China is the world’s biggest market by mobile game revenue (to reach $30 billion in 2020). It is also extremely difficult to navigate for foreign publishers. First, you’ve got stringent regulations imposed by the Chinese government. Secondly, sensitivities and preferences of the Chinese players can be a puzzle game in and of itself.

So launching in China is tricky, but nevertheless doable. GameRefinery explains how by looking at one of the most popular genres on mobile: Match 3.

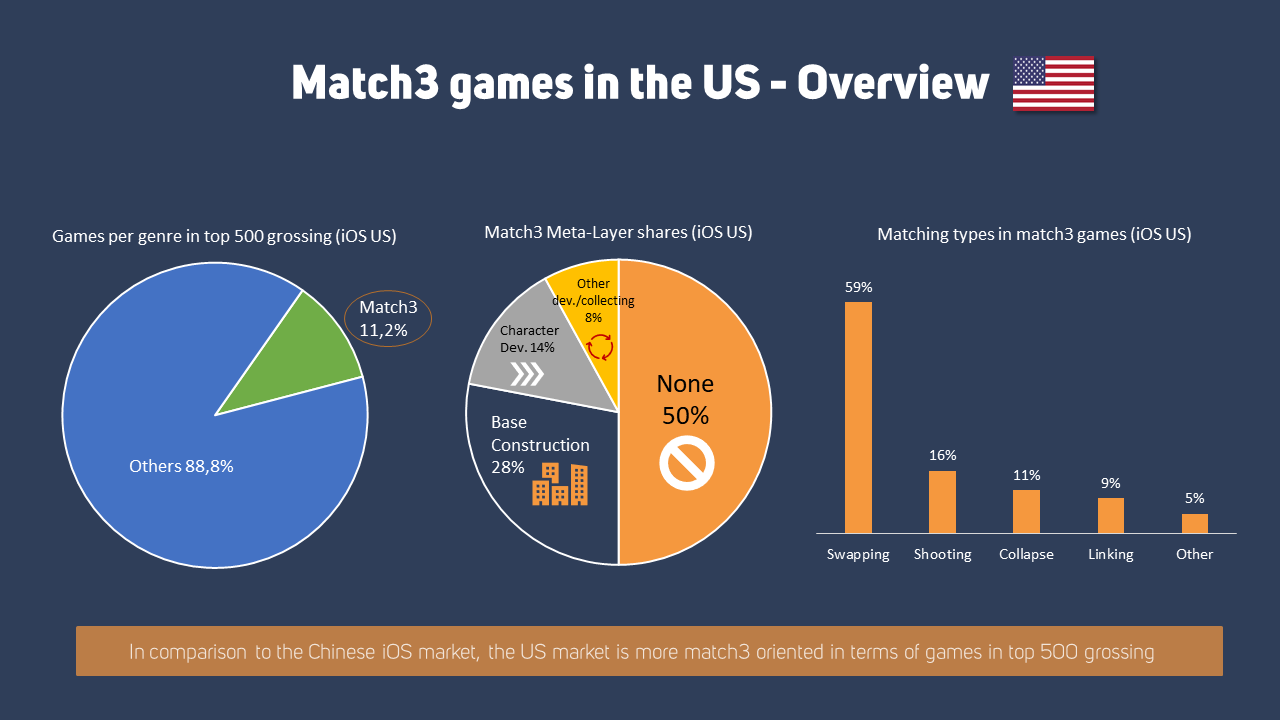

To put things in perspective, let’s look at how Match 3 games perform sales-wise in the US.

Image credit: GameRefinery

Key stats (iOS, US)

- Match 3 titles account for 11.2% of the US iOS Top 500 Grossing games

- Of those, 59%, are the “swapping” kind, while other matching types, including “shooting,” “collapsing,” and “linking” are far less popular.

- 50% of the US Top 500 Match 3 games have no meta. The games on that list do have meta layers, it’s usually “Base Construction” (28% of Match3 games). “Character Development” is seen in 14%. And 8% of games revolve around some other kind of development or collecting.

- Visual themes are split equally between “food,” “animals” and “other” themes

These stats sure look good and clear. But using those to make any assumptions about the Chinese market would be wrong.

