Square Enix has released a financial report for the fiscal year ended March 31, 2024. Let’s take a closer look at the company’s business metrics and its new strategy aimed at rebooting its development processes and delivering long-term growth.

Final Fantasy VII Rebirth

Financial highlights

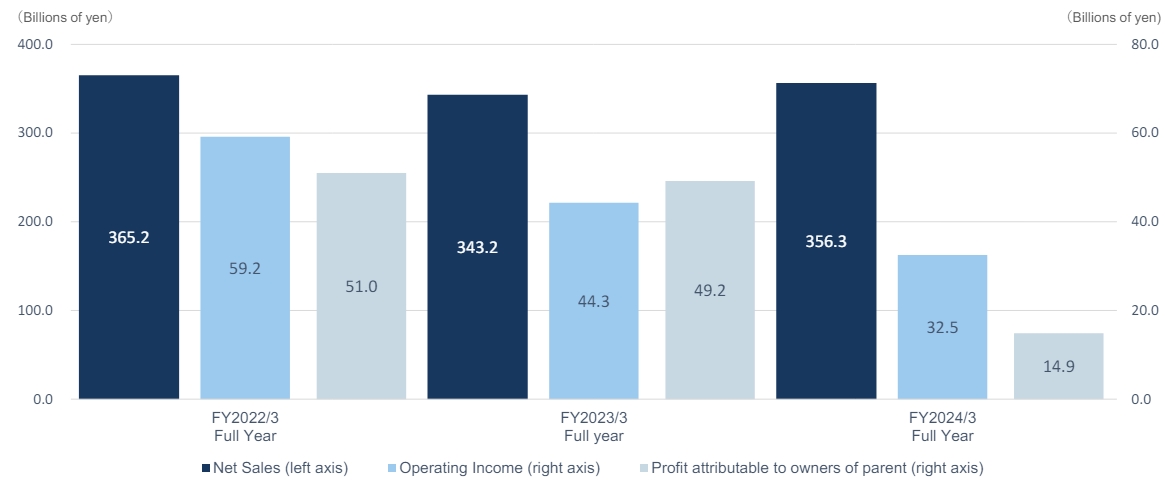

- According to its financial results, Square Enix reached ¥356.3 billion ($2.29 billion) in net revenue in FY24, up 3.8% year-over-year.

- The company’s operating income fell 26.6% year-over-year to ¥32.5 billion ($208.5 million).

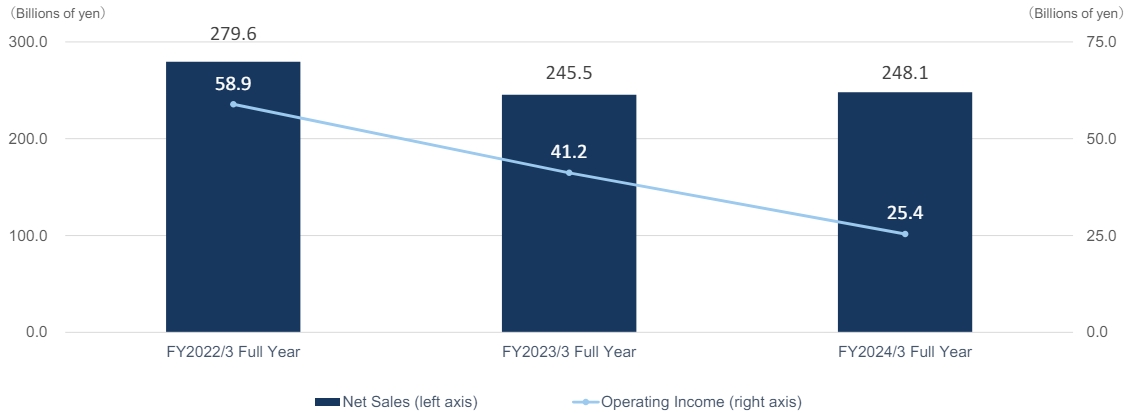

- Digital Entertainment, the company’s video game division, accounted for 69.6% of the total, or ¥248.1 billion ($1.59 billion). Its operating profit was ¥25.4 billion ($162.9 million), down 42.6% compared to FY23.

- Square Enix cited a decline in sales of MMO and mobile sub-segments, as well as “higher development cost amortization and content production account valuation losses” as the main reasons for the drop in profits.

- Games for Smart Devices/PC Browser (mobile titles) was the number one sub-segment by net sales — ¥101.5 billion ($651 million), down 10.6% year-over-year.

