Electronic Arts has released its financial report for the full year ended March 31, 2024. Let’s take a look at the company’s key metrics and its plans for the future, including the use of AI in game development.

Apex Legends

Financial highlights

- According to its FY24 earnings release, Electronic Arts reached $7.56 billion in net revenue, up 2% year-over-year. Live services accounted for 73.3% of the company’s total revenue.

- Net bookings (calculated by adding net revenue to the change in deferred net revenue for online games) grew 1% year-over-year to $7.43 billion.

- “Strength in live services was driven by high teens growth year-over-year in our global football franchise, fueled by FC Ultimate Team and FC Mobile, but was offset by declines in Apex Legends,” EA CFO Stuart Canfield said in a statement.

- Net profit was $1.27 billion, up 58.7% compared to the previous fiscal year.

- Console was the number one platform by revenue, generating $4.61 billion (+6% year-over-year). It is followed by PC ($1.62 billion, -7%) and mobile ($1.18 billion, -5%).

- For the current fiscal year ending March 31, 2025, EA expects its net revenue to reach $7.1-7.5 billion, and net income to be around $900 million-1.08 billion.

- The company’s board of directors also authorized a new stock buyback program, planning to repurchase $5 billion worth of shares over the next three years.

How did EA games perform in FY24?

- EA Sports and Madden NFL franchises delivered “record net bookings” in FY24, up 6% year-over-year.

- According to EA CEO Andrew Wilson, Apex Legends has surpassed $3.4 billion in lifetime net bookings since its launch in 2019.

- The Sims 4 has reached 85 million players since 2014, with double-digit growth in FY24. The Sims Online and The Sims Mobile have generated over 500 million downloads combined.

- Battlefield now has the largest development team in franchise history. It includes DICE, Criterion, Ripple Effect, and Motive.

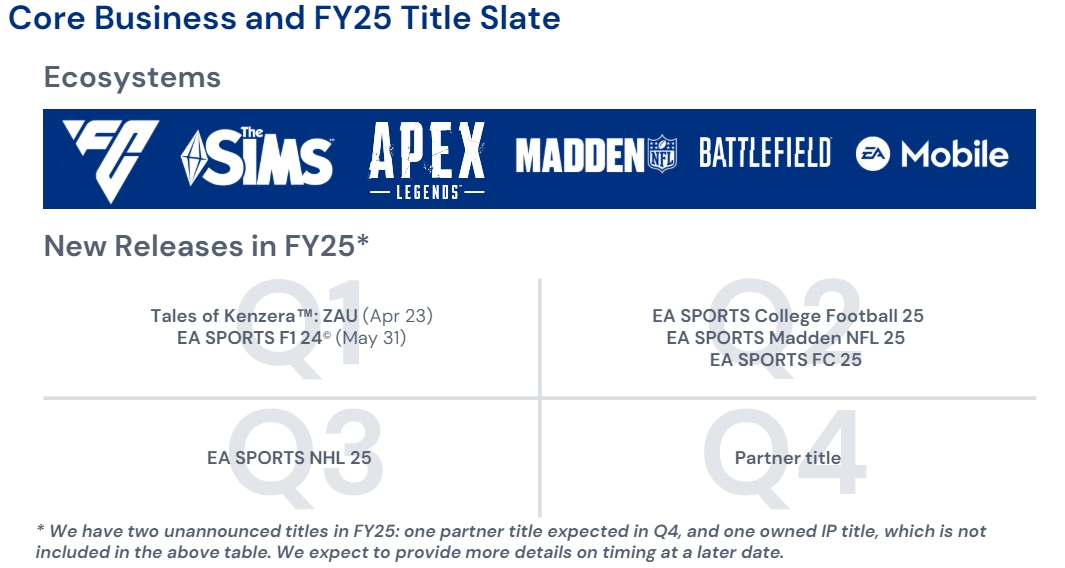

- EA plans to release two unannounced games in FY 25 (ending March 31, 2025): one partner title, scheduled for Q4, and one owned IP. According to Jeff Grubb, the latter is Dragon Age: Dreadwolf, although it has already been publicly announced.

What plans do EA have for AI and in-game ads?

During an earnings call, Andrew Wilson said Electronic Arts has an “incredible competitive advantage” thanks to its creative teams and portfolio of successful IP. “As we leverage the capabilities of AI, we believe it will further supercharge these differentiators,” he noted.

Wilson added that “based on our early assessment, we believe that more than 50% of our development processes will be positively impacted by the advances in generative AI.”

Perhaps on a five-year plus time horizon, we think about how do we take all of those tools we create and offer those to the community at large so that we can actually get new and interesting and innovative and different types of game experiences. Again, not to replace what we do but to augment, enhance, extend, expand the nature of what interactive entertainment can be in much the way YouTube did for traditional film and television.

CEO of Electronic Arts

According to Wilson, Electronic Arts plans to take advantage of “40 years of owned data” to train its models. He also noted that the company’s developers had a “real hunger” to get to this as quickly as possible to “build bigger, more innovative, more creative, more fun games more quickly so that we can entertain more people around the world on a global basis at a faster rate.”

The EA boss also answered a question about the use of ads in AAA games, saying that it is still too early to decide anything on this front. The company wants to be “very thoughtful” about using ads in its games, but there have been some internal discussions about this area.

“Our expectation is that advertising has an opportunity to be a meaningful driver of growth for us,” he explained. “We’ll be very thoughtful as we move into that, but we have teams internally in the company right now looking at how do we do very thoughtful implementations inside of our game experiences, but more importantly, as we start to build community and harness the power of community beyond the bounds of our games, how do we think about advertising as a growth driver in those types of experiences.”