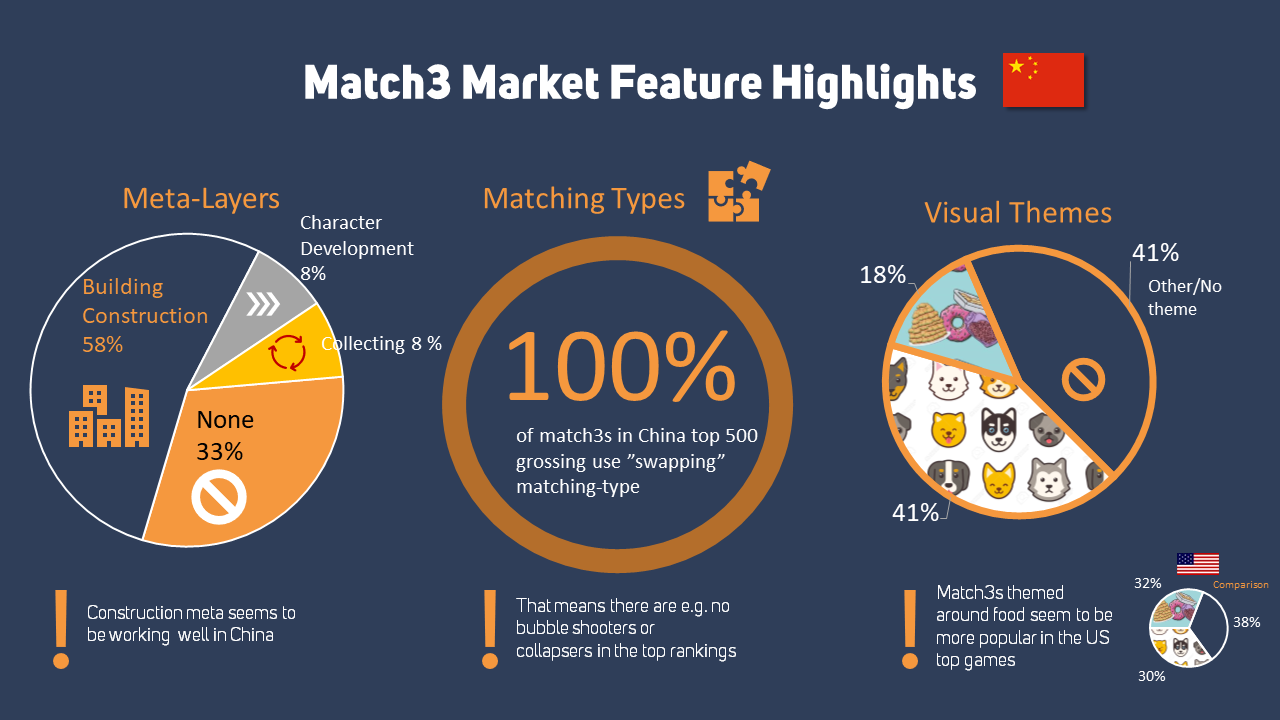

Image credit: GameRefinery

Key stats (iOS, China)

- Match 3 games only represent 2.6% of the Chinese iOS Top 500 grossing titles. This might sound disheartening, but it’s actually not so bad. Match 3 is, in fact, the second most popular subgenre in the casual category. Its small percentage has to do with the fact that the Chinese Top 500 grossing list is unconditionally dominated by RPG titles.

- If we further dissect Match 3 games on the Chinese Top 500, we’ll see that 42% are foreign titles, including Homescapes, Candy Crush Saga and Fishdom.

- All the successful Match 3 games use the “swapping” type of matching.

- Remember how half of US Match 3 games have no meta? Well you’d better have one if you are to succeed in China. 58% of Match 3 hits in China feature a “building construction” meta.

- Chinese players are not so keen of food-themed games which only account for 18% of Top 500. “Animals” make up 41%, and the other 41% falls under “Other” category.

Now who among non-Chinese developers have successfully implemented these strategies? Of course, it’s Playrix, whose Homescapes and Gardenscapes have made the company the most successful foreign Match 3 developer in China.

The full post is available here.