The video game market is growing slower than a year before and slower than Newzoo analysts predicted earlier.

Key findings:

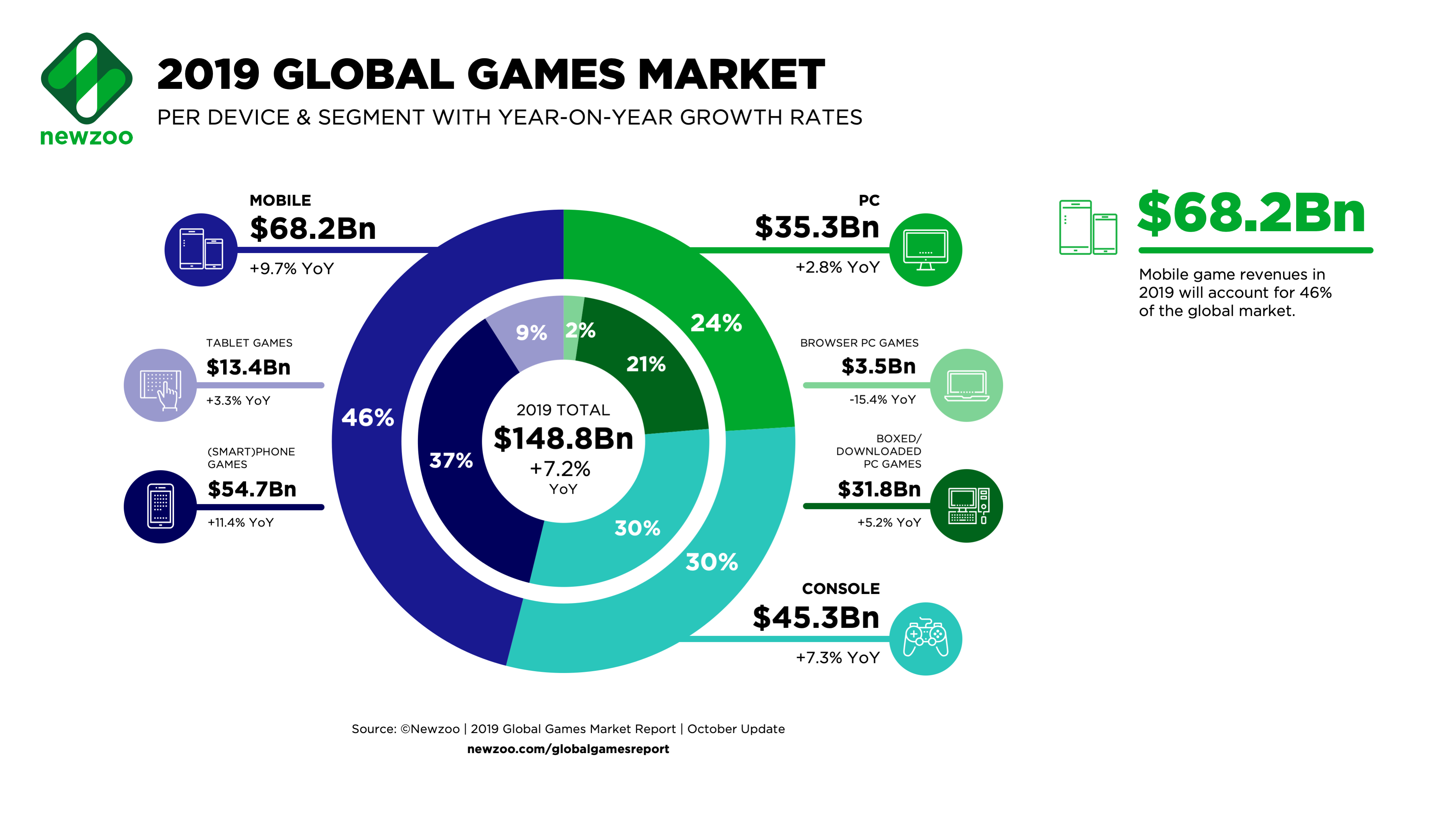

- in 2019, the video games market will generate $148.8 billion;

- China will remain the largest gaming market;

- mobile games will account for 46% of the video games market, down from 51%;

- mobile is now growing thanks primarily to developing countries;

- the growth of the console segment is slowing down as the customers are waiting for the new generation of consoles.

General

The expected revenue of the entire market will grow 7.2% year on year and reach $148.8 billion. This is lower than the previously predicted growth of 9.6% (and still lower that the 10.9% growth seen in 2018).

Newzoo had to adjust its previous forecast mostly because of the slowing sales in the console games segment. The firm initially expected it to grow by 13.4%, but according to the new estimates, it will only grow by 7.3%.

However, mobile is also not performing quite as strongly as predicted earlier. User spending is slowing down, and the share of mobile in the total revenue of the industry has also decreased. In 2018, mobile games accounted for 51% of the total revenue of the video games market, and now its share is down to 46%.

The revenue from mobile games is expected to reach $68.2 billion by the end of the year. This constitutes the annual growth of 9.7%. For comparison, in 2018 the segment grew 12.8%, and in 2017 – 23.3%.

This downward trend is due to the fact that the customer spending in Japan, South Korea and the USA has reached peak values. The market is no longer growing at the expense of these countries. Today, the main growth drivers are the Middle East, Latin America and Southeast Asia, where mobile Internet penetration continues to grow, and the spread of affordable smartphones brings new mobile players to the market.

The problem with emerging markets, however, is that people don’t pay here, even in free-to-play games. It’s much more difficult to convert these users into payers in comparison with the mature markets. That’s why the market is generally growing slower than before.