- Square Enix noted that multiple new games such as Final Fantasy VII Ever Crisis and Dragon Quest Champions “were unable to offset weak performances from existing titles.”

- HD Games (PC and console titles) ranked 2nd in annual revenue — ¥99.2 billion ($636 million), up 26.3% compared to FY23. The main games launched in FY24 included Final Fantasy XVI, Final Fantasy Pixel Remaster, Foamstars, Infinity Strash: DRAGON QUEST The Adventure of Dai, and Final Fantasy VII Rebirth.

- Despite multiple new releases, the sub-segment’s operating loss increased from ¥4.1 billion to ¥8.1 billion ($52 million).

- The MMO sub-segment reached ¥47.3 billion ($303.5 million) in revenue, down 11.2% year-over-year. Final Fantasy XIV and Dragon Quest X remained the main titles in operation.

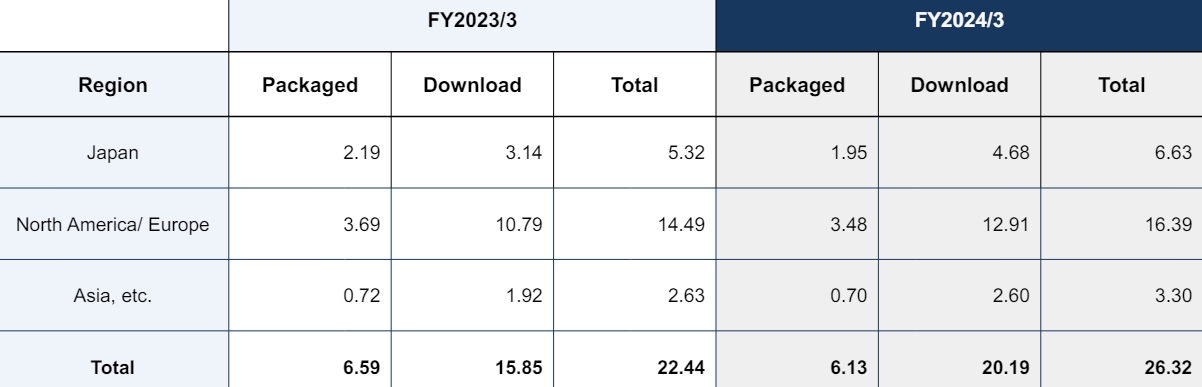

- In FY24, Square Enix sold 26.32 million copies of games (physical + digital), up from 22.44 million units sold in the previous year. North America and Europe accounted for 62.2% of the total, while the share of domestic sales (Japan) was 25.1%.

