Embracer Group has published its financial report for the full year ended March 31, 2024. The Swedish holding company has taken stock of its restructuring program and outlined a new chapter after deciding to split its business into three entites.

Financial highlights

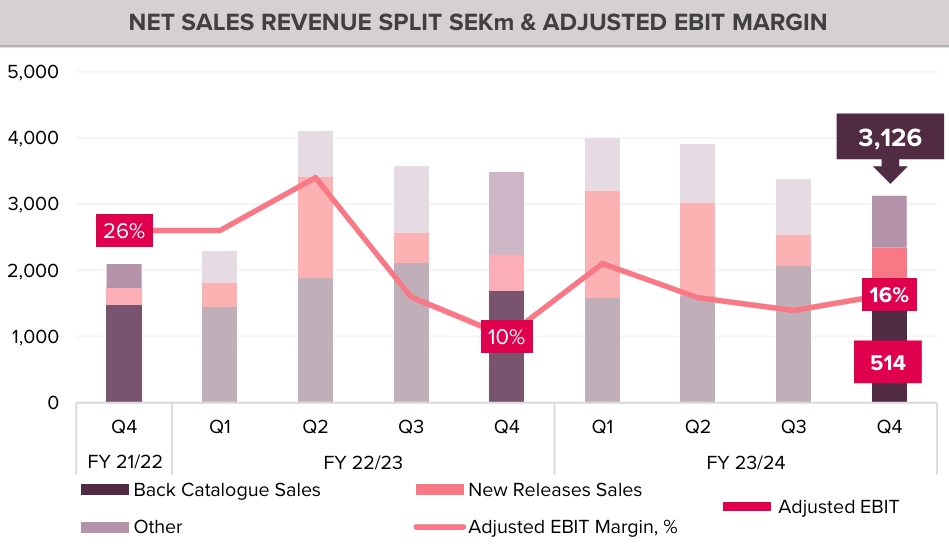

- According to its full-year report, Embracer Group reached SEK 42.2 billion ($3.94 billion) in net revenue last year, up 12% year-over-year. However, Q4 net sales fell 5% to SEK 8.87 billion ($830 million).

- Net loss for the full year was SEK 18.17 billion ($1.7 billion), compared to a net profit of SEK 4.4 billion ($417 million) in the previous year. The vast majority of the total, $1.69 billion, came in the fourth quarter alone.

- Tabletop Games was the biggest segment by revenue, growing 12.6% year-over-year to SEK 14.8 billion ($1.38 billion). It is followed by PC/Console ($1.34 billion, +7% YoY), Entertainment & Services, ($662 million, up 34.3%), and Mobile ($553 million, +1.6% YoY).

Game sales and pipeline

- New game releases for PC and console generated SEK 4.1 billion ($392 million) in FY23/24, up 44.6% year-over-year.

- The main revenue drivers in the fourth quarter were Star Wars: Battlefront Classic Collection (performed in line with expectations), South Park: Snow Day (within expectations), Tomb Raider 1-3 Remastered (above expectations), Alone in the Dark (below expectations), and Deep Rock Galactic: Survivor (outperformed expectations).

- Back catalog sales accounted for the majority of the segment’s full-year revenue — SEK 6.9 billion ($647 million), down 3% year-over-year.

- The main revenue drivers in Q4 were Dead Island 2, SnowRunner, Star Trek Online, Remnant II, Arizona Sunshine 2, Risk of Rain 2, Hot Wheels Unleashed 2: Turbocharged, Deep Rock Galactic, Neverwinter Online, and Welcome to Bloxburg.

- Dead Island 2 has already sold over 3 million units globally and surpassed 7 million players.

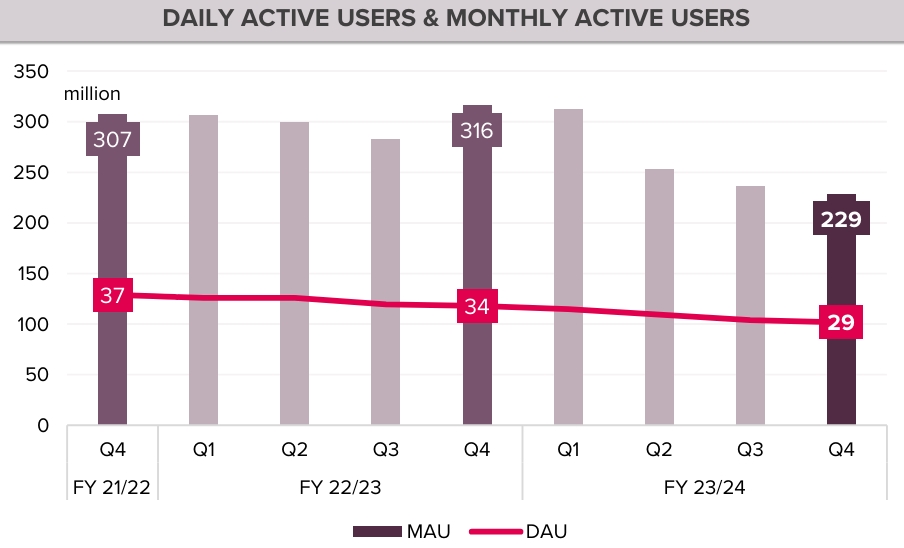

- As of March 31, Embracer’s mobile portfolio had just over 1 billion downloads. Its total DAU reached 31 million (down 4 million from the previous year), while MAU decreased from 301 million to 258 million.