Console games

Last year was very successful for the console segment. The rapid growth from $33.3 billion in 2017 to $38.3 billion in 2018 was due to three reasons:

- the rise of battle royales (primarily Fortnite);

- several game releases that defined the current generation (which Newzoo does not name);

- the continued strong performance of Nintendo Switch .

Initially, analysts expected these factors to continue in the first half of 2019. As for H2 2019, that’s when they thought the slowdown would begin because of the imminent arrival of the next-gen consoles.

However, a significant downturn began in the first half of the year, when both Sony and Microsoft officially confirmed the new consoles. This, according to the analysts, made users spend less on new releases. Two other factors also contributed:

- a natural decline in spending on battle royales:

- the gradual transition of the market to the subscription model.

Subscriptions, according to Newzoo, had a negative impact on the performance of several key releases. They didn’t sell as many copies as they could have because the players now had an alternative: to pay a monthly fee for the access to the vast library of games instead of acquiring buying new titles.

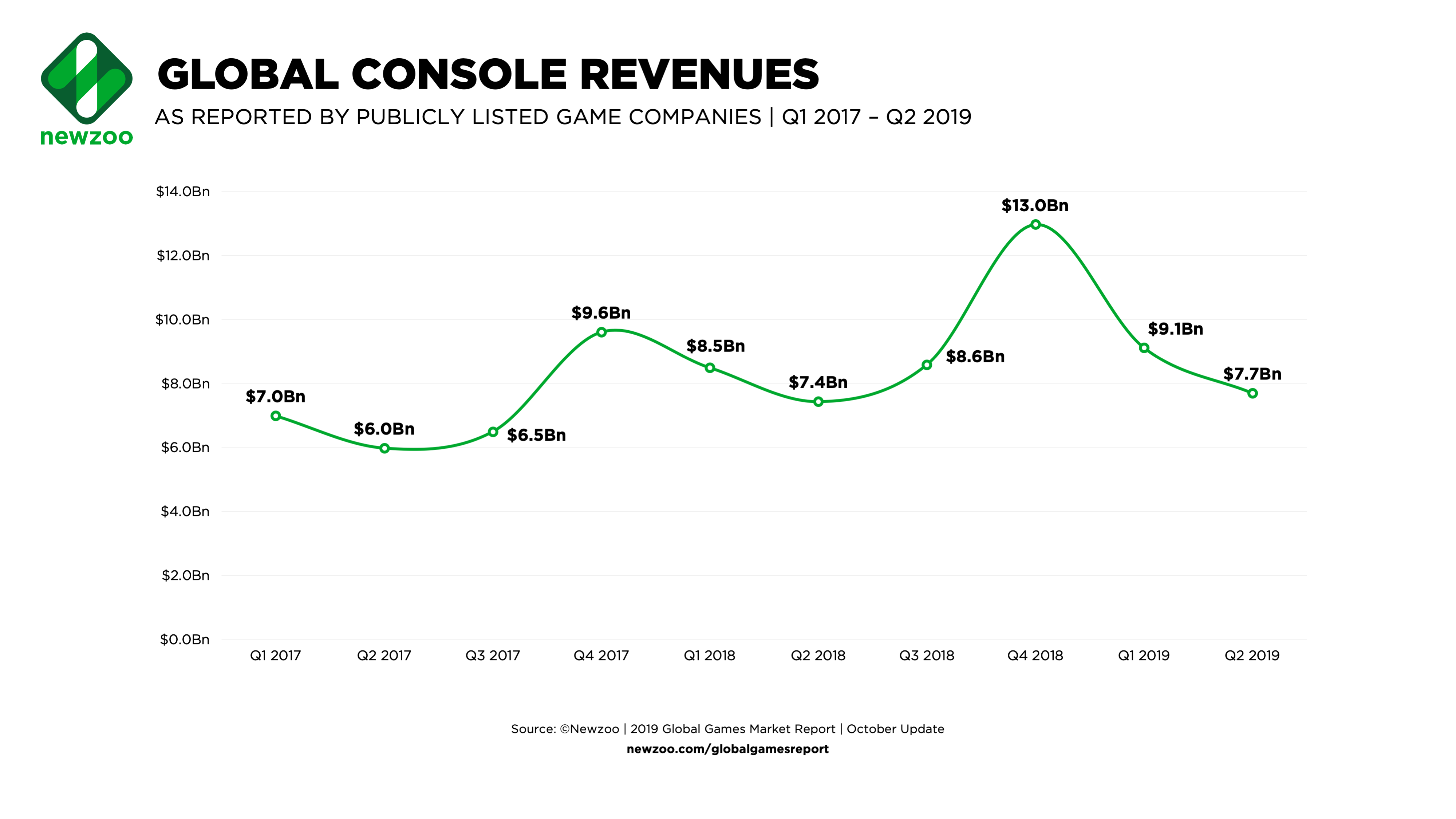

Revenues from console games of public companies in the first and second quarter of this year grew significantly slower than in the past. In 2018, the console games revenues grew 21% and 24% year on year in H1 and H2 respectively, and in 2019 we only saw them grow 7% and 4%.

Analysts say that the slowdown should in no way be seen as an alarming trend for the industry. It will only last until the release of the new generation of consoles in the second half of 2020.

Note: when working on this article, we found that the numbers from the new report do not coincide with the numbers that Newzoo reported for previous years. For example, in November 2018, the company claimed that the console game market would grow 15.2% , and now the growth is estimated at 26.6%. Some inconsistencies are pretty big, others are less significant, but we should urge you to be careful with Newzoo estimates. On the other hand, Newzoo itself notes that it re-evaluates and adjusts its data every quarter.