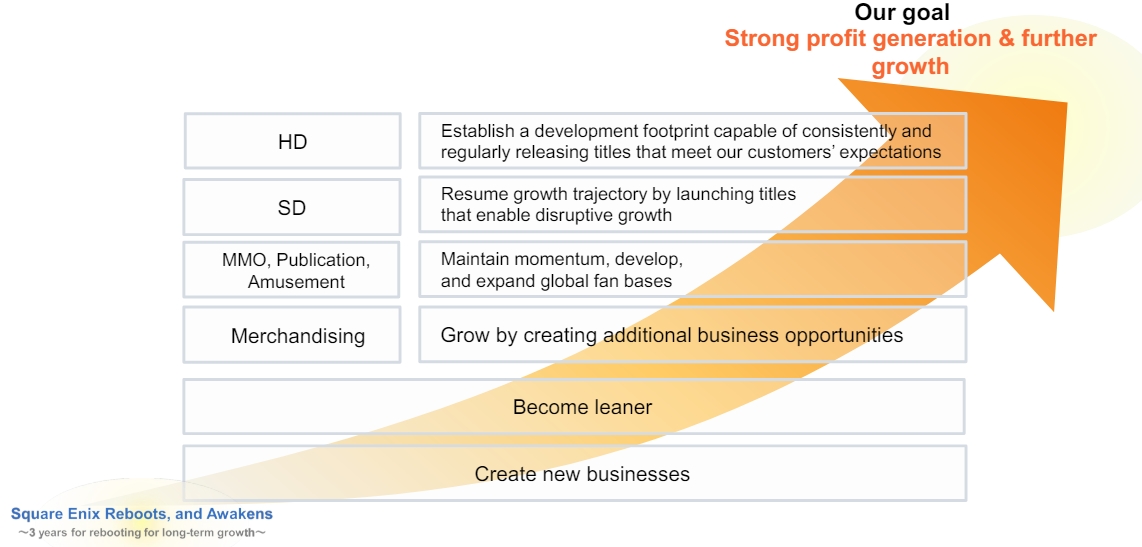

Square Enix “reboots and awakens”: key pillars of the new business strategy

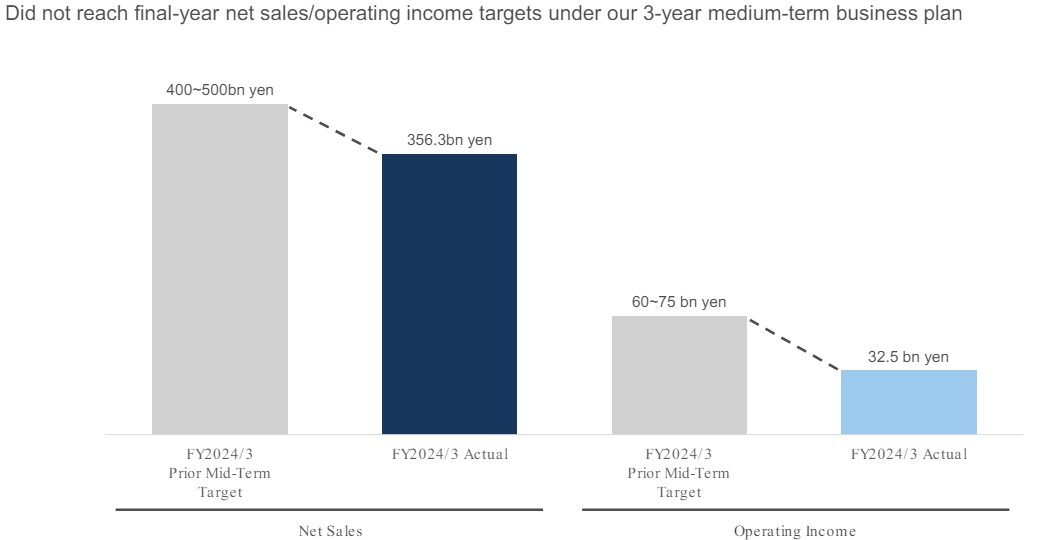

According to its business review, Square Enix missed revenue and profit targets under its previous 3-year business plan. FY24 net sales were $2.29 billion instead of the forecast ¥400-500 billion ($2.57-3.21 billion), and operating profit was $208.5 million instead of ¥60-75 billion ($385-481 million).

During its previous business plan, the Japanese publisher failed to:

- Achieve better profitability in HD game development (“Launched many titles but some failed to live up to profit expectations, especially outsourced titles and some AAA titles”);

- Grow its mobile gaming sub-segment (“Unable to launch hit titles to offset market maturation, aging of legacy titles”).

As part of its new philosophy, Square Enix plans to produce games and IP that will appeal to global audiences — or, in corporate parlance, “unforgettable experiences.”

The company’s new medium-term plan implies a reboot over the next three years. One of its goals is to optimize development and publishing processes in the Digital Entertainment segment. As part of this plan, Square Enix will:

- Shift from quantity to quality by striking a balance between supporting the creative vision of its developers and listening to its players’ voices (“It will strive for a regular launch cadence, focusing its development efforts and investments on titles with substantial potential to be loved by customers for years”);

- Regularly launching AAA games and prioritizing profitability when creating mid-class titles;

- “Aggressively pursue a multiplatform strategy” by releasing games on PC, PlayStation, Xbox, and Nintendo platforms (“Build an environment where more customers can enjoy our titles in regards to major franchises and AAA titles including catalog titles”);

- Consider launching mobile games on PC rather than just iOS and Android, as well as “maximize the acquisition of new users when launching a title and that of recurring users after starting management of game operation”;

- Implement a cross-media strategy to leverage its IP across various formats and reach new markets by establishing a new department focused on IP business development and licensing;

- Pursue initiatives “designed to win over PC users” and maximize digital sales of new games, as well as expand sales of back catalog titles to expand their lifecycles;

- Retire its unit-based organization and transition to a project management structure, as well as build a flat organization to “increase opportunities of promotion by selection in order to pursue a new talent”;

- Rebuild its overseas business divisions from the ground up by making structural reforms at its European and American offices to optimize costs.

In addition, Square Enix plans to allocate a maximum of ¥100 billion ($642 million) for strategic investments over the next three years, including ¥20 billion ($128 million) for share buybacks.