- The segment’s key revenue drivers were Sudoku.com, Alien Invasion, Art Puzzle, Jigsaw Puzzle, Number Match, and Solitaire.

- Embracer plans to release more than 70 games in FY24/25 (ending March 31, 2025), including Kingdom Come: Deliverance II, Killing Floor 3, and three unannounced titles.

- The company also listed its key franchises: Darksiders, Dead Island, Deep Rock Galactic, Kingdom Come: Deliverance, Killing Floor, The Lord of the Rings, Metro, Remnant, Satisfactory, Tomb Raider, and Wreckfest.

- “Through this year and next, we expect our updated capital allocation process, with improved standards for new and continued investment, to drive improving ROI from new game releases, as our pipeline increasingly consists of higher quality games,” CEO Lars Wingefors said.

Embracer’s post-restructuring future

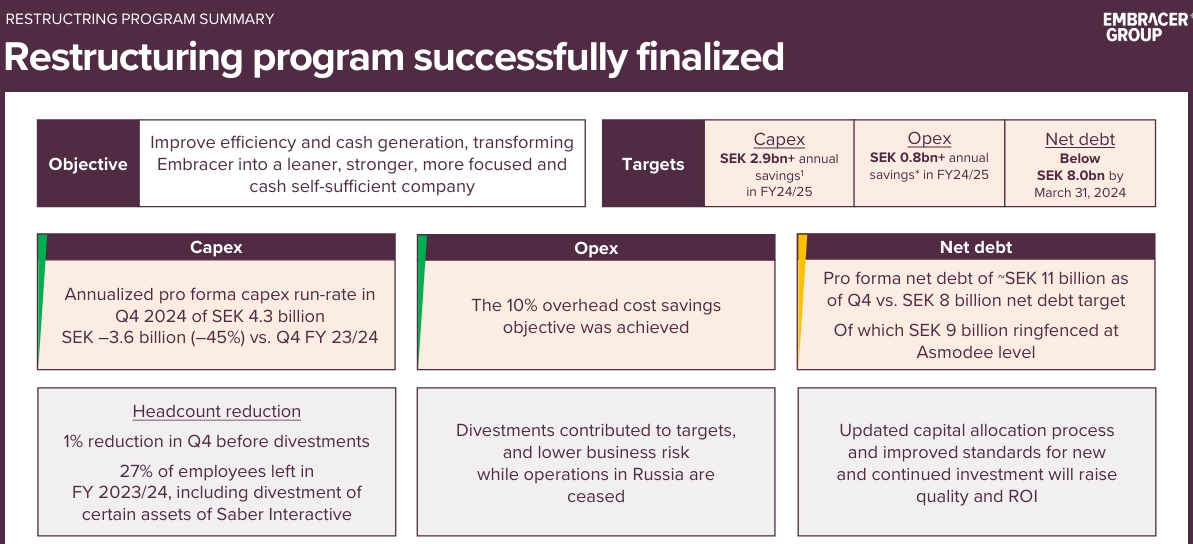

- Although its restructuring program was finalized on March 31, Embracer failed to achieve its initial target of reducing net debt to at least SEK 8 billion ($749 million). However, the company expects a “notable reduction” after Q4.

- Total restructuring costs amounted to SEK 3.38 billion ($317 million), of which SEK 1.2 billion ($116 million) came in Q4 alone.

- As of March 31, Embracer Group employed 12,069 people, reducing its total headcount by more than 4,500 employees compared to the previous fiscal year.

- Since the start of the restructuring program last June, the company laid off 1,583 people. In addition, around 3,000 employees left the group following the divestment of Saber Interactive.

- Goodwill impairment of Saber Interactive amounted to SEK 7 billion ($662 million), while the divestment of Gearbox Entertainment resulted in a non-cash expense (goodwill and game-related assets) of SEK 1.51 billion ($141.6 million).

- The partial sale of Gearbox is expected to close in the first quarter ending June 30, and the company has yet to finalize the divestment of Digic and Mad Head, two of the subsidiaries included in the Saber deal.

- “The divestments of parts of Saber Interactive and Gearbox Entertainment will improve profit margins and cash conversion, and reduce financial leverage, while the subsequent intention to initiate a separation of the group into three separate publicly listed companies, sets a clear strategic direction,” Wingefors noted.

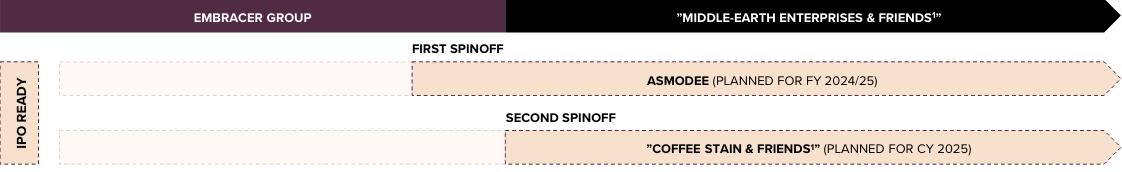

- Embracer recently decided to split into three public companies, and the process is “tracking according to plan.” According to Wingefors, each entity will have its own capital allocation and growth strategies.