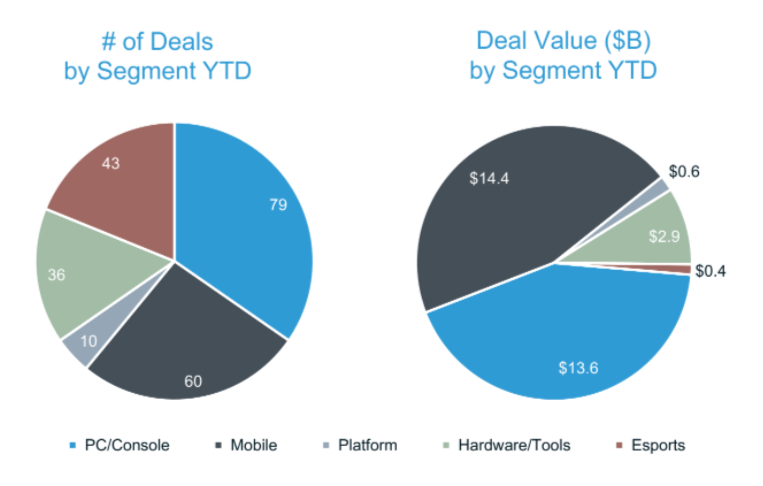

Unprecedented consolidation of the games market continues. According to the latest report by Drake Star Partners, game companies have already raised $71 billion in 844 deals so far this year, which is double the full dollar amount from 2020.

Key takeaways

- M&A deals account for almost half of the dollar value — $31.9 billion. There were 228 such deals during the first nine months of 2021.

- Private companies raised $9 billion in 493 deals from VCs and strategic investors, while public companies made 74 deals worth $16.6 billion.

- 47 companies raised $10.2 billion through IPOs in total. There were also a few SPAC listings worth $3 billion. The list of companies that went public in 2021 includes Krafton, Roblox, tinyBuild, Unity, Playtika, and Nexters.

- Microsoft’s Zenimax acquisition worth $7.5 billion is the largest M&A deal of the year so far. It is followed by Netmarble’s acquisition of mobile casino developer SpinX Games for $2.19 billion.

The full report can be found here.