew 5% to SEK 1.66 billion ($158.6 million). They were driven by Remnant II, Dead Island 2, Star Trek Online, Deep Rock Galactic, Neverwinter Online, Welcome to Bloxburg, Kingdom Come Deliverance, Marvel’s Guardians of the Galaxy, SOUTH PARK: SNOW DAY! and AEW: Fight Forever.

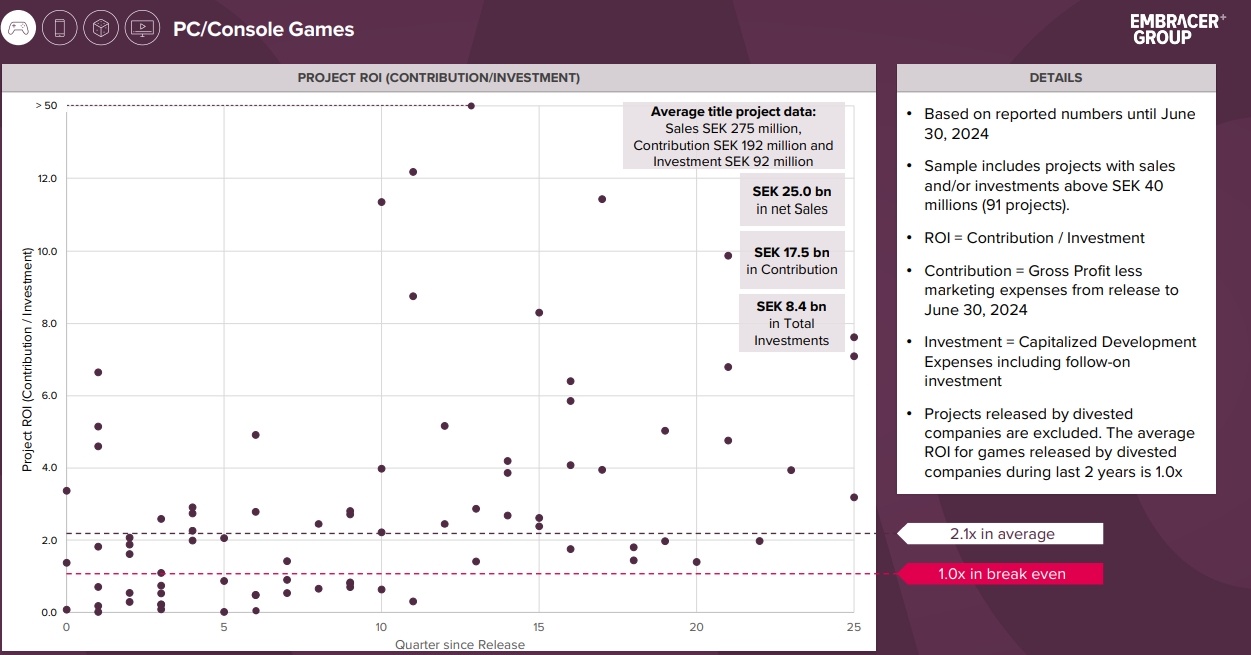

- The average ROI of Embracer’s PC and console titles surpassed 2x, with the average sales of SEK 275 million ($26.2 million). The average gross profit less marketing expenses was SEK 192 million ($18.3 million), while investment amounted to SEK 92 million ($8.7 million).

- The Swedish company plans to improve the profitability of its PC and console business by focusing on “own and controlled IPs, which typically have better unit economics.”

- CEO Lars Wingefors noted that “through this year and next, we [also] expect our updated capital allocation process, with improved standards for new and continued investment to improve ROI from new game releases as our pipeline increasingly consists of higher quality games.”

- Speaking of its IPs, Embracer said it is now “actively testing and prototyping multiple new game concepts” based on the Lord of the Rings franchise.

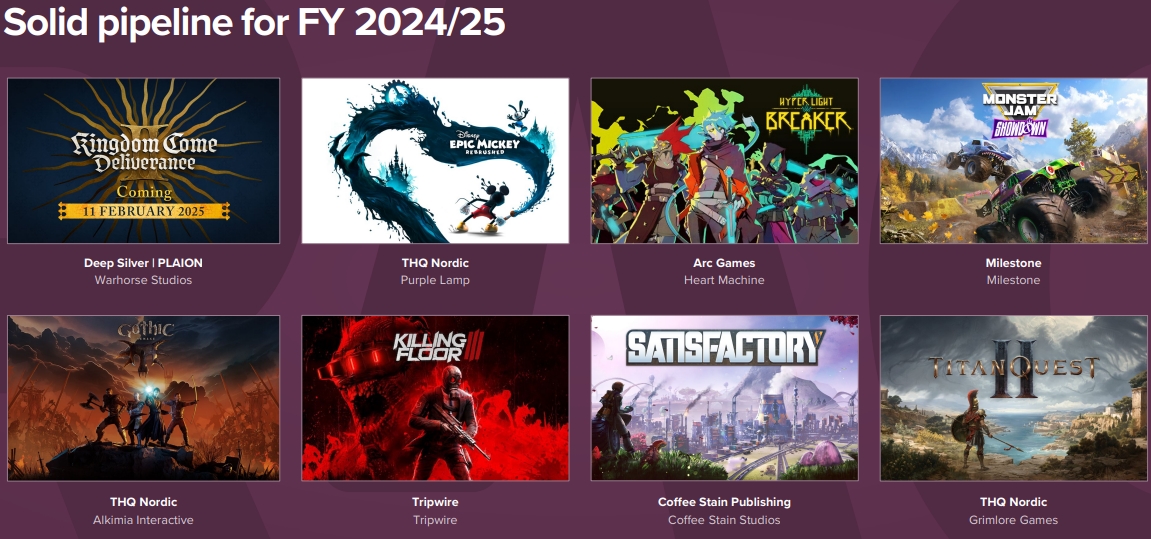

- “We are confident in our pipeline for the financial year, and still expect the value of completed game development for the year to be around SEK 3.9 billion [$371.5 million],” Wingefors said.

- In the current fiscal year ending March 31, 2025, Embracer plans to release games like Disney Epic Mickey: Rebrushed, Titan Quest II, Killing Floor III, Gothic 1 remake, Hyper Light Breaker, and Kingdom Come: Deliverance II. The latter was recently delayed to February 11, 2025.

- Other games in the company’s pipeline include Marvel 1943: Rise of Hydra (developed externally, Plaion will serve as a publisher), a Tomb Raider project (will be published by Amazon), Perfect Dark (developed by Crystal Dynamics and Microsoft’s The Initiative), and The Eternal Life of Goldman (developed externally by Weappy Studio).